Billy Markus, one of the founders of Dogecoin, commented on the Bitcoin price on his Twitter account today. The reasons Taurus based his expectations were rather ironic.

Dogecoin founder updates his $100,000 Bitcoin predictions

Bitcoin’s price has lost 75% since its November 2021 peak. $100,000 was a price that most analysts and investors expected to reach. However, despite all hopes, we are well below the level that PlanB targets in the S2F model. Bitcoin has failed to regain its previous levels throughout the year. Billy Markus says, “There is still time for Bitcoin to reach $100,000.” It also features a few claims about the latest events in the market.

what we learned about bitcoin in 2022:

🚫 store of value

🚫 inflation hedge

✅ speculative toy for gamblers and fraudsters— Shibetoshi Nakamoto (@BillyM2k) December 30, 2022

Markus says crypto firms are responsible for Bitcoin’s plunge. Companies like Voyager and 3AC followed Terra and FTX bankruptcies this year. According to Markus, Bitcoin is in the hands of these market-manipulating gamblers and scammers.

Meanwhile, US billionaire Dim Draper was among the 100,000 waiting faces in Bitcoin. Draper says that since last year, BTC could reach $150,000. cryptocoin.com We have conveyed what you have said in these months. However, current levels are far from this expectation.

How about Bitcoin?

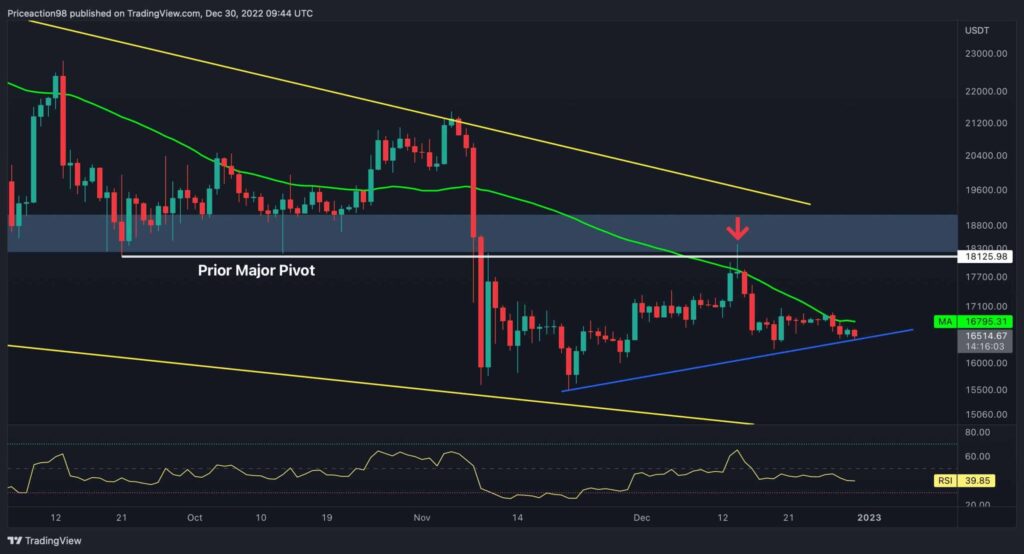

Bitcoin’s price started to recover after a serious drop towards $15,000 in mid-November. However, the rally did not last long and ended at the $18,000 resistance level. On the other hand, the $18,000 resistance level is aligned with Bitcoin’s previous major axis. In classical price action analysis, major pivots are crucial in serving as resistance or support for the price relative to the direction of the trend. Failure to surpass the previous major pivot on a bullish rally is a clear bearish sign.

As the chart shows, Bitcoin’s uptrend rally stalled at the previous major pivot at $18,300. In light of this, the price started another downtrend. Therefore, given the current market structure and price action, a drop below the blue trendline is more likely.

On the 4-hour chart, after being rejected at $18.3k, the price reversed. It started an impulsive bearish rally here. Short-term ongoing correction phases always accompany an impulsive rally. Therefore, after a sharp decline, the price entered a short-term consolidation phase. It then formed an ascending bearish wedge.

Recently, the price broke below the lower limit confirming the continuation of the downtrend and continuing to drop towards the next support level. The critical support level below is the main pivot before $15,900. If it fails, traders can expect another price drop towards the last cycle low of $15.4k.