Crypto analyst Akash Girimath gives two levels to accumulate SHIB with maximum returns. Analyst John Isige asks, “Is this the end of the road for APE bulls?” seeks an answer. Also, the analyst assesses the possibility of Ethereum Classic (ETC) rebound. We have compiled the forecasts and analyzes of analysts on three altcoin projects for our readers.

“Shiba Inu needs another hair-cut”

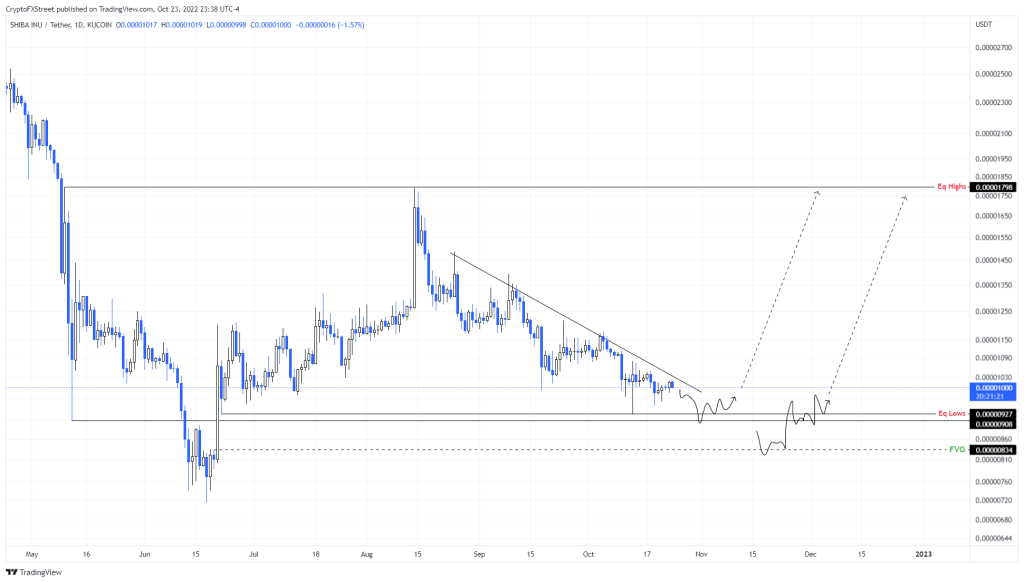

The altcoin price created an equal high, setting the second rise to $0.0000179 on August 14. Since then, the SHIB has produced lower highs and lower lows, indicating the continuation of a clear bearish trend. cryptocoin.com As you can follow, SHIB is currently above the $0.0000092 support level. It is possible that a slight increase in selling pressure combined with the decline in Bitcoin outlook could cause SHIB to drop.

Sell-stop liquidity falling below $0.0000090 is a good place for SHIB to save at a discount. However, investors should note that another drop is possible to fill the inefficiency at $0.0000083. Therefore, these two areas are places of interest for investors who want to play the SHIB rally. Market participants should note that liquidity remaining above the equally high levels at $0.0000179 is a good reason for SHIB to rise.

This move will allow market beacons to gather the buy-stop liquidity standing above it. Therefore, this trade is a long-term swing position. So, it is unlikely to appear in a few days.

SHIB 4-hour chart

SHIB 4-hour chartOn the other hand, if SHIB fails to bounce off the $0.0000090 and $0.0000083 levels, it will retest the $0.0000077 support base. The bullish thesis will be invalidated if the buyers do not step in here and allow the sellers to produce a daily candlestick below it. In such a case, it is possible for SHIB to continue its decline. Thus, it is likely to retest the $0.0000060 level.

Whales extinguish ApeCoin’s bullish spark

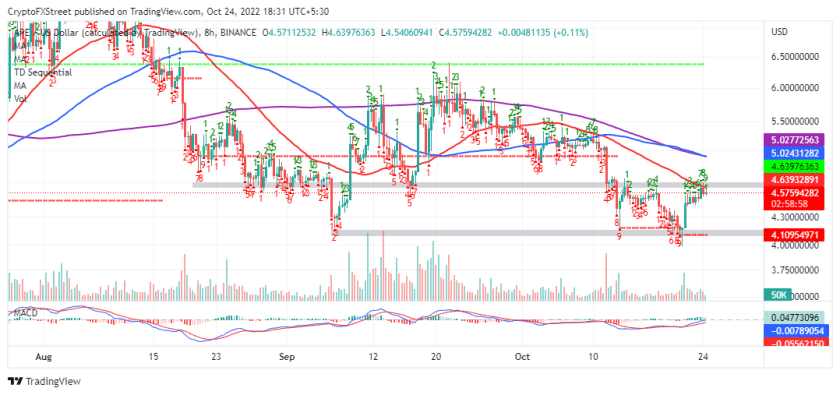

The TD Sequential indicator posted a buy signal on Friday, October 22. Thus, he sought individual investors from the sidelines. However, whales stubbornly continued their downward trend. This reduced the expected northward movement to $6.00 or even $6.50.

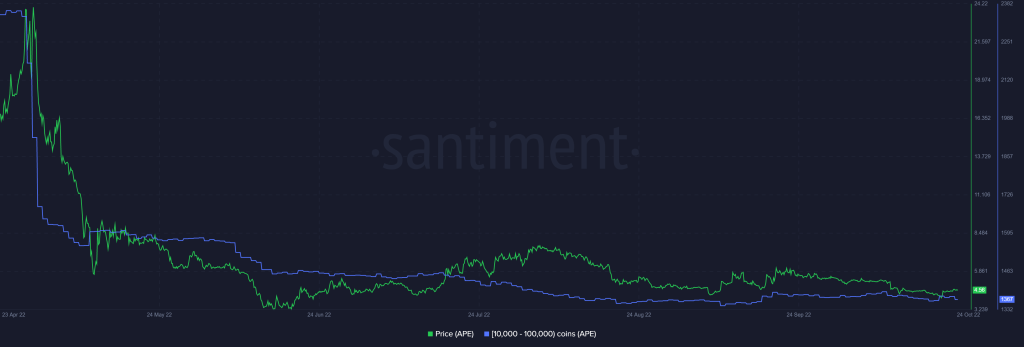

According to Santiment data, there is a steady decline in the number of addresses holding 10,000 to 100,000 APEs. There are only 1,367 addresses in this group, compared to 2,359 recorded on April 25.

ApeCoin supply distribution

ApeCoin supply distributionApeCoin usually tracks the movements of whales as seen in the chart above. Therefore, until the whales stop this selling frenzy, the upward movement is limited to the 50-day SMA (Simple Moving Average), red.

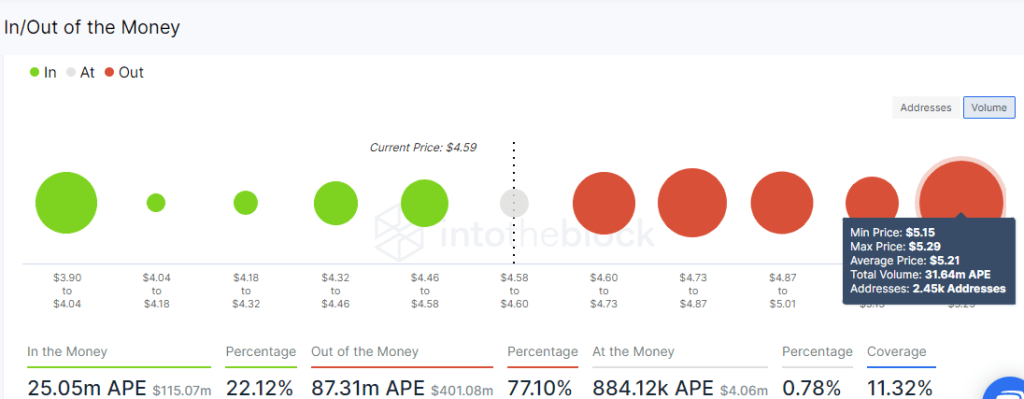

Meanwhile, IntoTheBlock’s IOMAP on-chain model paints a grim picture for ApeCoin. In the chart below, the red circles represent holders who have purchased APE in the respective price ranges. If the bulls manage to break the resistance at the 50 SMA, the $2,450 addresses that bought the $31.64 million APE between $5.15 and $5.29 could consider a head-to-head sale. This is a situation that will stifle growth and increase the risk of further declines.

ApeCoin IOMAP chart

ApeCoin IOMAP chartWhat’s next for altcoin price?

A buy signal from a TD Sequential indicator triggers the move from $4.10 to $4.64, while a sell signal from the same indicator screams doom for ApeCoin. This call is for dumping the APE. Along these lines, a green manifested on a nine candlestick, forcing sellers to take control again. Sell orders are recommended if the high of the six and seven candles on the count is exceeded by the high of the eight or nine bars, as well as the seller congestion at the 50 SMA.

APE eight hour chart

APE eight hour chartOn the upside, the MACD (Moving Average Convergence Divergence (MACD) indicator looks optimistic as it rises to the average line. Traders seeking long positions should wait for the MACD to rise above the average line (0.00) before activating their buys. Also, the 12-day EMA’ (Exponential Moving Average) needs to sustain a gap above the 26-day EMA to strengthen the bulls’ influence on ApeCoin.

ETC hash rate slips below a potential equilibrium

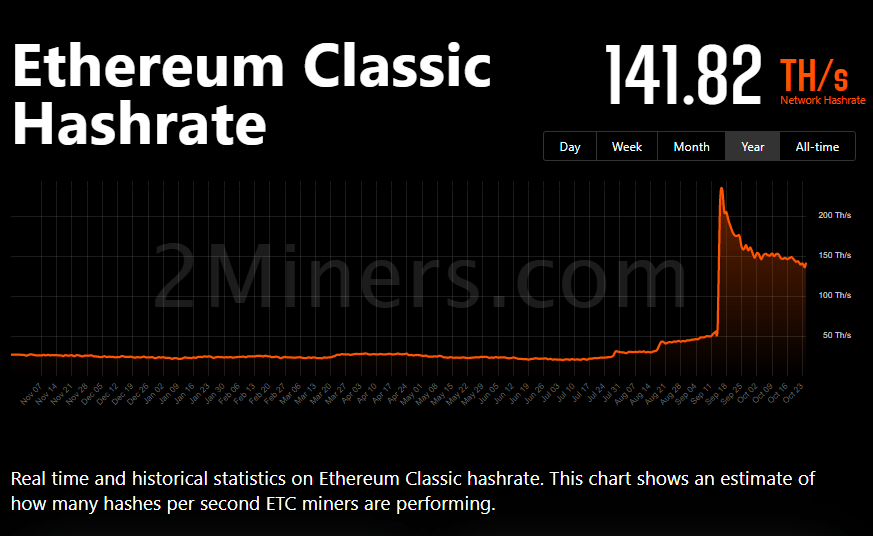

The Ethereum Classic hash rate rose to an all-time high of 234.35Th/s in the weeks before the Merge. At the time, miners in the Ethereum ecosystem saw Ethereum Classic as a valuable alternative for mining equipment. However, the trend in the Hash rate started to reverse soon after Merge went live on September 15th.

Altcoin price also erased more than 50% of the gains accrued between mid-July and mid-August. Although a pullback was expected for the hashrate, many believed it would settle to a balance of 150Th/s. Now, the hash rate has dropped to 135.90T/s amid the risks of a downtrend extending to 100Th/s.

Ethereum hash rate

Ethereum hash rateAltcoin in limbo

ETC has been screaming selling despite its technical outlook since Friday. Despite this, $20.00 respects the support. If ETC succumbs to selling pressure in this position, investors should wait for the down leg to retest the primary support at $13.50. A sell signal presented by the Super Trend indicator on August 19, adding credibility to the possibility of a downtrend. Also, ETC price stays below the applied moving averages.

ETC daily chart

ETC daily chartDMI (Directional Movement Index) on the same daily timeframe is giving another sell signal with -DI above +DI. On the other hand, support at $20.00 is likely to change the technical outlook of ETC price to bullish. In this case, it is possible that the rebound could exceed $30.00 or even $40.00.