According to crypto analyst Filip L, Dogecoin (DOGE) is seeing its price action come under bearish pressure. The analyst says Polkadot (DOT) is nowhere near a reversal as the bear market still sets the overall price direction. Also, Ethereum (ETH) is at risk of a bull trap as the bulls see the price action drop below an important technical limit. We have prepared Filip L’s DOGE, DOT and ETH analysis for our readers.

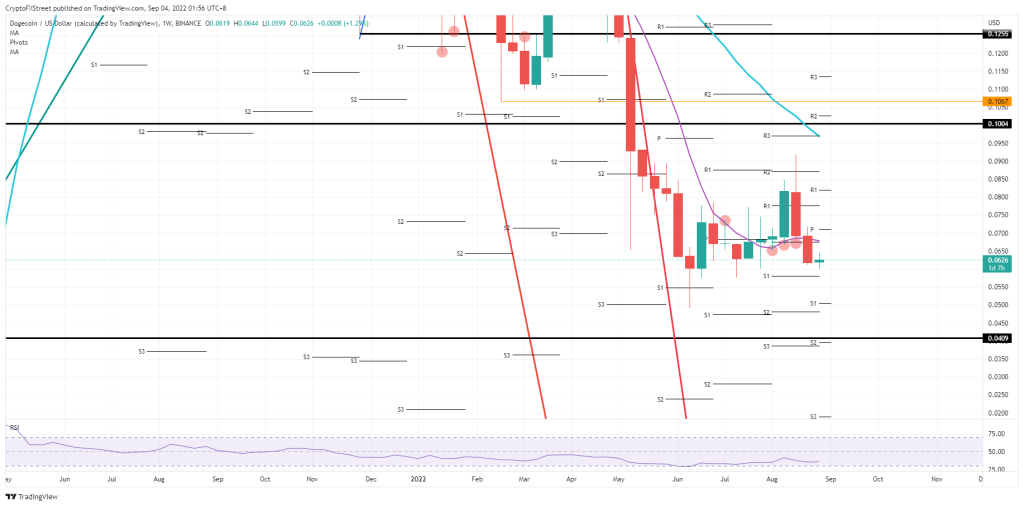

“DOGE will be kicked back to $0.05”

cryptocoin.com As you’ve been following, Dogecoin was on a good track to close this week on a good win. Unfortunately, DOGE bulls let the rope slip. Therefore, the bulls see their gains sinking to the bottom. Worse, it doesn’t help the general sentiment and conviction that the bulls look for before adding more money to their positions.

For now, DOGE finds support at $0.058, which makes sense with the S1 support level at this level in August. As September began, the pivots were redrawn. In this context, the S1 came out a little lower, around $0.05. Another round of dollar strength is likely in the coming weeks as DOGE price is almost certain to trade at $0.05.

DOGE weekly chart

DOGE weekly chartIf Dogecoin can break the 55-day Simple Moving Average (SMA) at $0.0674, it is likely to entice and attract investors and traders to the price action. Markets perceive this to be a game changer. That’s why there’s a huge influx of cash into the cryptocurrency. Elon Musk must find time to speak a word of support for DOGE. Thus, it is possible for the DOGE price to even fly to $0.10.

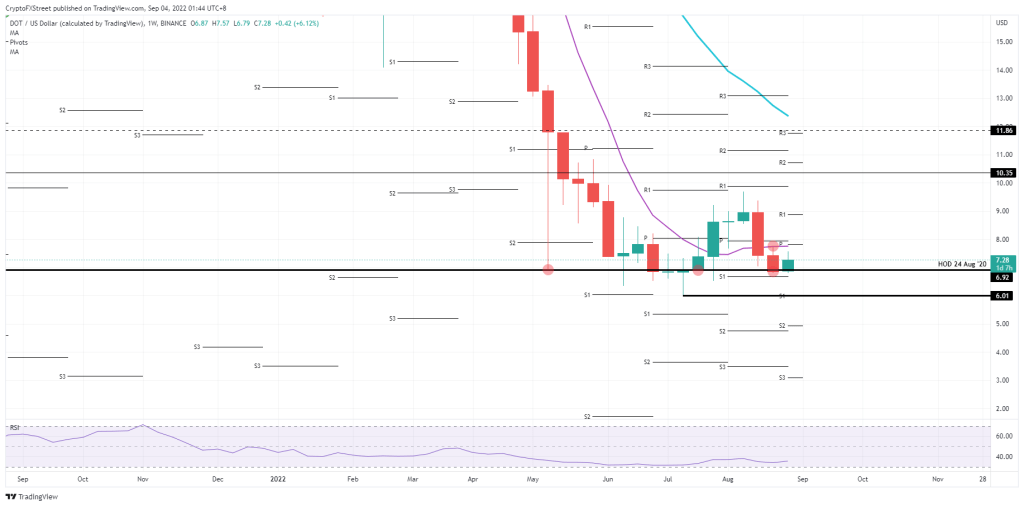

“DOT still under pressure from last week’s rejection”

Over a broader timeframe, the Polkadot (DOT) bear cycle is still very robust. So there is some logic to why this bullish candle is just a bearish one on the hot plate. Last week, the bulls tried to break the 55-day Simple Moving Average (SMA) around $7.75. They were then severely rejected. Then the DOT price dropped. This week’s closing provides some profit. Unfortunately, however, it failed to break above last week’s high and the 55-day SMA barrier.

DOT price, so it’s not going anywhere. It will only go further south after a small jump effort. The DOT will see the bulls get stuck at this support level at $6.92 before this level is broken. With the start of a new month, new pivots are drawn on the chart. The monthly S1 aligns perfectly with the 2022 low of $6. If this level does not hold, it is necessary to watch the monthly S2 at $ 5 .

DOT weekly chart

DOT weekly chartIt is possible that the bounce will continue somewhat into the next week. We can see the bears squeeze against the 55-day SMA. Once broken, it is possible to see a large bull flow with a steep rally. In this case, DOT is likely to rally to $10 and hit a new high since June.

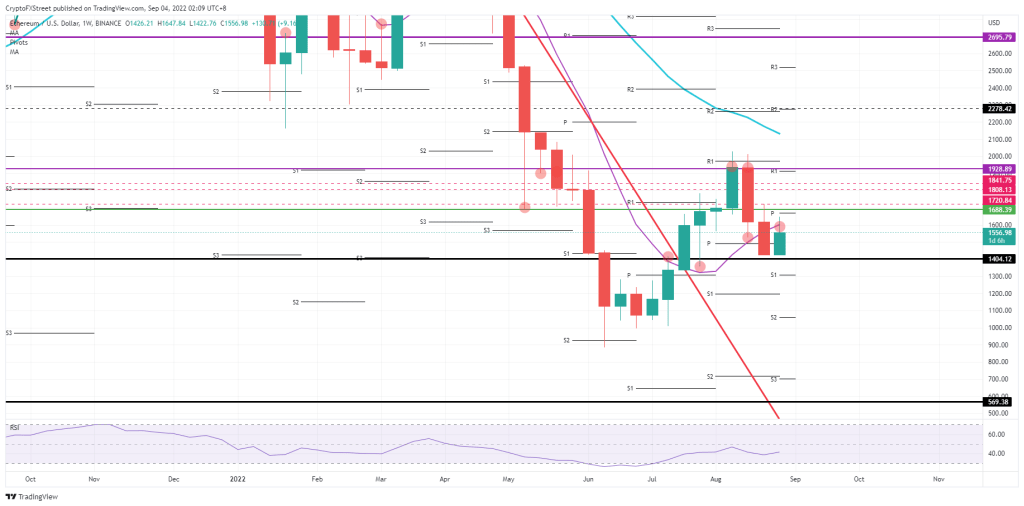

“ETH price will crash next week!”

Ethereum still has a few hours left if it wants to add more gains before closing this week. Along with the earnings, there is another big problem. The good news for that continues. The issue is the bull trap, which is caused by the failure of the bulls to secure weekly gains above the 55-day Simple Moving Average (SMA) above $1,600.

ETH risks falling to the ground behind this bull trap. If the bull trap falls in line with a negative trading week in the general markets next week and more dollar strength is added to it, the base of $1,404 is likely to hold and break. Plenty of free rooms are unlocked until the first support is reached from the July low of $1,011.

ETH weekly chart

ETH weekly chartWhile this bull trap is there, it could easily disappear if global markets start the new trading week on a positive note. The bulls are likely to bounce back easily above this $1,600 level. More gains are likely towards around $1,928 by Friday. Thus, it is possible that it will return to its August high.