Since so much has been done about artificial intelligence (AI) recently with artificial intelligence tools like OpenAI’s ChatGPT, investors are now looking for deep learning algorithms to gauge future crypto price trends. In this article, let’s take a look at what levels machine learning algorithms PricePredictions expect by the end of the month for DOGE, LUNC, XRP and BTC.

Machine learning algorithm sets DOGE price for February 1

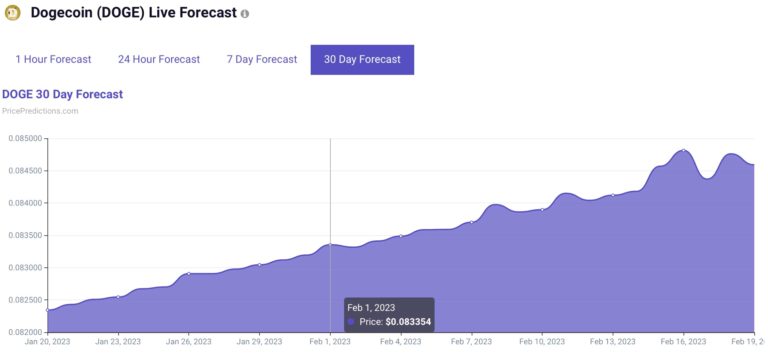

Dogecoin (DOGE) outperformed most cryptocurrencies in the 2022 bear market. It managed to stay in the top 10 throughout the year. In price predictions, the 30-day forecast from machine learning algorithms PricePredictions shows that Dogecoin will trade at $0.0833 on January 31, about 2.5% higher than its current price.

Dogecoin is currently facing the $0.091 resistance and if the price rises above the position, the bulls will likely start an uptrend towards $0.1.

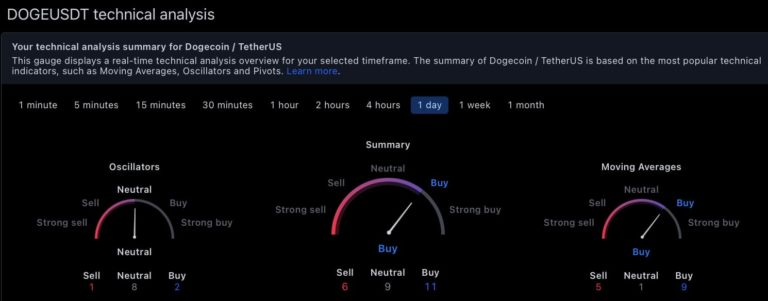

Elsewhere, daily indicators on TradingView are still bullish for Dogecoin. Indicators summary is in the ‘buy’ zone at 11, moving averages are for ‘buy’ at 9. Oscillators show ‘neutral’ at 8.

If the integration of Dogecoin (DOGE) as a payment option on the social media platform takes place after Elon Musk profits from its acquisition of Twitter, this could trigger further price increases, but expectations are just speculation for now. Elsewhere, Dogecoin could be bullish as the community focuses on new products like Libdogecoin, Dogecoin Standard, and GigaWallet, among others.

Terra Classic (LUNC)

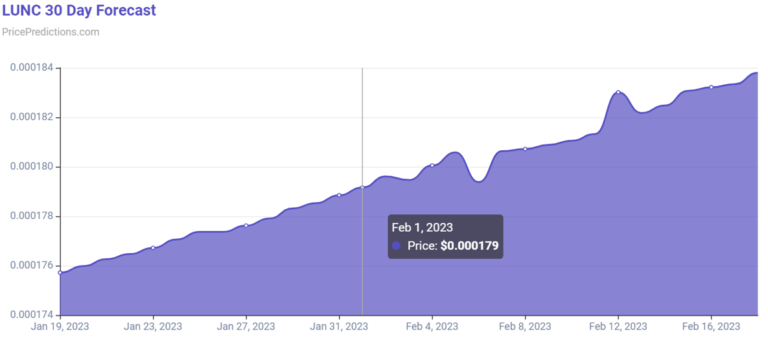

The LUNC price is on the rise as the bulls beat the bears after moving sideways for weeks since the start of the year. Terra Classic is still showing signs of vitality in the crypto market after the collapse of the Terra (LUNA) ecosystem. Various factors come into play when examining LUNC’s price movements, from network development to input from the community. However, significant uncertainties remain regarding the future of LUNC, although it has shown signs of recovery despite the previously expanding bear market in 2022.

Accordingly, PricePredictions’ 30-day forecasts predict that LUNC will likely trade at $0.000179 on February 1.

It’s worth noting that the LUNC community is moving towards $1 with campaigns complete with an accelerated LUNC burn rate. The token’s potential is also supported by the token burning efforts of established exchanges like Binance.

The LUNC price was also affected by the development around the lawsuit facing Terra founder Do Kwon. On January 11, LUNC fell into decline after a lawsuit against Kwon was dismissed in New York. Still on the run, Kwon denies any involvement in the collapse, despite facing allegations that he violated South Korea’s capital market laws.

Ripple (XRP)

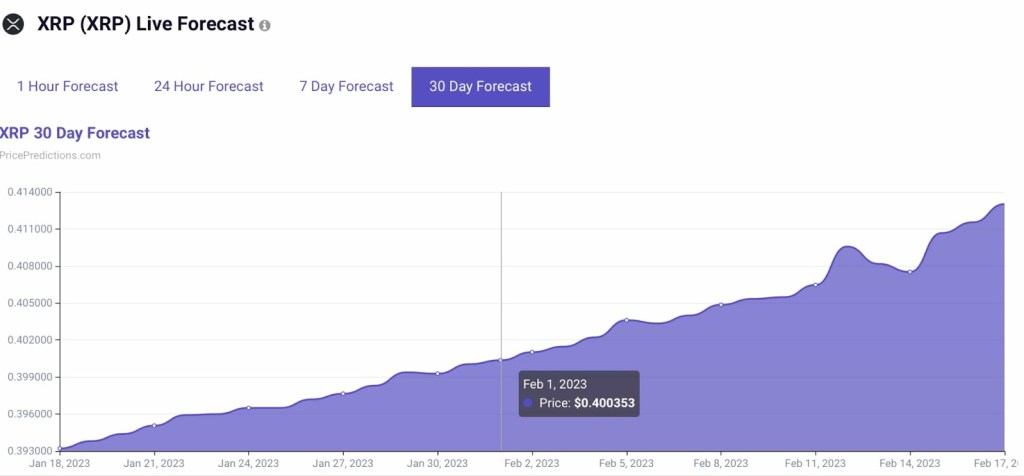

As the widely publicized litigation between the SEC and Ripple draws to a close, investors are hoping that a positive ruling in the lawsuit against the regulator will have a significant bullish impact on the XRP price. Specifically, the machine learning algorithm at PricePredictions predicts that XRP will likely extend its uptrend from January to February. According to the forecast, XRP is expected to trade at $0.400353 on February 1. This represents an increase of about 2.8% from its current price.

In recent developments from the case, expectations are that Ripple will win, given defense attorney John E. Deaton’s optimism that the SEC will lose the case. As the lawyer pointed out, the SEC’s argument that the XRP token has always been a security was proof that the Howey test is a problematic and difficult thing to use in the case of Ripple Labs and XRP.

All of this suggests that, according to Deaton’s analysis, the SEC’s conclusion that XRP meets Howey’s second and third extremes is incorrect, and thus the SEC has little chance of success in this situation.

Bitcoin (BTC)

Bitcoin got off to a strong start in 2023, reaching multiple key support levels. Investors hope these levels can provide a basis for the first cryptocurrency to continue its bullish trend. The upward momentum came as a result of investors catching positive news on macroeconomic factors.

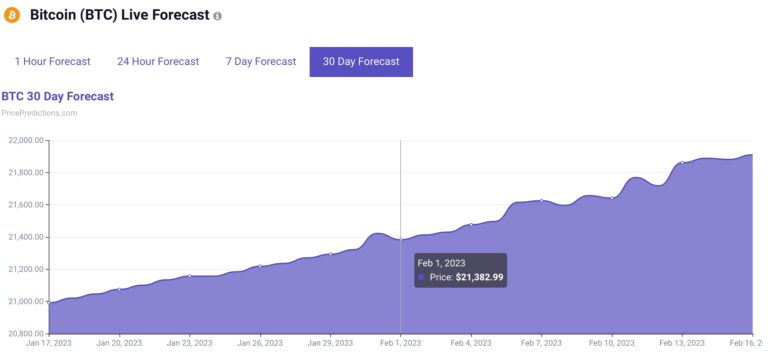

While the Bitcoin price has continued to rise over the past week, investors are hoping it will continue to climb as we enter February. Machine learning algorithms at PricePredictions predict that Bitcoin will continue to rise higher to trade at $21,382 on February 1, 2023.

It is interesting that Aurelien Ohayon, CEO of strategic services platform XOR, predicted that 2023 could be the year Bitcoin was in a bull run. According to his research, the first cryptocurrency to hit the market typically experiences a bull market after four years, and a bearish market typically lasts about a year. In this respect, cryptocoin.comWe have compiled the 2023 forecasts of different experts in this article.