Former Goldman Sachs executive and macroeconomics expert Raoul Pal pointed to a development that he thinks could affect Bitcoin and altcoin prices. He believes that if the dollar continues to rise, it could worsen the outlook for many assets, including oil and emerging market stocks. Here are the details…

Raoul Pal points to DXY for Bitcoin and altcoin market

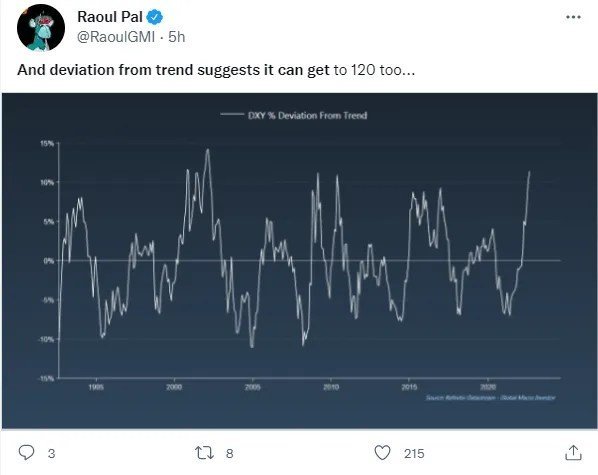

Pal, CEO and co-founder of Real Vision Group, said that a deviation from the trend indicates that the dollar index (DXY) may also rise to 120 levels. The dollar index is an indicator that measures the strength of the dollar against a basket of currencies. Pointing to a steep dollar index chart, “If the dollar continues to rise, it will really break something. It literally moved parabolic,” he said.

Pal, CEO and co-founder of Real Vision Group, said that a deviation from the trend shows that the dollar index may also rise to 120 levels. The dollar index is an indicator that measures the strength of the dollar against a basket of currencies. Pal also pointed out that the continued dollar rally could affect risky assets. The expert used the following statements:

I don’t think stocks are showing new lows but I’m not sure about that. Same with crypto… I think we got rid of weak economic data this week.

Pal pointed to the importance of the bond market

Emerging market stocks saw a sharp drop on Monday after US Fed Chairman Jerome Powell indicated that higher rates could continue for a while. Investors and traders will pay attention to the unemployment claims that will be announced this week. A strong job market is one factor the Fed may consider before deciding on a future course of rate hikes.

If the economic data is weak, investors may think the Fed may be less hawkish when it comes to future rate hikes. Pal also believes the bond market is the most overvalued against the business cycle to date. “If the bond market turns, eventually everything turns,” Pal said.

Real Vision CEO praised Anchor

cryptocoin.com As we reported, Pal praised Anchor Protocol, which gave 20 percent interest on UST, the troubled algorithmic stablecoin of the Terra ecosystem, which collapsed in June. After LUNA’s collapse, Pal got a lot of backlash.