Most major altcoins, including Bitcoin and AVAX, have bounced off strong support levels. According to crypto analyst Rakesh Upadhyay, it is possible for them to challenge the overall resistance to sustain the upward move. Can Bitcoin continue to rally or will the bears pose a strong challenge at higher levels? The analyst studies the charts of the top 10 cryptocurrencies to find out.

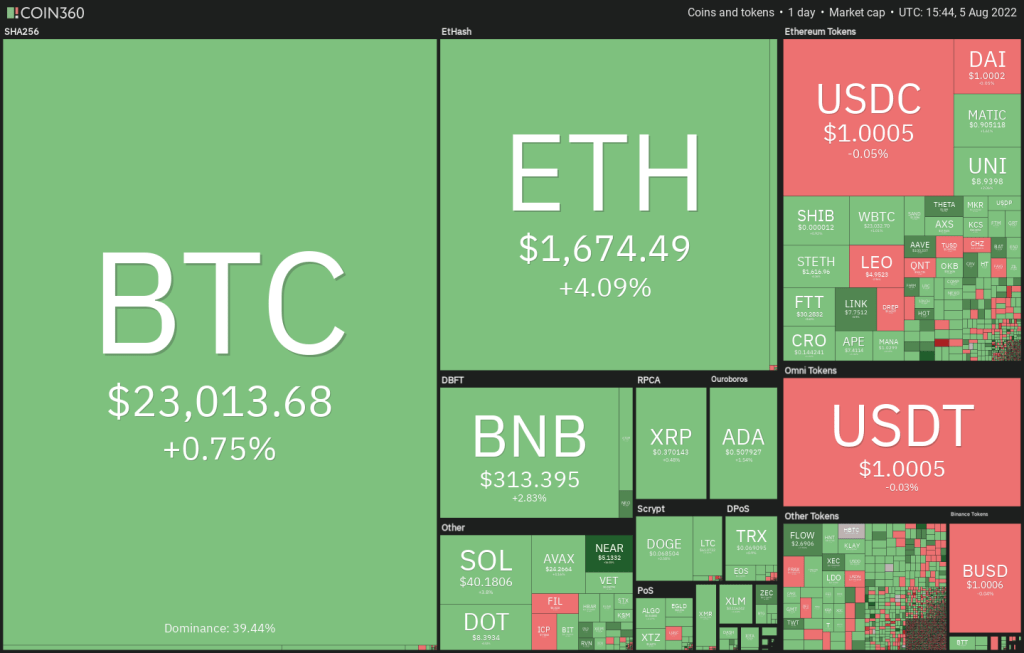

An overview of the cryptocurrency market

cryptocoin.com As you follow, the US Labor market added 528,000 jobs in July, much better than the 258,000 forecast. Wages rose 5.2% year-on-year and 0.5% monthly. This is a sign that inflation remains high. It also indicates that the Fed may continue to raise interest rates in the near future. After staying closely associated with the US equity markets for the past few months, the crypto space may be ready to chart a new course.

Bloomberg Intelligence senior commodity strategist Mike McGlone and senior market analyst Jamie Coutts said in a recent report that Bitcoin (BTC) is starting to form a foundation similar to that seen around $5,000 in 2018-2019. They expect the recovery to separate from equities and behave more like US ‘Treasury bonds or gold’.

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360During the ongoing bear market, crypto prices fell sharply. Despite this, it did not whet the appetite of investors. A report by crypto analytics firm Messari and Dove Metrics notes that the crypto space has raised $30.3 billion in funds in 2022. Thus, it shows that it exceeds the total amount collected in 2021. Now it’s time for analysis…

BTC, ETH, BNB, XRP and ADA analysis

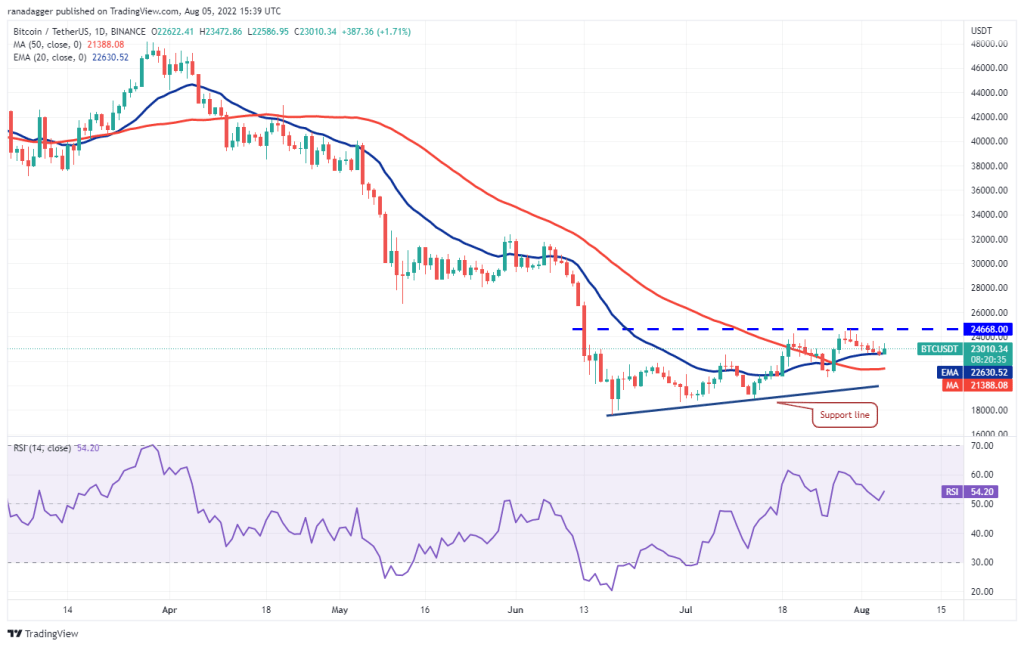

Bitcoin (BTC)

The bears pushed the BTC price below the 20-day exponential moving average (EMA) ($22,630) on August 4. However, it failed to sustain lower levels. This indicates that the bulls are aggressively defending the level.

The slowly rising 20-day EMA and the relative strength index (RSI) in the positive zone point to a minor advantage for buyers. If the price rises from the 20-day EMA, the bulls will try to push BTC to the overhead resistance at $24,668. This is an important level to consider. Because if the price rises above $24,668, it is possible for BTC to gain momentum and rally to $28,000 and then $32,000. Such a move would probably suggest that BTC has bottomed out.

Contrary to this assumption, if the price drops from the current level or overhead resistance and falls below the 20-day EMA, it will signal that the bears will continue to sell on minor rallies. It is possible that this could open the doors for a drop to the 50-day simple moving average (SMA) ($21,388).

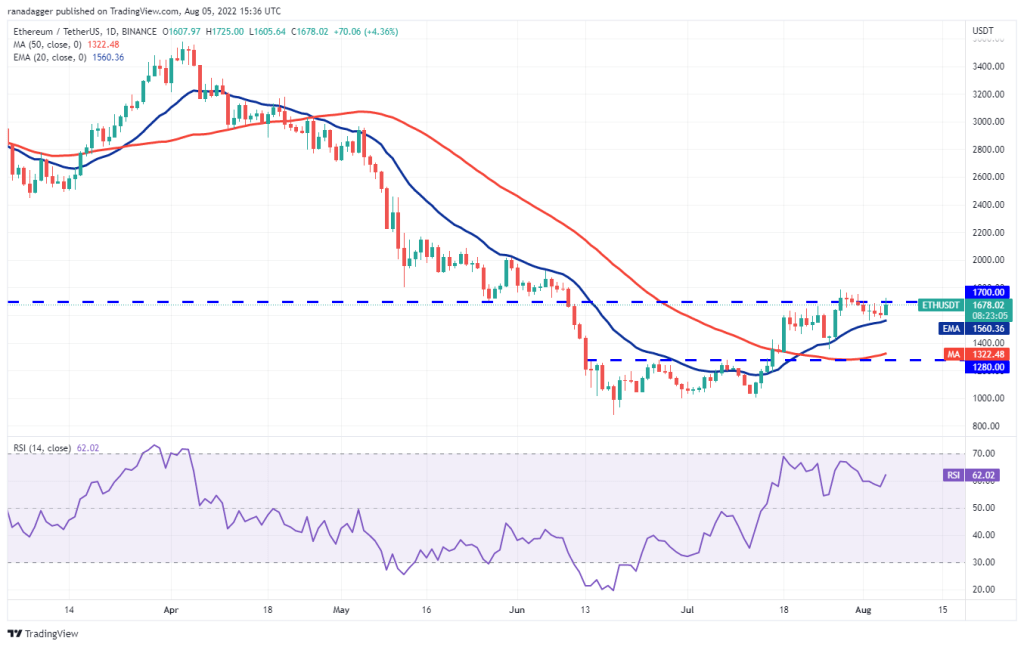

Ethereum (ETH)

ETH has been trading between the 20-day EMA ($1,560) and the $1,700 resistance for the past four days. Usually, narrow gap trading is followed by a range expansion.

The upsloping 20-day EMA and the RSI in the positive zone are giving the buyers an edge. A break and close above the overhead resistance zone between $1,700 and $1,785 is likely to open the doors for a possible rally to $2,000 and then $2,200. Alternatively, if ETH drops from the current level and dips below the 20-day EMA, it will signal that the bears will continue to defend the top zone with all their might. It is possible that this will cause strong support to drop at $1,280.

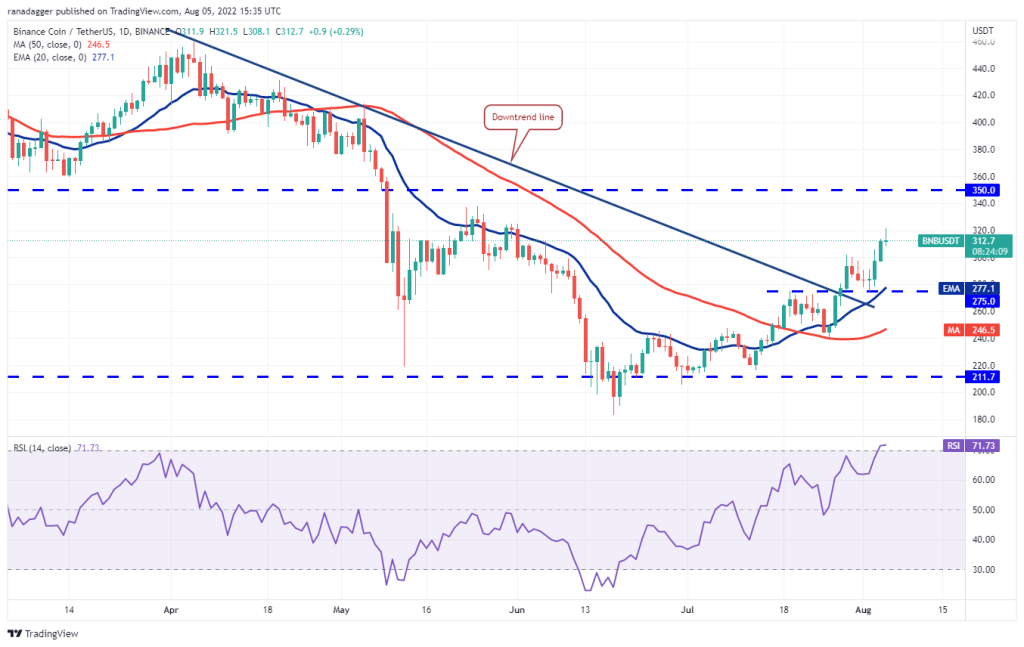

Binance Chain (BNB)

BNB bounced off the $275 support on August 2. It then rallied above the immediate resistance of $302 on August 3. This indicates that the upward movement has resumed.

The rising 20-day EMA ($277) and the RSI in the overbought zone suggest that the bulls dominate. It is possible for BNB to rise to the stiff overhead resistance at $350. This level is likely to attract strong selling from bears. To invalidate this bullish view, the bears will need to push the price below the 20-day EMA and sustain it. If this happens, short-term traders are likely to rush to the exit. This is also likely to pull BNB to the 50-day SMA ($246).

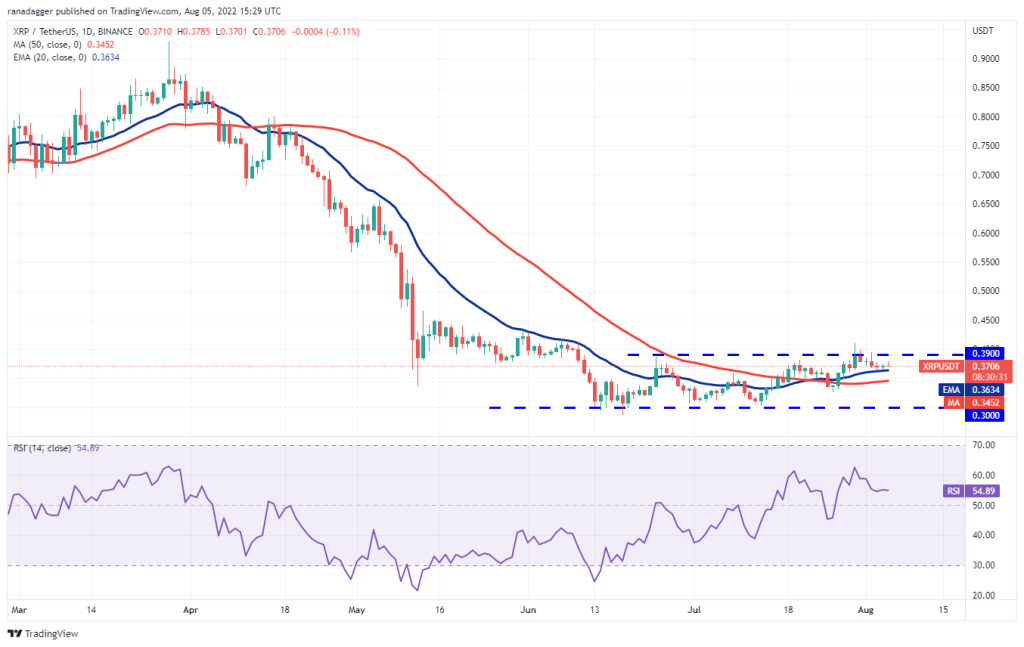

Ripple (XRP)

Buyers successfully held the 20-day EMA ($0.36) support in the past few days. However, it failed to provide a strong recovery in XRP. This shows that the bears are selling in the rallies.

XRP is likely to be stuck between the 20-day EMA and the overhead resistance zone between $0.39 and $0.41. If the bulls break through the overall hurdle, it is possible that the positive momentum will increase and XRP rally to $0.48 and then $0.54. Alternatively, if the price drops and dips below the 20-day EMA, it indicates that demand has dried up. This is likely to drop XRP to the 50-day SMA ($0.34). It is also likely to hold XRP between $0.30 and $0.39 for a few more days.

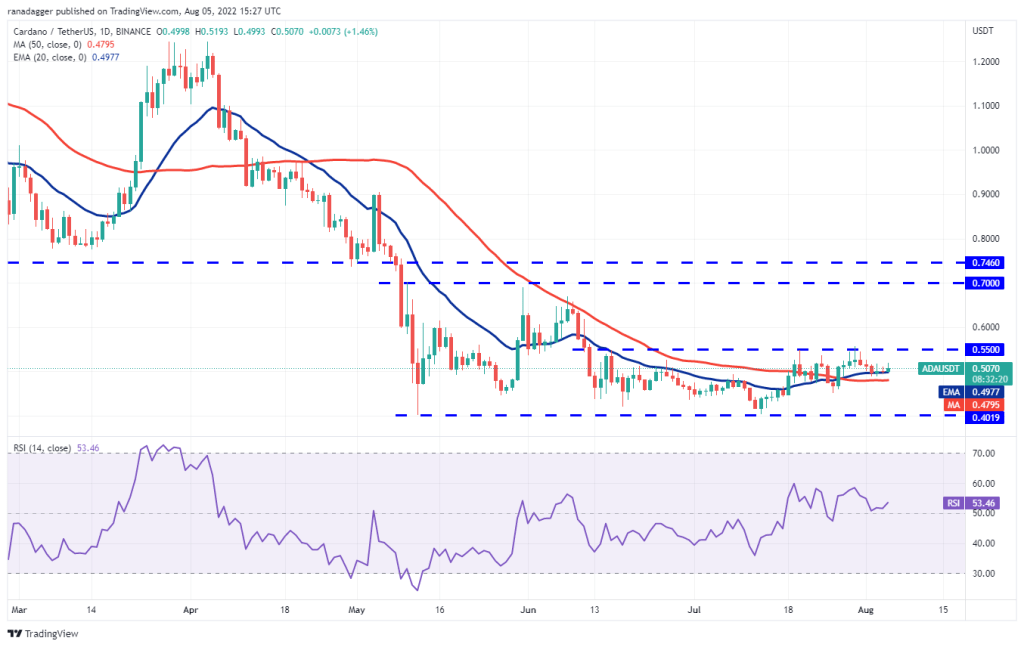

Cardano (ADA)

The bears have repeatedly tried to push Cardano below the 20-day EMA ($0.50) over the past three days. But the bulls held their ground.

ADA has rebounded from the 20-day EMA. Buyers will now try to push the price above the overhead resistance at $0.55. If they manage to do so, it is possible for the bullish momentum to increase and ADA to rally to $0.63 and later to $0.70. Alternatively, if the price drops from overhead resistance, it will indicate that the bears are active at higher levels. Sellers will then try to push the price back below the moving averages. This will keep ADA in the $0.40 to $0.55 range for a while.

SOL, DOGE, DOT, MATIC and AVAX analysis

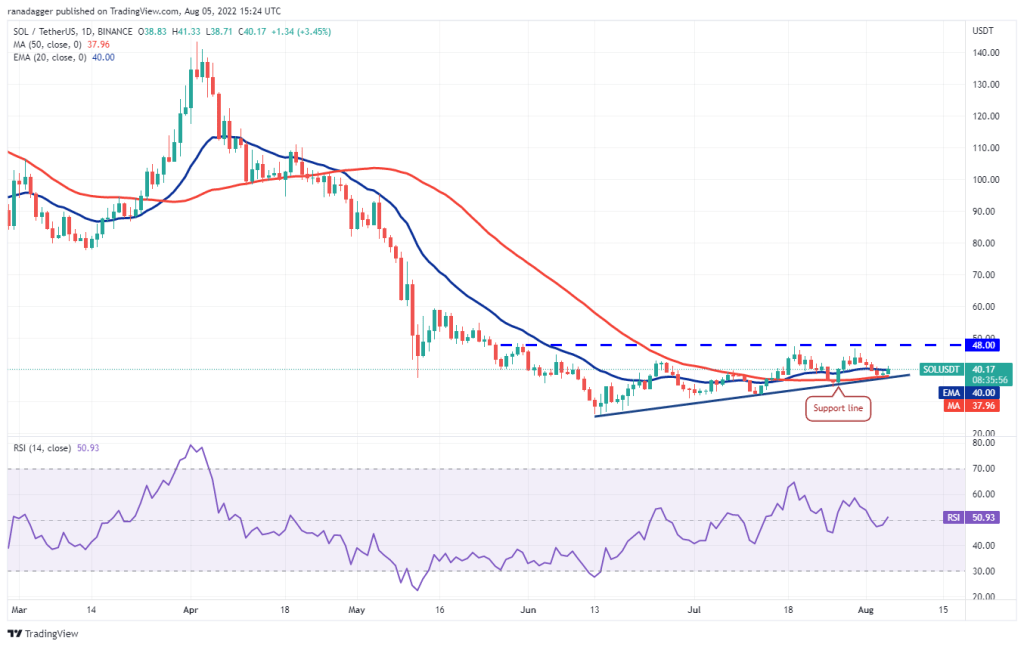

Left (LEFT)

The bears tried to push the price below the support line on August 3. However, the bulls successfully defended the level. Solana created an intraday candlestick chart on August 4. This was also on the upside on August 5th.

If the buyers sustain the price above the 20-day EMA ($40), the SOL could climb to $44. It is then likely to retest the stiff overhead resistance at $48. The bulls will have to break through this hurdle to signal the formation of an ascending triangle pattern. This bullish setup has a target of $71. Contrary to this assumption, the bullish setup will be invalidated if the price drops and dips below the support line. SOL is likely to slide towards the strong support at $31 later.

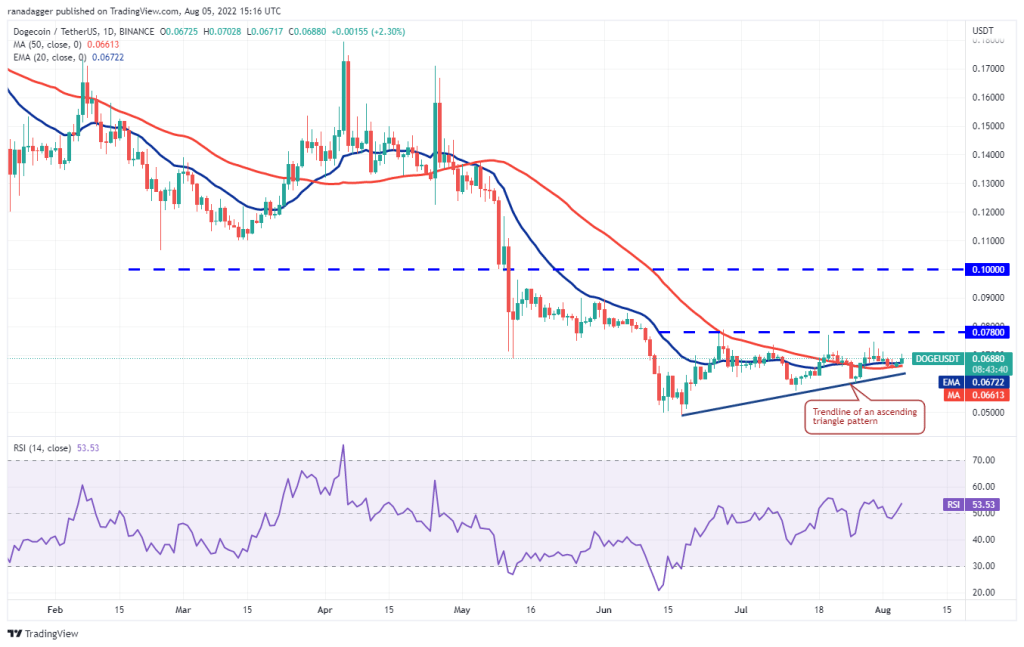

Dogecoin (DOGE)

DOGE bounced off the 50-day SMA ($0.07) on Aug. The bulls extended the upward move above the 20-day EMA ($0.07) on August 5.

The bulls will try to push the price towards the overhead resistance at $0.08. This is an important level for bears to defend. Because a break and close above this will complete an ascending triangle pattern. It is possible for DOGE to start an upward move towards the formation target at $0.10 and then $0.11. On the other hand, if the price drops from the current level and dips below the 50-day SMA, it means that the bears are selling in rallies. DOGE is likely to drop to the support line of the triangle later on. A break below this level is likely to negatively impact the bullish setup.

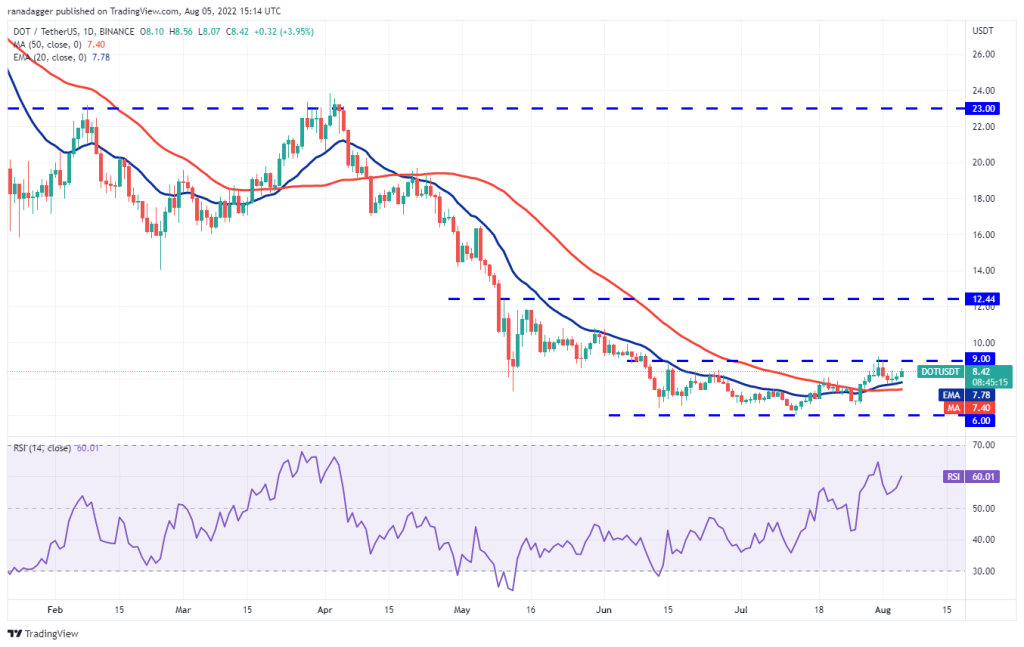

Polkadot (DOT)

DOT bounced off the 20-day EMA ($7.78) on Aug. It showed that demand was at lower levels. Buyers will try to push the price into the overhead resistance zone between $9 and $9.21.

If the bulls break through this overall hurdle, it is possible for DOT to gain momentum and start its northward walk towards $10.80 and then $12. The upward sloping 20-day EMA and the RSI in the positive zone indicate that the buyers are in control. Bears will need to sell aggressively to invalidate this bullish view. It should also lower the DOT below the moving averages. If that happens, it’s possible that the DOT will be stuck between $6 and $9 for a while.

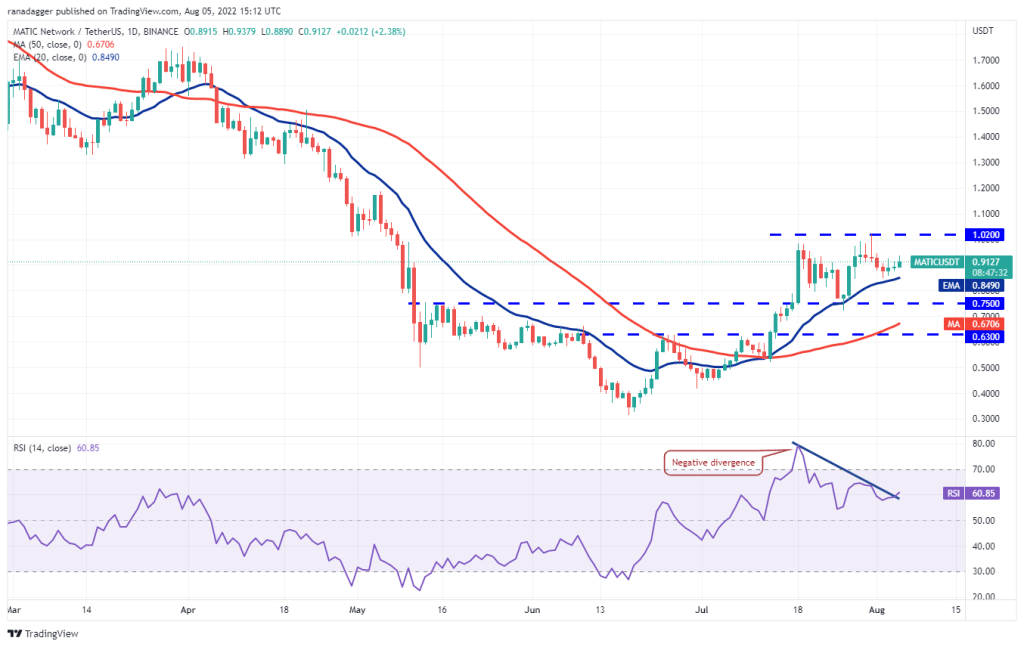

Polygon (MATIC)

Buyers held Polygon above the 20-day EMA ($0.85) during the correction. This marks a shift in sentiment from selling on rallies to buying on dips.

Both moving averages are rising and the RSI is in the positive territory. This gives buyers an advantage. If the bulls propel the price above the overhead resistance at $1.02, a MATIC rise to $1.26 and then $1.50 is possible. Conversely, if the price declines and dips below the 20-day EMA, it will suggest that MATIC may extend its stay for a while, between $0.75 and $1. Sellers will gain the upper hand on a break below $0.75.

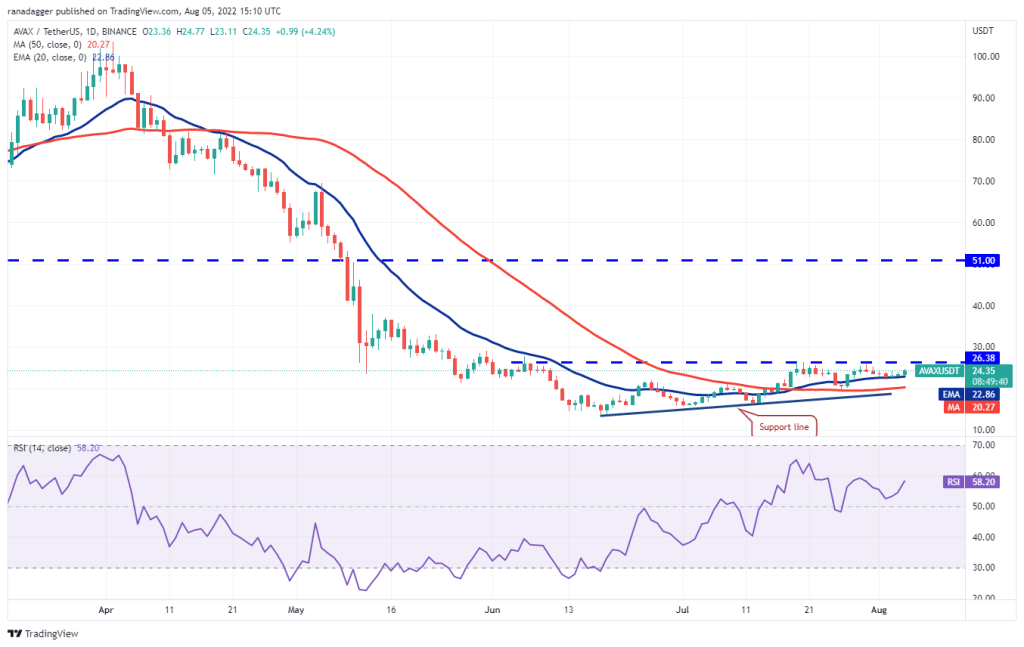

Avalanche (AVAX)

AVAX has bounced off the 20-day EMA ($22.86). This indicates that the bulls are buying dips to this support.

Buyers will push AVAX price to the stiff overhead resistance at $26.38. The slowly rising 20-day EMA and RSI in the positive zone point to the advantage for buyers. If the bulls push the price above $26.38, AVAX will complete the ascending triangle pattern. AVAX could then rise to $33 and then to $38. Contrary to this assumption, AVAX is likely to drop to the support line if AVAX price drops from overhead resistance and dips below the 20-day EMA.