Bitcoin is witnessing a mighty battle between bulls and bears. However, according to crypto analyst Rakesh Upadhyay, sellers currently have a slight advantage. Will the buyers defend the close support levels in altcoins including Bitcoin and DOGE or can the bears defeat the bulls? The analyst examines the charts of the top 10 cryptocurrencies to find out.

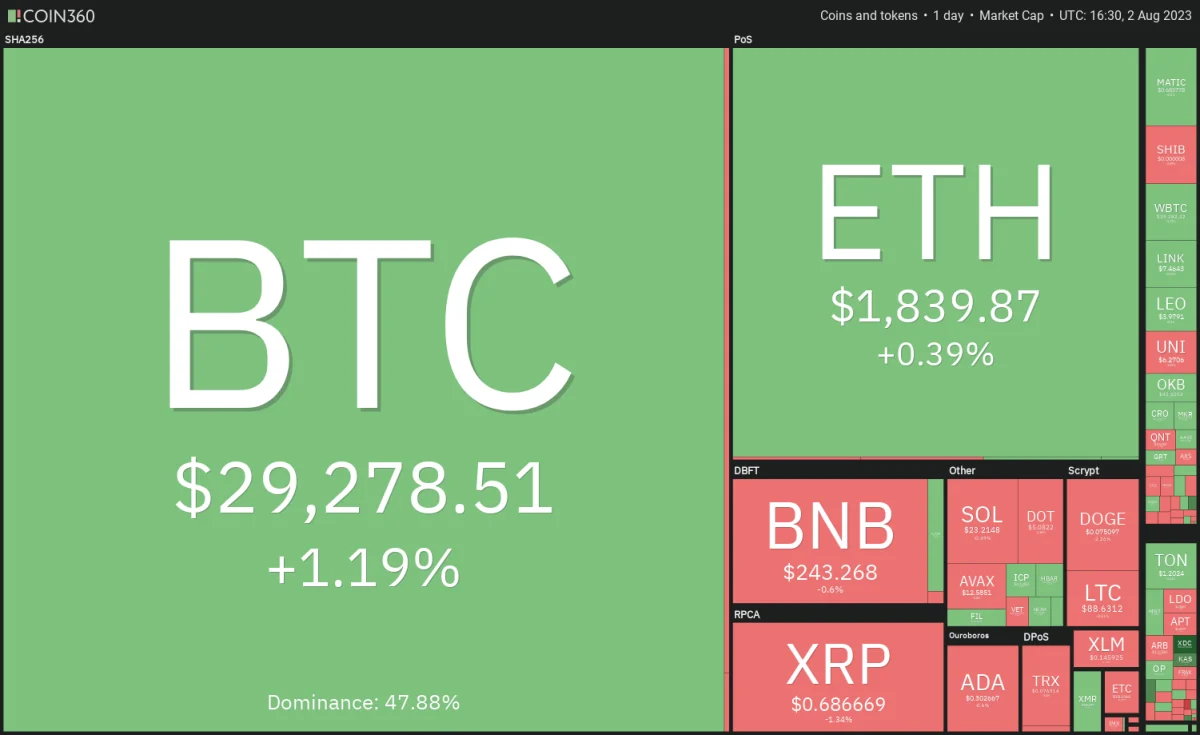

An overview of the cryptocurrency market

Rating agency Fitch downgraded the US long-term credit rating from AAA to AA+ on August 1. This move reduced his tendency to take risks. US stock markets witnessed profit bookings on August 2. On the other side, cryptocoin.com As you follow, the recovery in the cryptocurrency market has stopped. However, the markets may calm down after the sudden reaction. Cryptocurrency markets will likely continue to focus on news and events surrounding Bitcoin spot exchange-traded fund (ETF) applications. Bloomberg ETF analysts Eric Balchunas and James Seyffart said in a statement that the probability of getting the green light for an ETF application has increased from 1% a few months ago to 65%.

Daily cryptocurrency market performance. Source: Coin360

Daily cryptocurrency market performance. Source: Coin360Recent developments in the crypto industry have revived Bitcoin bulls. MicroStrategy, the software development firm founded by Michael Saylor, plans to raise up to $750 million through stock sales to use the funds for working capital and buy more Bitcoin. The firm currently holds 152,800 Bitcoins, worth about $4.5 billion at current prices.

BTC, ETH, BNB, XRP And DOGE analysis

Bitcoin (BTC) price analysis

Bitcoin’s volatility increased on August 1. The bears pushed the price below the $28,861 close support. However, the long tail on the candlestick indicates aggressive buying at lower levels.

The bulls pushed the price above the 20-day exponential moving average (EMA) of $29,596. But they are struggling to get past the $30,000 barrier. This shows that the bears do not want to give up and sell in the rallies. The 20-day EMA is flattening and the relative strength index (RSI) is just below the midpoint. This indicates a gap formation in the near term. The limits of the range could be $30,050 on the upside and $28,585 on the downside. If buyers push the price above this narrow range, BTC is likely to rise to the overhead resistance zone of $31,000 to $32,400. On the downside, a crack below $28,585 is likely to start a downside move towards $27,500 and then $26,000.

Ethereum (ETH) price analysis

Narrow gap trading in Ether resolved to the downside on August 1. However, the bears failed to sustain lower levels, as evidenced by the long tail on the day’s candlestick.

A positive sign in favor of the bears is that they are not allowing the price to climb above the 20-day EMA ($1,873). The bears are trying to strengthen their positions by keeping the price below the 50-day simple moving average (SMA) of $1,864. If they do, ETH is likely to drop as low as $1,813. A break and close below this level could drop ETH to $1,700 and then to $1,626. If the bulls want to avoid the short-term decline, they will have to overcome the hurdle at the 20-day EMA. It is also possible that this could start a rally towards the psychological resistance of $2,000.

Binance Coin (BNB) price analysis

BNB volatility rose on August 1. However, the bulls failed to push the price above the resistance line of the triangle.

The flat moving averages and the RSI near the midpoint do not give the bulls or bears a clear advantage. If the price rebounds from the moving averages, the probability of a breakout above the triangle will increase. If this happens, it is possible for BNB to rally as high as $265. Conversely, if the price slides below the moving averages, BNB is likely to drop to the support line of the triangle. If this support breaks down, BNB is likely to retest the vital support at $220.

Ripple (XRP) price analysis

XRP recovered from the $0.67 support on August 1. However, the bulls failed to sustain higher levels. This shows that the bears are selling on every small relief rally.

The bears are trying to pull the price back towards the $0.67 support. Repeated testing of a support level in a short range tends to weaken it. If the $0.67 level gives way, a drop to the $0.56 breakout level is possible for XRP. Alternatively, if the price rebounds strongly from $0.67 once again, it will indicate that the bulls are fiercely defending the level. This is also likely to push the price towards the immediate resistance of $0.75. A break above this level could open the doors for a possible rally to $0.85.

Dogecoin (DOGE) price analysis

DOGE price bounced back from the 20-day EMA ($0.07) on August 1. This shows that lower levels are attracting buyers.

However, the bulls failed to push DOGE price above the overhead resistance near $0.08. The bears took this opportunity and pushed the price back to the 20-day EMA. If this support is broken, it will indicate that the bulls have lost control. It is possible for DOGE price to drop to the $0.07 breakout level later. Instead, if DOGE price rebounds from the 20-day EMA once again, it will signal that sentiment remains positive and the bulls are buying the dips. It is also possible that this will increase the likelihood of a breakout above the overhead resistance. DOGE price is likely to rally to $0.10 later.

ADA, SOL, MATIC, LTC and DOT analysis

Cardano (ADA) price analysis

The bears dragged Cardano below the close support of $0.30 on August 1. However, the bulls bought the drop to the 50-day SMA ($0.29).

Buyers will need to push the price above the $0.33 to $0.34 resistance zone to indicate a reversal. It is possible for ADA to rally up to $0.38 later, where the bears can again make a strong defense. Contrary to this assumption, if the price continues to decline and breaks below the 50-day SMA, it will indicate that the bears have taken control. ADA is likely to drop to $0.26 and eventually $0.24 later.

Solana (SOL) price analysis

Solana bounced back from strong support at $22.30 on August 1. However, the bulls were unable to push and sustain the price above the 20-day EMA ($24.02).

This is a negative sign and indicates that the bears are selling on every small rise. Sellers will again try to push the price below the support zone between $22.30 and the 50-day SMA ($21.05). If they do, it is possible for the SOL to start a deeper correction towards $18 and then $16. On the other hand, if the price bounces off $22.30 once again, it will show that the bulls are fiercely holding this level. The SOL could rise to $25.68 first and then retest the key $27.12 resistance.

Polygon (MATIC) price analysis

MATIC is gradually being pulled down. The bears pushed the price below the 50-day SMA ($0.69) on July 31. However, the bulls pushed the price back above the level on August 1.

The gradually falling 20-day EMA ($0.72) and the RSI below 44 suggest that the bears have a slight advantage. If the price drops and dips below $0.65, further selling is possible. Thus, a drop to $0.60 is possible for MATIC. This negative view will be invalidated in the near term if the price turns up from the current level and rises above the 20-day EMA. This is also likely to open the doors for a possible rally to $0.80. It is also possible that this level is a hard barrier. However, if the bulls overcome this, MATIC is likely to reach $0.90.

Litecoin (LTC) price analysis

Litecoin bounced off the strong support at $87 on August 1. This indicates that the price is stuck in the range between $87 and $97.

The 20-day EMA ($92) is flat and the RSI is just below the midpoint. This shows that there is a balance between supply and demand. This balance will shift in favor of the bears if they drop the price below $87. It is possible for LTC to drop to $81 and then to $75 later. Contrary to this assumption, if the price reverses above $87, it will indicate that LTC will extend its stay in the range for a few more days. The bulls will need to push the price above $97 to start a rise towards $106.

Polkadot (DOT) price analysis

The Bears tried to resolve the uncertainty in Polkadot in their favor on August 1. However, the bulls thwarted this attempt.

A minor positive point in favor of the bears is that the bulls are not allowing the price to push the price above the 20-day EMA ($5.21). This indicates that higher levels continue to attract selling by the bears. Important support to watch on the downside is the 50-day SMA. If the price stays below this level, intensification of selling is possible. Thus, the DOT is likely to drop to $4.74 and then to $4.65. Conversely, a rally above the 20-day EMA could increase the likelihood of a rally towards the overhead resistance of $5.64.