Bitcoin’s price has soared to $31,000 as a handful of spot BTC ETF filings and Fed Chairman Jerome Powell’s views on stablecoins seem to have improved crypto investors’ view of the market. Will the rally of Bitcoin and altcoins including DOGE continue for a few more days or is it time to split the profits? Crypto analyst Rakesh Upadhyay examines the charts of the top 10 cryptocurrencies to find out.

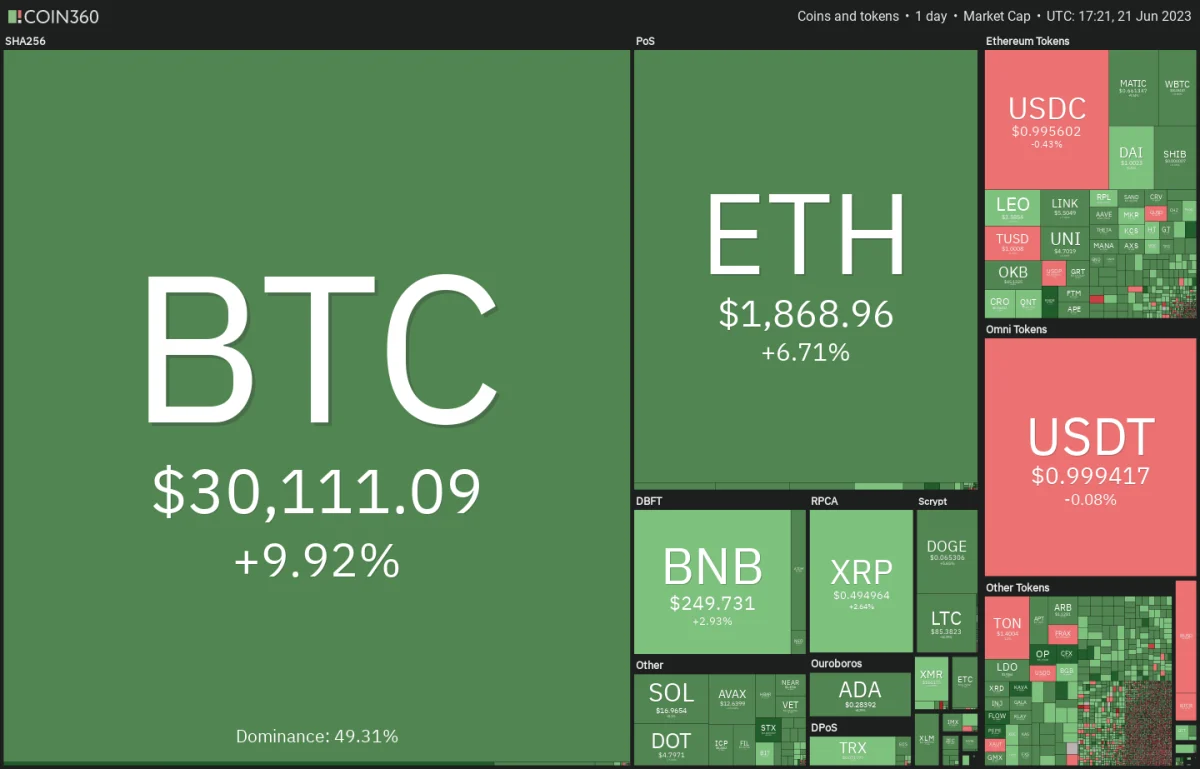

An overview of the cryptocurrency market

cryptocoin.com BlackRock’s application for a spot Bitcoin exchange-traded fund (ETF) has encouraged other financial firms to do the same. First up, New York-based wealth management fund WisdomTree filed a new application for a Bitcoin ETF on June 21. This was followed by investment manager Invesco, who later reactivated the spot ETF application. These announcements increased investor sentiment. Thus, it caused a ‘short squeeze’ and additional buying interest from traders waiting on the sidelines. A series of events over the past few days have fueled buying interest in Bitcoin. Thanks to this, the market dominance of Bitcoin increased to over 50% on June 19th.

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360Short-term investors expecting a rapid rise to all-time highs may be in for a shock. In the latest issue of its weekly newsletter, The Week On-Chain, analytics firm Glassnode warned investors that their patience could be tested for another eight to 18 months before the market hits all-time highs.

BTC, ETH, BNB, XRP and ADA analysis

Bitcoin (BTC) price analysis

Bitcoin broke the 20-day exponential moving average (EMA) of $26,934 on June 17 and closed above it. The bears tried to push the price below this level again on June 18. But the bulls remained in their places.

This led to aggressive purchases on 19 June. It also gained further momentum on June 20. This has thrown the price above the resistance line of the descending channel pattern. Thus, it signaled a short-term trend change. This move probably hit the stops of a few short bears causing a short squeeze. This caused the price to skyrocket to $30,800 on June 21.

Bears are unlikely to give up easily. They will try to stop the rally at $31,000. However, if the bulls do not leave much ground above the current level, it will increase the likelihood of a rally above the overall resistance. If this happens, it is possible for BTC to rally to $32,400. The bears are expected to defend this level with all their might. Because if they fail to do so, BTC is likely to rise to $40,000. If the bears want to trap the bulls, they will have to drive the price below the moving averages. This could result in a long liquidation and threaten the $25,250 support.

Ethereum (ETH) price analysis

Ether bounced back from the strong $1,700 support on June 19th. It also gave a strong buy signal at this level.

The bulls continued their buying and pushed the price above the 20-day EMA ($1,781) on June 20. This was the first sign that the bears were losing control. The upward momentum increased even more on 21 June. Thus, it sent ETH above the downtrend line. It is possible for ETH to rise to the psychological resistance of $2,000. On the contrary, if the price changes direction from the current level and dips below the 20-day EMA, it will indicate that the bears are in control. ETH is likely to drop as low as $1,700 later.

Binance Coin (BNB) price analysis

The wick on the BNB June 21 candlestick indicates that the bears are selling relief rallies to the 20-day EMA ($257).

The downward sloping moving averages and the relative strength index (RSI) in the negative zone suggest that the bears have an advantage. If the price turns down from the current level, a drop as low as $230 is possible for BNB. It is likely to retest the vital support at $220 later. Conversely, if the bulls overcome the hurdle at the 20-day EMA, it will indicate solid demand at lower levels. BNB will then likely try to climb higher to $272, the 61.8% Fibonacci retracement level, and then $290, the 50-day simple moving average (SMA).

Ripple (XRP) price analysis

XRP fell sharply from the 20-day EMA ($0.49) on June 20. Thus, it broke below the 50-day SMA ($0.47). However, the long tail on the candlestick indicates aggressive buying at lower levels.

The 20-day EMA has flattened. Also, the RSI is just above the midpoint. This shows that there is a balance between supply and demand. If the bulls hold the price above the 20-day EMA, it is possible to open the doors for a potential rally to the overhead resistance of $0.56. It is also possible that this level will act as a strong barrier again. The 50-day SMA remains the key support to watch out for on the downside. If this level is exceeded, the advantage will change in favor of the bears. It is possible for XRP to drop as low as $0.41 later.

Cardano (ADA) price analysis

The long tail on the Cardano June 20 candlestick shows that the bulls are trying to protect the zone between $0.25 and $0.24.

It is possible for ADA to reach the $0.30 level, which is likely to act as a tough resistance. If the price drops sharply from this level, ADA is likely to consolidate between $0.30 and $0.24 for a while. Contrary to this assumption, if the bulls push the price above $0.30, it will indicate the start of a sustained recovery towards the 50-day SMA ($0.34). On the downside, support stands at $0.25 followed by $0.22.

DOGE, SOL, MATIC, LTC and DOT analysis

Dogecoin (DOGE) price analysis

DOGE bounced off the strong support at $0.06 on June 20. Thus, it showed that the bulls are fiercely defending this level.

DOGE breakouts above the 20-day EMA ($0.06) indicates that the bears are losing control. DOGE price is likely to rise to $0.07 later. If the price drops sharply from this level, it will signal that DOGE will stay between $0.06 and $0.07 for a while. Buyers will need to break the $0.07 barrier to show strength. It is possible for DOGE to rise to $0.08 later, where the bears will again make a strong defense. On the downside, a drop below $0.06 will give the bears an advantage.

Solana (SOL) price analysis

Solana climbed above the $16.18 close resistance on June 20. Thus, it reached the 20-day EMA ($17.04) on June 21.

If the price drops from the current level and breaks below $16.18, it will indicate that the bears are active at higher levels. In this case, the SOL is likely to retest the critical support zone between $15.28 and $14.06. Alternatively, if the bulls push the price above the 20-day EMA, a break below $15.28 will indicate a bear trap. It is also possible that this will cause a short squeeze, pushing SOL to the 50-day SMA ($19.34).

Polygon (MATIC) price analysis

MATIC is gradually rising towards the $0.69 breakout level. The 20-day EMA ($0.69) is also placed at this level. Therefore, bears are expected to fiercely defend this resistance.

The downward sloping moving averages and the RSI in the negative zone point to a minor advantage for the bears. If the price turns down from $0.69, it is possible for MATIC to be stuck between $0.69 and $0.50 for a few days. The first sign of strength would be a break and close above the 20-day EMA. Such a move would indicate strong buying at the lower levels. MATIC is likely to rise to the 50-day SMA ($0.82) later. The most important support on the downside is $0.50.

Litecoin (LTC) price analysis

Litecoin sharply recovered from the strong support at $75 on June 20. This indicated that the bulls were aggressively buying dips up to this level.

Purchases continued on 21 June as well. Thus, the bulls pushed the price above the 20-day EMA ($81), signaling a reversal. There is currently a minor resistance at the 50-day SMA ($85). But the bulls are likely to surpass it. Thus, it is possible for LTC to reach $92 first and then $98. Time is running out for the bears. If they want to re-establish control, they will need to quickly push the price below the $75 to $71 support zone. Until that happens, the bulls are likely to see the dips as a buying opportunity.

Polkadot (DOT) price analysis

The bears tried to pull Polkadot towards the $4.22 support on June 20. However, the long tail on the day’s candlestick indicates strong buying at lower levels.

Buyers pushed the price to the 20-day EMA ($4.76), which is likely to act as a strong resistance. If the bulls push the price above the 20-day EMA, it is possible for the DOT to hit the $5.15 breakdown level. This level is likely to pose a strong challenge for the bulls again. If the price turns down from this level, the DOT could oscillate between $5.15 and $4.22 for a while. The bears will have to push the price below $4.22 to start the next leg of the downtrend.