According to crypto analyst Rakesh Upadhyay, the recovery in the US stock markets seems to have acted as a catalyst for the relief rally in Bitcoin and certain altcoins. What are the key levels of resistance that must be overcome for a sustained recovery to begin in Bitcoin and major altcoins including DOGE? The analyst examines the charts of the top 10 cryptocurrencies to find out.

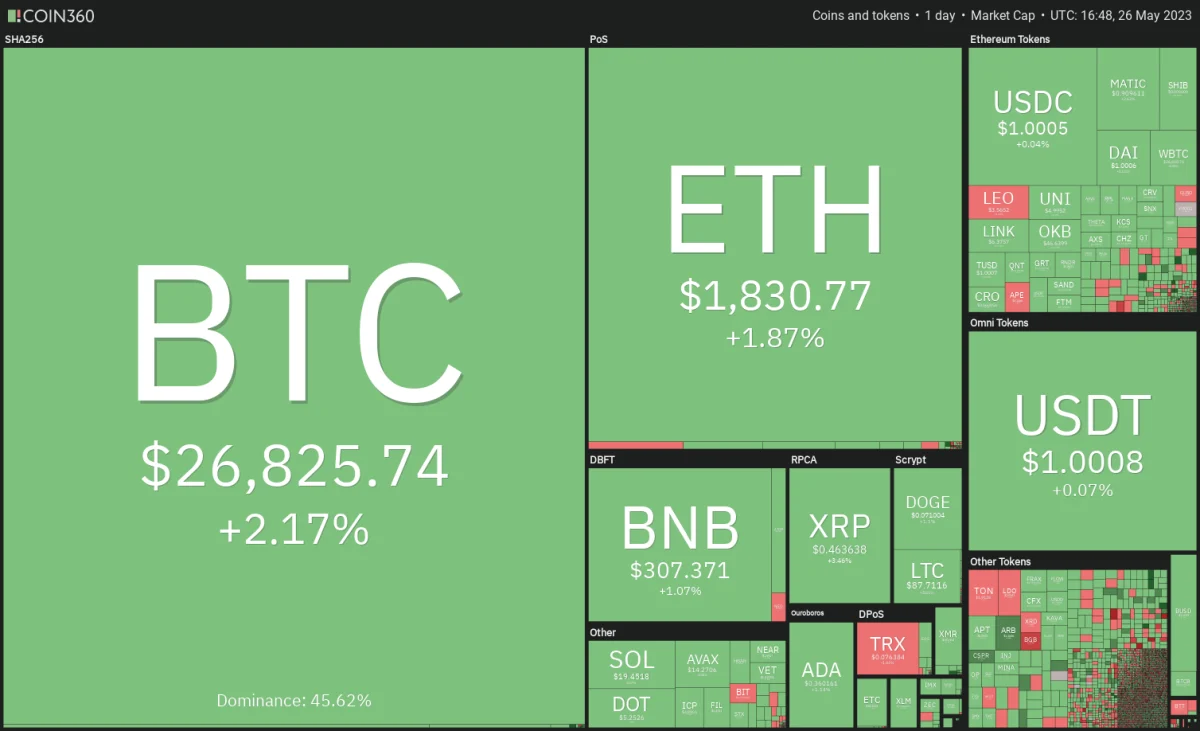

An overview of the cryptocurrency market

cryptocoin.com As you follow, Bitcoin is fixed below $27,000. Also, the weakness over the past few days has boosted analysts’ predictions for a drop to $20,000. Everything is possible! However, the bulls are unlikely to give up the $25,000 support without a fight. Checkmate, principal analyst at Glassnode, said in comments on May 24 that the sell-side risk ratio metric shows that “sellers are exhausted on both sides”, indicating that big moves are “approaching”. The last time the sell-side risk ratio was this low was in late 2015. This started the bull run that reached $20,000 in December 2017.

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360Another short-term positive development is that market watchers expect an agreement on the debt ceiling to be reached. Thus, this is what drives the price of US stock markets on May 26. If the risk perception continues, it is possible that the demand for Bitcoin will increase.

BTC, ETH, BNB, XRP and ADA analysis

Bitcoin (BTC) price analysis

Bitcoin jumped from $25,871 on May 25. Thus, it approached the strong support zone between $25,811 and $25,250. The bulls will try to push the price up to $27.173, the 20-day exponential moving average (EMA).

It is possible that this level will again attract the strong selling of the bears. If the price turns down from the 20-day EMA, it will signal a negative sentiment where the bears are selling at the rallies. The most important level to watch on the downside is $25,250. The bulls are expected to defend this support with all their might. Because if this level drops, it is possible for BTC to drop to $24,000 and eventually $20,000. On the contrary, if the bulls pierce the overhead resistance at the 20-day EMA, BTC is likely to rise to the resistance line. Buyers will need to get past this hurdle to show that the fix may be over.

Ethereum (ETH) price analysis

ETH has been trading inside a falling wedge for the past few days. The bears tried to push the price to the support line of the wedge on May 25. However, the bulls bought the dip aggressively, as seen by the long tail on the candlestick.

The bulls are trying to pull and sustain the price above the 20-day EMA ($1,829). If they are successful, it is possible for ETH to rise to the resistance line. This is an important level to consider. Because a break above it will increase the probability of a rally to $2,000. If the price turns down from the current level or resistance line, it will show that the bears remain active at higher levels. This is also likely to cause ETH to be stuck in the wedge for a few more days.

Binance Coin (BNB) price analysis

BNB slumped near the horizontal support at $300 on May 26. However, the long tail on the candlestick indicates buying by the bulls.

The 20-day EMA ($311) remains the key resistance level to watch out for on the upside. If the price turns down from this level once again, the probability of a drop below $300 will increase. If it breaks above this level, it is possible for BNB to slide to the support line of the descending channel pattern. Conversely, if the price rises and breaks above the 20-day EMA, it will indicate solid demand at lower levels. BNB could then attempt a rally towards the resistance line. Buyers will need to break through this hurdle to signal the start of a rally towards $350.

Ripple (XRP) price analysis

The bears pulled XRP below the 20-day EMA ($0.45) on May 24 and 25. However, they were unable to maintain lower levels. This indicates that sentiment has turned positive and traders are buying dips to the 20-day EMA.

The fact that the price is stuck between the moving averages indicates indecision between the bulls and bears. A breakout and a close above the 50-day simple moving average (SMA) at $0.47 will turn the advantage in favor of the bulls. XRP is likely to start its march northward towards $0.54 and then $0.58 later. Alternatively, if the price breaks and stays below the 20-day EMA, it will indicate that the bears are back in the game. It is possible for XRP to drop to the key $0.40 support later on.

Cardano (ADA) price analysis

ADA is witnessing a tough fight between bulls and bears near the uptrend line. The bears are trying to push the price below the uptrend line. However, the bulls are fiercely defending the level.

The falling 20-day EMA ($0.37) and the relative strength index near 42 suggest the bears have the upper hand. Sellers will need to push the price below $0.35 to start the next leg of the downward move at $0.30. If the bulls want to take control, they will have to push and sustain the ADA above the moving averages. This will open the doors for a possible rally towards the overhead resistance of $0.44, where the bears can again put up a strong defense.

DOGE, MATIC, SOL, DOT and LTC analysis

Dogecoin (DOGE) price analysis

The bears pulled DOGE below the $0.07 support on May 25. However, the long tail on the candlestick indicates that the bulls are trying to hold the level.

The bulls will have to maintain their buying pressure and push the price above the 20-day EMA ($0.07) if they want to prevent another attack by the bears. There is another hurdle at $0.08. However, if it exceeds this, it is possible for DOGE to start its journey towards $0.10. Instead, if the price turns below the current level or the 20-day EMA, it will indicate that the bears are selling on every minor rally. This will increase the probability of a drop below $0.07. Thus, DOGE will likely drop to $0.06.

Polygon (MATIC) price analysis

MATIC has turned down from the 20-day EMA ($0.89) on May 25. But the bears failed to sustain lower levels. Strong buying by the bulls pushed the price above the 20-day EMA on May 26.

Buyers tried to extend the relief rally above the 50-day SMA ($0.98). However, the long wick on the candlestick of the day indicates that the bears are active at higher levels. If the buyers can turn the 20-day EMA to support, MATIC is likely to try to reach the downtrend line again. On the contrary, if the price turns down and breaks below the 20-day EMA, it will indicate that supply has outstripped demand. It is possible for MATIC to drop to the vital support at $0.82 later. If it breaks above this level, a drop to $0.69 cannot be ruled out.

Solana (SOL) price analysis

The bulls managed to hold the $18.70 support on May 24 and 25. But they failed to start a strong relief rally in the SOL. This indicates a lack of demand at higher levels.

Time is running out for the bulls. Unless they start to rally quickly, the bears will try to further strengthen their positions by pulling the price below the $18.70 support. If they do, it is possible for SOL to start a journey towards $16. The first sign of strength will be a break and close above the downtrend line. SOL is likely to rise to the 50-day SMA ($21.65) later. If it breaks above this level, it will likely start a rise towards $27.12.

Polkadot (DOT) price analysis

The shallow bounce of DOT from strong support at $5.15 on May 25 and 26 shows that the bulls are not buying aggressively. Bears will try to use this opportunity and develop their advantage.

If the price dips below $5.15, it is possible for DOT to gain momentum in the pair. Thus, a drop towards the next major support at $4.22 is likely. If the bulls want to avoid a decline, they will need to quickly push the price above the 20-day EMA ($5.40). If they do, it will indicate that buyers are attempting to form a higher low at $5.15. It is possible for the DOT to rise to the 50-day SMA ($5.82) first and then move towards the bearish trend line. A break above this level will indicate that the corrective phase may have ended.

Litecoin (LTC) price analysis

LTC has been hovering between $96 and $75 for the past few days. It is possible that the price action within the range is random and volatile.

The bulls started a recovery that reached the moving averages on May 25. If LTC turns down from the current level, the next stop is likely to be the bullish trend line. If the price turns up from the uptrend line, it will indicate that LTC is attempting to form a symmetrical triangle pattern. If LTC rises above the moving averages, it will signal that short-term sentiment has turned positive. In this case, LTC is likely to try to climb higher to $96, where the bears will form strong resistance again.