Bitcoin’s price action remains sluggish. However, certain altcoins are showing signs of breaking out of their own resistance levels, according to crypto analyst Rakesh Upadhyay. Even if Bitcoin consolidates, can certain altcoins, including DOGE, wake up from their slumber. The analyst examines the charts of the top 10 cryptocurrencies to find out.

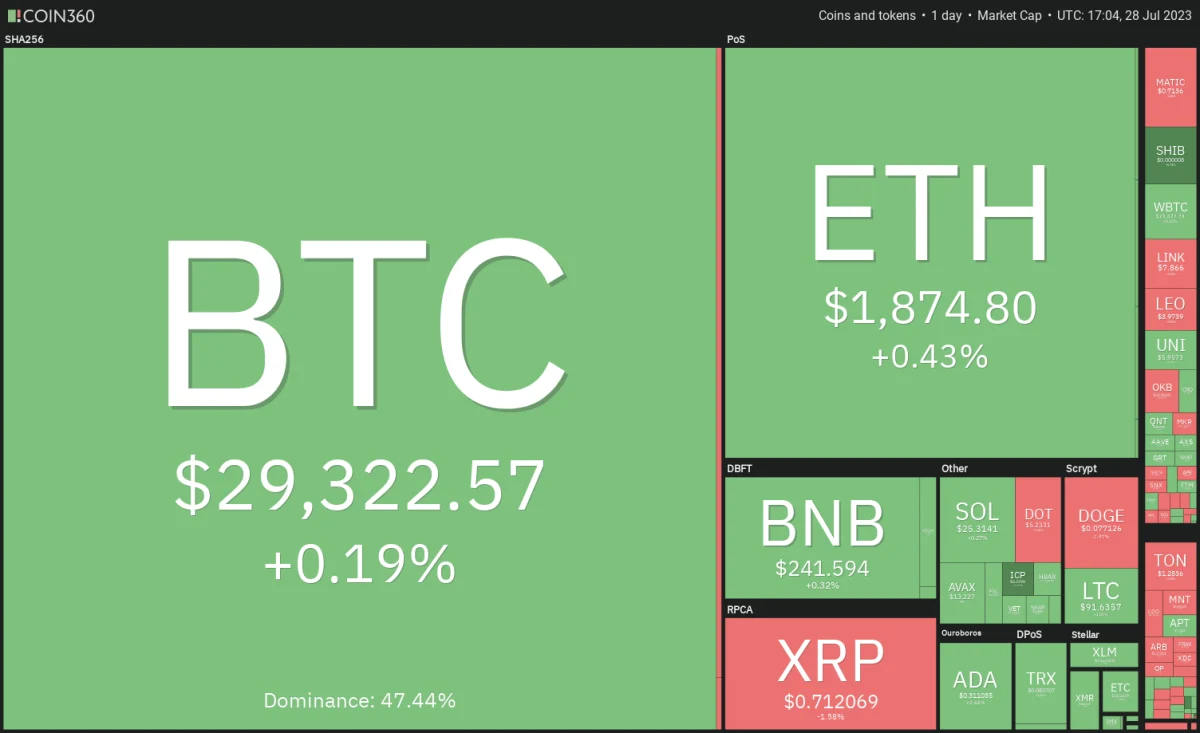

An overview of the cryptocurrency market

cryptocoin.com As you can follow, the Federal Reserve raised interest rates by 25 basis points on July 26. After that, the comment made by Fed Chairman Jerome Powell could not get Bitcoin out of the range it was in. This shows that the event did not contain any surprises. It also signals that the outcome has already been priced in by the markets. Crypto markets continued their sluggish performance after the US Personal Consumption Expenditure (PCE) Index came in lower than analysts’ expectations on July 28. PCE is the Fed’s preferred measure of inflation. That’s why market watchers watch closely.

Daily cryptocurrency market performance. Source: Coin360

Daily cryptocurrency market performance. Source: Coin360While short-term price movements can keep traders guessing, it’s important to keep an eye on the long-term crypto story. Standard Chartered head of crypto research, Geoff Kendrick, said in an interview with CNBC that he expects Bitcoin to end 2024 with $100,000 to $120,000. Kendrick has the belief that Bitcoin will witness price patterns during previous halving cycles.

BTC, ETH, XRP, BNB and ADA analysis

Bitcoin (BTC) price analysis

Bitcoin’s bounce from the 50-day simple moving average ($29,250) is fading near the 20-day exponential moving average ($29,743). This indicates that higher levels are attracting sellers.

The 20-day EMA has started to turn down and the relative strength index (RSI) is in the negative territory. This shows that the bears have a slight advantage. If the bears pull the price below the $28,861 close support, it is possible for BTC to start a downside move towards $27,500 and then $26,000. Such a move would indicate that BTC will extend its stay in the $24,800 to $31,000 region for a while. The important level to watch on the upside is the 20-day EMA. If it breaks this resistance, BTC is likely to rally towards $31,000. The bears will likely face an acid test of $31,000 to $32,400.

Ethereum (ETH) price analysis

ETH has been stuck between the moving averages for the past few days. This indicates that the bulls are buying dips to the 50-day SMA ($1,854). However, it also reveals that they were unable to push the price above the 20-day EMA ($1.881).

This narrow-range operation is unlikely to continue for long. So, it may soon be resolved with a strong break. If the bulls push the price above the 20-day EMA, a rally to $1,930 and eventually $2,000 is possible. Conversely, if the price drops and breaks below the 50-day SMA, it will show that the bears have taken the lead. In this case, ETH could oscillate in the wide range between $1,626 and $2,000 for a while.

Ripple (XRP) price analysis

It is possible for XRP to enter a period of consolidation after the sharp rally on July 13. The limits of this range would likely be $0.67 and $0.85.

The 20-day EMA ($0.68) is gradually rising. Also, the RSI is in the positive territory. This shows that the bulls have a slight advantage. It is possible for XRP to rally to $0.75. Also, if it breaks above this level, the rally is likely to continue to $0.85. Conversely, if the price drops and dips below $0.67, it will indicate that the bears are taking control. XRP could then retrace to the $0.56 breakout level. This level is likely to attract buyers.

Binance Coin (BNB) price analysis

BNB price action has been random and volatile inside the triangle as both bulls and bears battle for supremacy.

If the buyers push the price above the moving averages, a rise to the resistance line of the triangle is possible for BNB. This is an important level for the bears’ defense. Because a break above this could push the price higher towards $265 and then the $290 pattern target. Instead, if the price turns down from the current level, it will indicate that the bears are maintaining the selling pressure. BNB is likely to fall to the support line later on. This level can attract buyers. But if they fail to achieve a meaningful bounce, BNB is likely to drop further. Thus, it is possible for it to retest the vital support at $220.

Cardano (ADA) price analysis

Cardano rebounded from the $0.30 breakout level on July 26. This shows that the bulls are trying to defend the support strongly.

The 20-day EMA ($0.30) is flat. Also, the RSI is near the midpoint. This does not give the bulls or bears a clear advantage. If the bulls hold the price above the 20-day EMA, a rally to the overhead resistance of $0.34 is possible. This level is likely to act as a strong barrier. However, if it exceeds, ADA is likely to reach $0.38. If the bears want to prevent an up move, they will need to quickly push the price below the uptrend line. If they manage to do so, it is possible for ADA to drop to $0.27 and then to $0.26.

SOL, DOGE, MATIC, LTC and DOT analysis

Solana (SOL) price analysis

SOL bounced off support at $22.30 on July 25. Thus, it broke above the 20-day EMA ($24.07) on July 26, showing that the range-bound movement remains intact.

The rising 20-day EMA and RSI in the positive zone point to the advantage for buyers. If the price turns up from the current level, the bulls will try to push the SOL towards the overhead resistance of $27.12. A break and close above this barrier could indicate the start of a new uptrend. On the other hand, a break below the 20-day EMA is likely to push the price towards the key $22.30 support. This is an important level to pay attention to. Because if it breaks, it is possible for the SOL to drop to the 50-day SMA ($20.22).

Dogecoin (DOGE) price analysis

DOGE broke above the overhead resistance of $0.80 on July 25. However, the bulls failed to sustain the momentum. This indicates higher levels of selling.

The bears pushed DOGE price below the $0.08 breakout on July 26. It is possible for DOGE to slide to the 20-day EMA ($0.07). This point is an important level to watch in the near term. If the price rebounds from the 20-day EMA, it will indicate that sentiment has turned positive and the trader is buying on the dips. This would increase the likelihood of a break above $0.08. If this happens, DOGE price is likely to rally higher towards $0.10. This positive sentiment will disappear if the price continues to drop below $0.07.

Polygon (MATIC) price analysis

MATIC has been trading between the moving averages for the past three days. This shows that there is a situation of indecision between the bulls and the bears.

If the price breaks below the 50-day SMA ($0.69), it will indicate that the bears are back in the driver’s seat. It is possible for MATIC to decline to $0.65 and then strong support at $0.60. On the contrary, if the price rises and rises above the 20-day EMA, it will indicate that the bulls have overpowered the bears. This could start a recovery towards $0.80 and then towards $0.90.

Litecoin (LTC) price analysis

LTC is trying to recover. However, the bulls are facing stiff resistance at the 20-day EMA ($92). This indicates that the bears are active at higher levels.

If the price turns down from the 20-day EMA and dips below $87, it will indicate a resumption of the downward move. LTC is likely to drop to $81 later and the bulls will try to stop the decline. Alternatively, if the bulls push the price above the 20-day EMA, it will indicate that the selling pressure will ease. There is a minor resistance at $96. However, if the bulls overcome this, a rally towards $106 is possible.

Polkadot (DOT) price analysis

The bulls have repeatedly failed to push Polkadot above the 20-day EMA ($5.24) in the past three days. This shows that the bears are selling on small rallies.

The bears will try to further strengthen their positions by pulling the price below the 50-day SMA ($5.05). If they do, the DOT is likely to drop to the next support at $4.74 and then $4.65. Contrary to this assumption, if the price rises and breaks above the 20-day EMA, it will suggest a solid buy lower. This will likely keep the DOT between the 50-day SMA and $5.64 for a few more days.