The Ripple victory of July 13 has lifted a huge burden from the altcoin market. Positive developments also provided some recovery in terms of price. According to closely followed analysts, various indicators are giving important signals that the rally may continue.

These 5 altcoins are on good ground for a ‘true rally’

XRP

XRP has attracted significant attention recently due to its strong price rally. However, it remains on the radar of radical change seekers. The burgeoning open interest (OI) in XRP futures contracts offers a clearer picture of continued market sentiment and the true potential for further growth.

Open interest refers to the total number of unpaid derivative contracts such as futures and options. Rising open interest represents the flow of new money into the market and indicates that the current trend is gaining momentum. For XRP, the increase in OI indicates that investors are actively participating in the market. This could potentially signal a more significant bullish run.

XRP has faced a massive rally since the partial victory vs. the SEC.

Daily XRP volumes have overtaken BTC volumes, and BTC dominance has declined substantially due to strengthening XRP.

However, amidst the strength, OI is pushing to new highs. https://t.co/WzjhlF6NGf

— K33 Research (@K33Research) July 19, 2023

However, even as clear interest in XRP grows, it is losing trading volume. This drop in volume may be due to market participants re-evaluating their positions after the initial excitement surrounding the recent court ruling in favor of Ripple Labs. XRP’s price rally has largely received the support of individual investors. However, the drop in volume indicates that institutional investors are cautious. According to the data, XRP has surpassed BTC and ETH in volume figures for the past month.

Hedera (HBAR)

Hedera is on the list because of its Ledger Technology (DLT) for stablecoins. Byunghee Kim, head of Blockchain at Shinhan Bank, praised the enormous potential of stablecoins in a recent statement, while also impressing Hedera:

By providing a cost-effective, fast and reliable method of transnational value transfer, stablecoins promote financial inclusion and increase the accessibility of financial services for underserved individuals and businesses.

Stablecoins are going to be the gateway to getting tradfi markets onchain, starting with one obvious pain point: international remittance. @hedera is laying the foundation for this transition. Great collaboration between @ShinhanBankENG SCB TechX, @swirldslabs, @HBAR_foundation https://t.co/fpgJO2Co3A

— Sabrina Tachdjian (@tsakoog) July 19, 2023

Kim highlights the advantages of Hedera’s EVM-compliant technology, which streamlines processes by eliminating middlemen, thus reducing costs and speeding up remittances. This cutting-edge technology underpins Hedera’s smart contract capabilities, ensuring seamless compatibility with Ethereum.

Technological advances have led to a bullish wave in the Hedera (HBAR) market in the past 24 hours. The bulls have reached a 30-day high of $0.0606 at the time of writing, marking a significant rise from the 24-hour low of $0.05433.

Stellar (XLM)

It emerges as a featured player in Stellar (XLM). Stellar’s price rose by a staggering 74.7% last week, making it one of the most impressive weekly rallies of the year, according to Coinecko data. The price continues to maintain its double-digit gains today.

A key factor contributing to Stellar’s remarkable success is the rapidly increasing adoption of the Stellar protocol in the Latin America region of the Axelar network (LATAM). This latest development has significantly increased the utility and relevance of Stellar as a seamless and accessible payment model for a large number of users. cryptocoin.comIn this article, we have included the recent Bitso partnership that has driven the XLM price.

.@StellarOrg USDC continues to gain traction as a fast, low cost Layer 1 for digital dollar payments around the world. https://t.co/T6BeEREZdj

— Jeremy Allaire (@jerallaire) July 19, 2023

One of the key metrics that underscores Stellar’s impressive trajectory is the remarkable increase in trading volume. Currently, trading volume has increased by more than 240% to an impressive $1 billion. This increased volume was a testament to the growing interest and trust in XLM

Chainlink (LINK)

The LINK market is in the early stages of a close breakout from a macro consolidation. The altcoin broke the critical $8 resistance, up 10 percent on Thursday. Interestingly, daily trading volume increased by more than 237 percent to nearly $1 billion, according to CMC data.

The LINK rally was linked to a new protocol released this week. This protocol will now expand to 5 more new networks. These are: Arbitrum Goerli, Avalanche Fuji, Ethereum Sepolia, Optimism Goerli and Polygon Mumbai. Here’s what you need to know about the LINK rally.

As for price predictions, LINK is on the verge of breaking a falling wedge, according to altcoin analyst Captain Faibik. The analyst predicts a profit potential of 260-280 percent in the medium term with the increasing trading volume. Also, LINK bolstered its bullish outlook by the fact that the weekly RSI is approaching the 2-year downtrend resistance.

$LINK On the Verge of Falling Wedge Breakout..!!

– Accumulation Phase

– RSI is Approaching the 2yr Downtrend Resistance.

– Volume is Coming in.+260-280% Profit Potential in the Midterm..#Crypto #Chainlink #LINK pic.twitter.com/R1WFJGCrmU

— Captain Faibik (@CryptoFaibik) July 20, 2023

Dogecoin (DOGE)

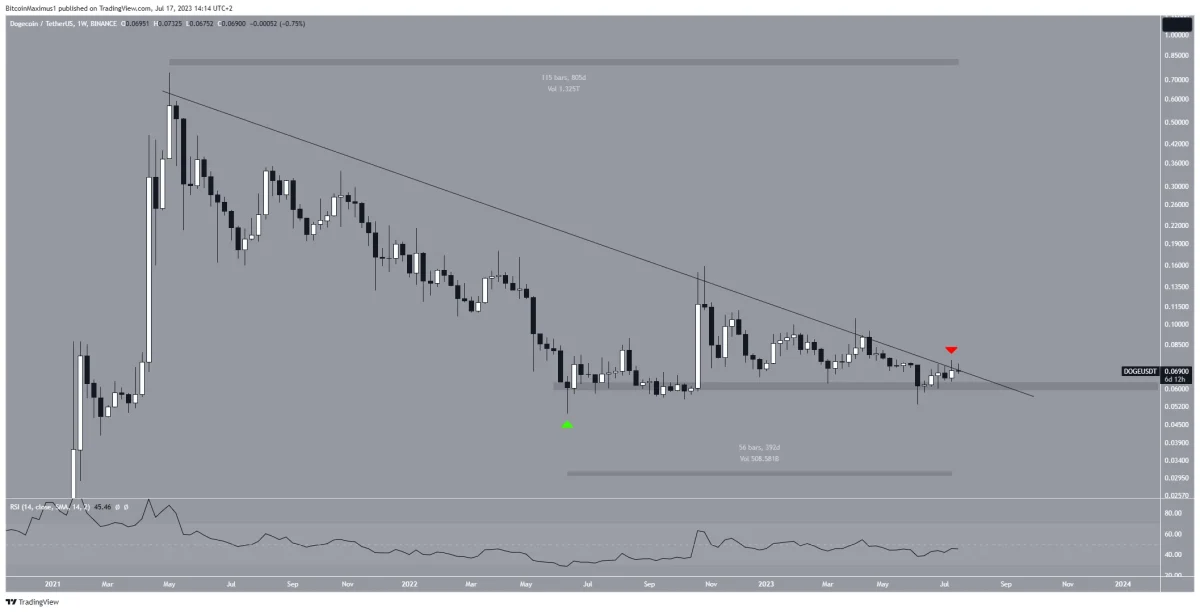

DOGE price is also trading in a critical resistance-support zone that will determine the trend direction. The weekly chart shows that the price has broken below a descending resistance line since reaching the May 2021 high of $0.739. This decline ended with a religion of $0.049 in June 2022.

Following this, DOGE price experienced a rebound (green icon). It started trading above the $0.060 horizontal support level. However, it has not yet crossed the long-term descending resistance line that has been in effect for 805 days.

On the upside, DOGE price broke out of a descending resistance line on June 22. After confirming this as support (green icon), the price resumed its bullish action. Also, DOGE retraced the horizontal support area of $0.065. The long-term DOGE price forecast will determine whether it will break through the long-term resistance line or the long-term horizontal support area. In the case of the former, the price could rise to the next resistance at $0.15, according to technical analyst Valdrin Tahiri.