Many altcoins, including Bitcoin and DOGE, have returned to key overhead resistance levels. However, will the bulls muster up enough momentum to ensure a sustained breakout? Also, could higher highs continue to witness aggressive selling by the bears? Analyst Rakesh Upadhyay examines the top 10 cryptocurrencies to find out the answers to these questions.

An overview of the crypto market

The recovery in the market is led by Bitcoin (BTC), which broke above the $21,000 level. But BlockTrends analyst Caue Oliveira says on-chain data has shown a decline in “whale activity” since May. He also notes that it inhibited the flurry of activity during the Terra (LUNA) event.

A survey in China shows that most respondents believe Bitcoin could drop much more. Also, nearly 40% of respondents say they will buy Bitcoin if the price drops to $10,000. Only 8% of voters are interested in buying if Bitcoin drops to $18,000.

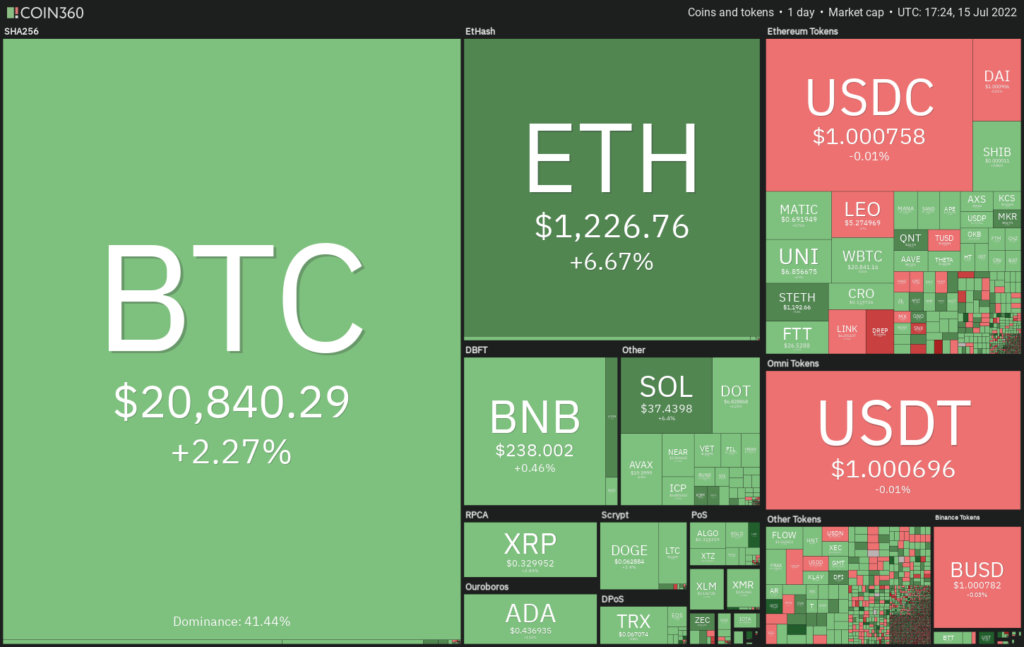

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360cryptocoin.com As you follow on , millionaire investor Kevin O’Leary says crypto markets will likely witness ‘major volatility’. He also notes that it may enter a state of ‘total panic’ before entering an accelerated growth phase.

In addition, he states that companies run by ‘stupid managers’ will face difficulties. But he adds that this will result in the rise of more powerful companies. Now it’s time for analysis…

BTC, ETH, BNB, XRP and ADA analysis

Bitcoin (BTC)

BTC fell below the support line of the symmetrical triangle on July 13. But the bears failed to sustain lower levels. This indicates that the bulls bought the dip and pushed the price to the 20-day exponential moving average (EMA) ($20,842).

The bulls will need to hold the price above the 20-day EMA to indicate that the bears may lose control. Above the 20-day EMA, the recovery is likely to extend to the 50-day simple moving average (SMA) ($23,753).

A break and close above this resistance is likely to indicate that BTC may have bottomed out. This positive view may be invalidated if the price drops from the current level and dives below the support line. Such a move increases the likelihood of a retest of the key support zone between $18,626 and $17,622.

Ethereum (ETH)

ETH broke below the support line of the ascending triangle formation on July 12. But the bears failed to sustain lower levels. The price rallied from $1,006 and re-entered the triangle on July 13. This suggests that the break below the triangle could be a bear trap.

Buyers will try to push the price above the overhead resistance of $1,280 and the 50-day SMA ($1,358). If successful, it is possible for ETH to start a rally towards the $1,679 pattern target. Meanwhile, the bears are expected to pose a strong challenge at the $1,700 breakout level. Another possibility is for the price to drop from $1,280. In this case, it is possible for ETH to fall back to the support line of the triangle. The bears will need to drop ETH below $998 to gain the upper hand.

Binance Coin (BNB)

BNB rebounded the strong support at $211 on July 13, indicating that the bulls are buying dips to this level. The relief rally broke above the 20-day EMA ($233) on July 14. Now, the bulls will try to push the price towards the 50-day SMA ($250).

The 20-day EMA has flattened and the relative strength index (RSI) is in the positive territory. This shows that the bulls are on a reversal. A break and close above the 50-day SMA is likely to increase the likelihood of BNB bottoming at $183. This is likely to start a march north towards $300.

Alternatively, if the price breaks from the 50-day SMA and dives below the 20-day EMA, a drop to $211 is possible for BNB. This is likely to keep BNB between $211 and $250 for a few more days. A break and close below $211 is possible, paving the way for a possible retest of critical support at $183.

Ripple (XRP)

XRP has recovered the strong support at $0.30, showing that the bulls are keeping the level alive. On July 15, the recovery reached the downtrend line, which acts as a formidable barrier.

If the price breaks and sustains below the 20-day EMA ($0.33), it will indicate that the sentiment will remain negative and traders are selling in rallies. The bears will then make an attempt to push the price towards the strong support at $0.30. If this level gives way, XRP is likely to complete a descending triangle pattern. It is possible that this could signal a resumption of the downtrend.

Conversely, if the price rises from the current level and breaks above the downtrend line, it will invalidate the descending triangle pattern. The failure of a bearish pattern is often a bullish sign as it can lead to a short covering by aggressive bears. XRP is likely to rally to $0.45 later.

Cardano (ADA)

ADA bounced off the critical support at $0.40 on July 13, indicating that the bulls are attempting to hold the level. The relief rally reached the 20-day EMA ($0.46), which could act as a stiff resistance.

If the price declines sharply from the 20-day EMA, the probability of a break below $0.40 increases. It is possible that this will start the next leg of the downtrend and bring ADA down to $0.33. On the contrary, if the bulls push the price above the moving averages, it suggests that the downtrend may weaken. ADA is likely to rally to $0.54 later, where the bears could pose a strong challenge again.

SOL, DOGE, DOT, SHIB and AVAX analysis

Left (LEFT)

SOL fell below the triangle on July 11. However, the bears failed to take advantage of this and push the price below the immediate support at $31. The price returned from $32 on July 13 and climbed above the moving averages.

Buyers will try to push and sustain the price above the resistance line of the triangle. If they are successful, it would suggest that SOL may have formed a low below $25. It is possible for SOL to start an upward move towards $48 later. The moving averages are on the verge of completing a bullish crossover and the RSI is in the positive territory. This suggests that the bulls have a slight edge. To invalidate this positive view, the bears will need to push the price below $31.

Dogecoin (DOGE)

DOGE broke below the immediate support at $0.06 on July 12. However, it has made a strong recovery. It then rose above the level on July 13. This shows that the bulls are buying on the dips.

Buyers will now try to push the price above the overhead resistance on the moving averages. If they are successful, DOGE price is likely to rally to $0.08 and then $0.09. Conversely, if DOGE price turns down from the moving averages, it will indicate that the bears are in control. Sellers will then try to push the DOGE price down to the critical support at $0.05. A break and close below this level is likely to mark the start of the next leg of the downtrend.

Polkadot (DOT)

DOT broke below the strong support at $6.36 on July 12. However, it recovered from $6 on July 13. This shows that the bulls are trying to trap the aggressive bears.

The price reached the 20-day EMA ($7.02), which could act as a strong resistance. If buyers push the price above this level, the probability of a rally towards the 50-day SMA ($7.94) increases. A break above this resistance is likely to indicate that DOT may have bottomed.

Contrary to this assumption, if the price drops from the 20-day EMA, the bears will make another attempt to push the price below $6. If they do, it is possible for the DOT to start its downward move towards $5.

Shiba Inu (SHIB)

SHIB fell below $0.0000010 on July 12. However, lower levels have attracted strong buying from the bulls. This pushed the Shiba Inu price above the psychological level of $0.000010 on July 13.

Buyers pushed the Shiba Inu price above the 20-day EMA ($0.00010) on July 15. This opens the doors for a possible rise to the overhead resistance at $0.000012. It is possible that this level will again attract strong selling by the bears.

If the Shiba Inu price drops from $0.000012, SHIB is likely to drop back to $0.000010. In addition, it is possible that he will be stuck between these two levels for a few more days. On the other hand, if the bulls push the Shiba Inu price above $0.000012, a rally to $0.000014 is possible for SHIB. The slowly rising 20-day EMA and the RSI in the positive zone suggest that the bulls have a slight advantage.

Avalanche (AVAX)

AVAX has formed an ascending triangle pattern that will complete on a break and close above the overhead resistance at $21.35.

The 20-day EMA ($18.73) has flattened out and the RSI is at the midpoint, showing an equilibrium between supply and demand. If this balance pushes and sustains the price above $21.35, the bulls will turn in their favor. If that happens, AVAX is likely to rise to its $29 model target.

This positive sentiment could be invalidated in the short term if the price drops from overhead resistance and breaks below the support line. It is possible that this will invalidate the bullish setup and open the doors for a possible drop to $13.71.