Real Vision CEO Raoul Pal thinks that the leading altcoin Ethereum (ETH) could enter a price rally before another correction for macro conditions. The former Goldman Sachs executive says the “overall sentiment” indicates that ETH will bounce back to a new low. He says he will retest the last low. Here are the details…

Raoul Pal talks about the leading altcoin ETH

Raoul Pal believes that Ethereum will most likely act against the sentiment of the crowd. Pal relates that his hunch was in the direction of “maximum pain”. According to Pal, hedge funds scramble to buy if ETH exceeds $1,800 to $2,000. Even funds, according to the expert, cannot afford not to participate. Pal used the following statements:

Above this level, individuals will start to have difficulties along with institutions. $2,200 to $2,300 is the key point for me… It may break either before or after the merger. Once everyone bounces back, the market could recover sharply before rising again depending on the macro.

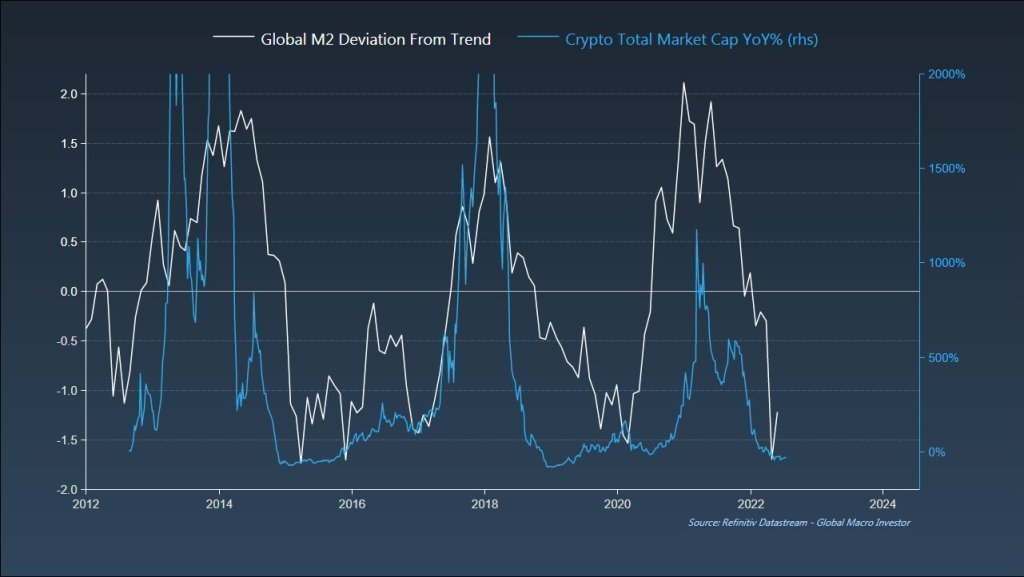

ETH is trading at $1,645 at the time of writing. The second-ranked crypto asset by market cap has dropped almost 2.5 percent in the last 24 hours. cryptocoin.com As we have also reported, “Merge” refers to the transition of Ethereum to the new PoS system. Ethereum developers say Merge is currently scheduled for September 19. Pal also states that crypto is driven by the M2 money supply. The M2 money supply represents roughly the total amount of money in circulation plus highly liquid non-cash assets that are close to or easily convertible into cash. Pal stated that the M2 is “about to return.” He said that crypto is also “anticipating this turn”.

Pal: ETH is booming against BTC

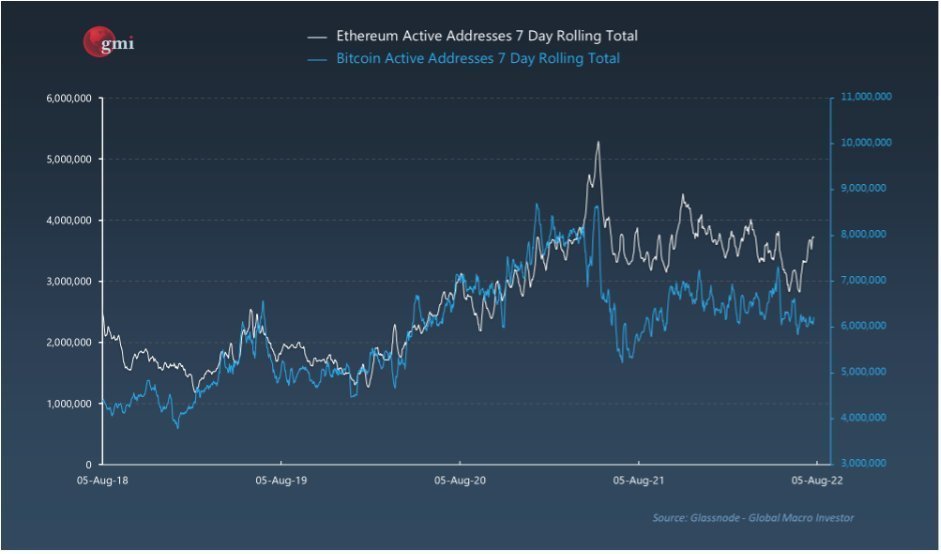

Pal also underlines that Ethereum has recently outperformed Bitcoin (BTC). “ETH is also exploding against BTC.” uses expressions. The macro guru says that Ethereum’s bullish momentum against Bitcoin (ETH/BTC) is most likely supported by strong fundamental growth. According to the expert, ETH is driven by superior current network effects and network activity.

Pal concludes by reiterating that investors and traders standing on the sidelines will be encouraged to participate when Ethereum takes action. Pal said, “My hunch is that the market is underweight (as with equities). I also think the path to pain is higher. But that’s just more short-term considerations,” he said.