Whether zakat and fitra will be given with crypto money has been a matter of curiosity by those who invest in digital assets. Is zakat given on crypto money in particular? The answer to this question is often sought after. The Presidency of Religious Affairs clarified whether zakat and fitra, which are obligatory to be given in Ramadan for Muslims who can afford it, are also valid for crypto assets.

Is Zakat Given To Cryptocurrency?

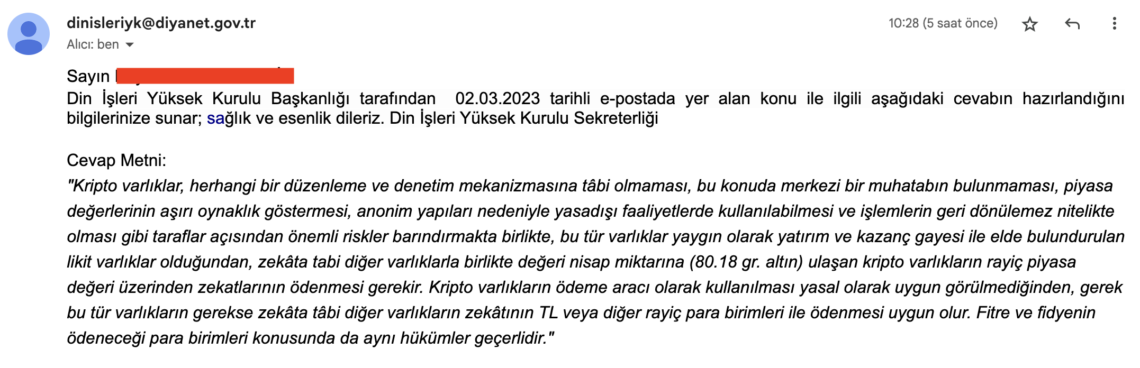

The Presidency of Religious Affairs answered our questions about whether it is possible to give zakat and fitra with crypto money.

According to the statement of the Presidency, zakat and fitra are not given with crypto money, but it is necessary to give zakat with the amount calculated over the equivalent of the digital asset you have. For this, calculations are made based on current gold prices. If the amount of crypto money in your hand reaches the price of 80.18 grams of gold, the zakat must be paid at the current market value.

The Directorate of Religious Affairs noted the following in its statement on the subject:

“Although crypto assets are not subject to any regulation and control mechanism, there is no central interlocutor in this regard, their market values are excessively volatile, they can be used in illegal activities due to their anonymous structure, and the transactions are irreversible, such assets are common. Since they are liquid assets held for investment and profit purposes, zakat must be paid over the current market value of crypto assets whose value reaches the nisab amount (80.18 gr. gold) together with other assets subject to zakat. Since the use of crypto assets as a means of payment is not considered legally appropriate, it is appropriate to pay the zakat of both such assets and other assets subject to zakat in TL or other current currencies. The same provisions apply to the currencies in which the fitra and ransom will be paid.”

What is Zakat?

Zakat in Islam refers to the obligation to give a certain percentage of one’s property to the poor and needy. Generally, zakat is given at the rate of 2.5 percent per year on certain tangible assets such as cash, gold, silver, agricultural products, animals and commercial goods. Zakat is an act of worship aimed at sharing a Muslim’s material wealth in line with Islamic principles and contributing to social solidarity.

Zakat is obligatory on Muslims who have reached puberty, are free and have mental capacity. In addition to the fact that one year has passed since the zakat is given, it must be more than a year’s debt and essential needs.

The amount of nisab, which is the minimum measure of wealth; 80.18 gr or the equivalent of money or trade goods under gold is 595 gr in silver, 5 in camels, 30 in bovines and 40 in ovines. When calculating zakat, the zakat rate is calculated on the remaining property after deducting the current debts.

The person giving zakat must have more than enough goods to meet his basic needs. People who make a written or verbal commitment to provide basic needs such as shelter, clothing and food, which are necessary for a safe and healthy continuation of life, do not have to give zakat.