With the cryptocurrency market on the brink of a new era, the emerging reserve evidencesystems will be sufficient for protection?

The cryptocurrency market is going through one of its toughest times. terrafor the market that collapsed with the outbreak of the crisis FTX The stock market crash was also a heavy blow. Currently, the crypto market is feeling the bear trend most deeply. After these processes Binance came up with an idea to restore credibility in the market. The idea was that exchanges go for proof of reserve. Moreover Binancetoday introduced the new proof-of-reserve system, Proof of Reserve ( POR ) announced. But will all these efforts be an adequate safeguard for the next collapse?

Market Crashes and Exit Liquidity

Decentralized smart contracts platform and stablecoin issuer Luna’s Its collapse became one of the most important crypto events of the year. By market value rank top 10project involved, 120 dollars was able to rise to the highest level. As the network structure, lunaand TOPTroubles in the system connecting the coins to each other made the project history.

This is the collapse luna The reflection of the project on the investors was quite heavy. In a momentary collapse, only Luna’swith the reset 40 billion dollars it evaporated. So just a cryptocurrency, its investors 40 billioncaused the dollar to disappear.

Peg broken USTwanting to save Luna Foundationstarted to sell all its reserves. bitcoin They didn’t hesitate to sell even Luna, especially Luna. Hundreds of thousands of Bitcoin The foundation has dealt a heavy blow to the market. That crash evaporated billions of dollars from the entire market. Bitcoin’s fall, stablecoins shake-up and Luna’sreset allegedly one hundred He destroyed over a billion dollars. Of course, there are winners as well as losers. We can say that this money has been in the hands of someone. However, this did not prevent the collapse of the industry.

On the other hand, the collapse and subsequent bankruptcy of FTX also went down in history as an important event. This event was enough to evaporate over $70 billion from the cryptocurrency market. BinanceCEO Changpeng Zhao, FTX Referring to the problems experienced on the side, he stated that he would sell the FTTs he had. In the process that started after this discourse, FTXand of AlamedaThe dirty cart appeared. FTX, sister company Saving Alameda had transacted with user assets for In the resulting balance sheet, it was understood that billions of dollars were wasted. The fall of this news and the collapse of FTX, in one day 10 billion dollars evaporated. The crypto industry has taken one of the hardest hits of the year. Alamedaand of FTX the projects he invested in began to collapse one after another. Some filed for bankruptcy and investors suffered.

So, Will Evidence of Reserves Cover the Billion-Dollar Collapses?

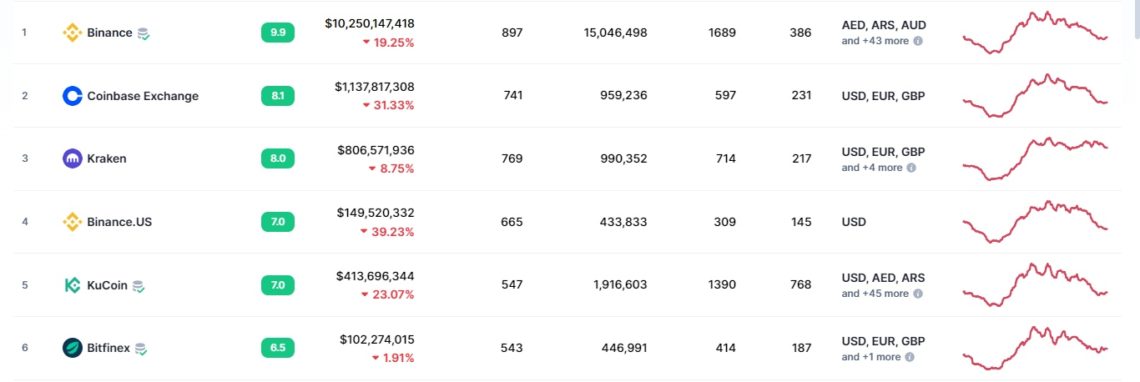

With the onset of proof of reserve, many cryptocurrency exchanges have begun to disclose some of their holdings. According to Nansen data, it is the largest cryptocurrency exchange in the world. Binance’s It has proof of reserve of $64 billion. Reserves of other exchanges 6 billion dollarswith 1 billionbetween dollars.

coinbase The statement made by him was also noteworthy. Stock market in hand 2 million Bitcoins He said he had reserves. Its approximate value 30 billion dollarsat levels.

However, let’s say that in a market crash, billions of dollars evaporate and panic selling begins. In this case, will the reserves remain intact?

approximately per day 10-15 billion FTX, which captured a $$ transaction volume, was holding just as much customer assets. However, the effect of the collapse and the panic process caused instant exits in the stock market. Unable to meet its collateral and deliver assets to its customers, FTX had to halt transactions.

Considering this process, it seems that no stock market is guaranteed in a possible collapse. Because here, rather than the effect of the collapse, the panic experienced by the investors is more effective.

Exchanges in a Possible FTX or Luna Crash

In the future of the crypto industry, we may see a crash story again. This is always on the table. In such a case, on average 50 billion A dollar coin can evaporate. Although this evaporation moves from the losing side to the winning side, it creates a domino effect in the collapse of the market.

a possible 50 billionin the dollar crash BinanceThe processes that all other exchanges will experience, including

The principle structure of cryptocurrencies is directly proportional to the number of coins and the amount of dollars invested in the coins. A coin with a market value of $100 million, 50 million contains a dollar asset. In this principle, which is accepted with the logic of liquidity, the logic of the trader is valid. coinWhile those who want to buy have to leave dollars in the liquidity pool, those who want to buy dollars leave coins in this liquidity pool. LiquidityThe decrease in the dollar in the pool and the increase in the amount of coins mean that the project price also decreases.

Cryptocurrency exchanges also run their algorithms on this principle. For each listed coin, the coin and its corresponding dollar amount are in the pool. A person who wants to buy A coin from the stock market leaves dollars on the stock market and receives his coin. In this case, the dollar transferred to the stock market is added to the liquidity pool of A coin. In the reverse transaction, the stock market gives dollars and takes the coin and adds it to the liquidity pool.

In the event that a listed coin explodes, the liquidity pool of that coin is almost completely emptied by investors. Only the amount of coins remains in the pool and the price value of the project is reset. The possibility of such a situation is always on the table. In case of this, the effect with the panic experienced, 10 timescan go up.

In this case, the reserves of the stock markets will begin to melt. In particular, there will be serious pressures on the stablecoin reserves of exchanges. Because, users will try to get their dollar equivalent by leaving their coins in the pool. The fact that such a panic and collapse cannot be covered by any stock market has also emerged after recent events.

What Should Exchanges Do?

One of the world’s largest cryptocurrency exchanges FTX , has more errors behind its collapse. The company’s executives traded in leveraged trades quite often. They had to show customer funds as collateral. Because in the bear market, they were an audience that liked to open long-term trades.

This new model and move put forward by Binance is very promising in terms of the market. Of course, this requires impeccable management.

Because the proofs of reserve offered by the exchanges are actually seen as consisting entirely of customer funds. Liquidity pool in the stock market 1:1 Let’s say it responds. Panic and money outflow caused by a possible collapse, 1:1If the rate is exceeded, it will cause the exchanges to stop their withdrawals.

In decentralized exchanges, this is exactly the case. 1:1rate of operation. pancakeswap Let’s take the stock market as an example. The projects that come out here fill the liquidity pool and coins they are added to the market. In this case, the assets of each user are kept in the pool with the same amount of money. Selling pressure lowers the price, while buying pressure raises the price. But by no means is this pool available for other operations.

By using a simple algorithm, exchanges have to hold assets that correspond to the coins they distribute to users. They also have to secure them against any hacking incidents. For this, although proof of reserve will come, it will not be enough. For example, when the managers of exchange A open a trade with these assets, a crack occurs in the pool. This crack is in a possible collapse 1:1means not being able to pay the user.

Precautions should be taken before the Dominoes are toppled

To protect the crypto ecosystem, which is a global industry, it can be useful to resort to traditional methods. Exchanges calculate the corresponding amount of coins for all dollars from their users. 1:1 be reflective. Even if this reflection gives confidence, on the other hand, it is necessary to secure the safe.

Decentralized The centralization of the crypto industry, which started as a journey, comes to the fore here. Because the stock markets can strengthen the effect of the collapse in the slightest algorithm deviation. FTXThe incident was one of the most important warnings of this.

Entrusting assets to a global medium rather than relying on individuals and institutions can solve the entire problem. for example World Central BankAuditing and controlling stock market reserves could also help deal with a potential collapse with less hassle.

Of course, here are some steps that stock markets should take. Binance’s bailout fund BNB, BTCand BUSD has a collection. In fact, stablecoins should be completely included in the recovery fund created by exchanges for the crypto industry. This should be chosen from the most reliable stablecoins. Because in the collapse of the market, stablecoins will remain as pegs, while cryptocurrencies may decline.

Conclusion

The crypto industry, which has become a new industry, will continue to exist in the future. This year’s FTX and luna events have been one of the factors that made the crypto industry a more reliable and safer industry. In this way, change and control began. In the next few years, we are very likely to see the crypto industry on a whole new level.