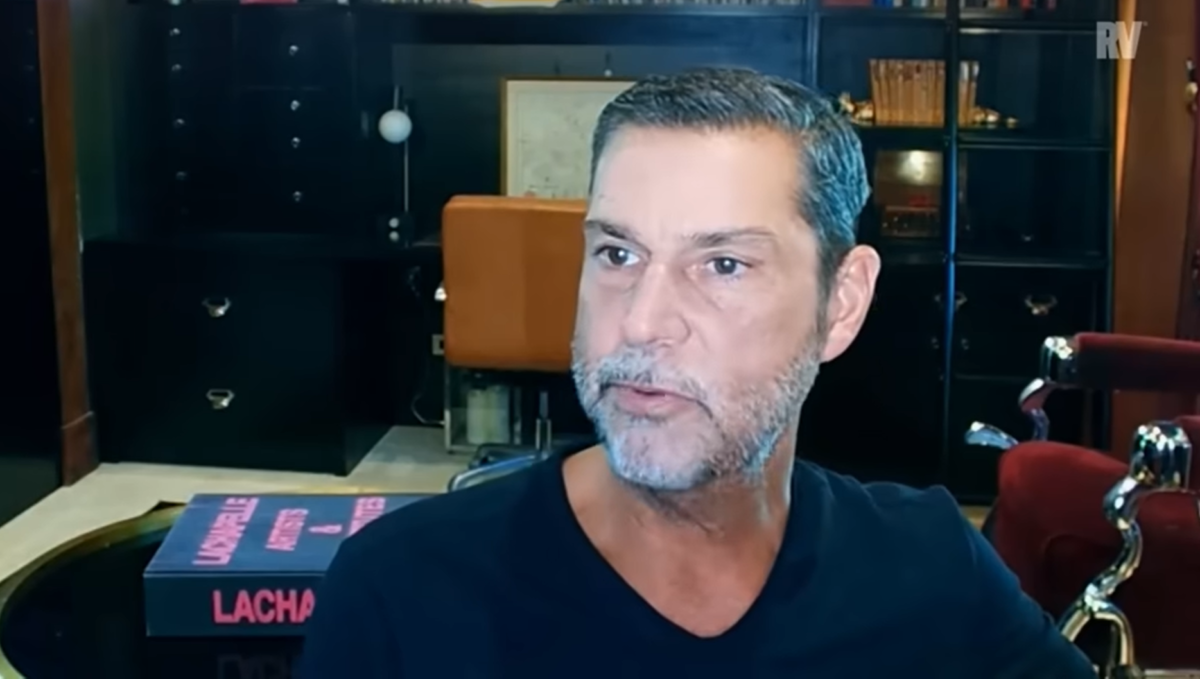

Real Vision CEO Raoul Pal pointed to a potential bull pattern that historical data confirms. Rally expectations for Bitcoin are not limited to this. The famous economist also draws attention to technological developments.

Bitcoin ready for 2x rally, according to Raoul Pal

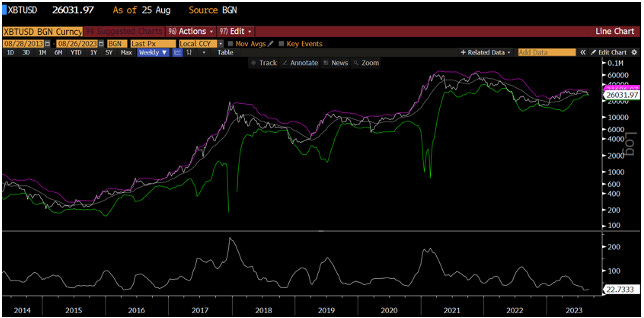

Former Goldman Sachs executive Raoul Pal pointed out an important Bitcoin bull pattern that has recurred 5 times in the past. In his current blog post, Pal said that Bitcoin’s 30-day historical volatility fell below 20 for the first time since the beginning of the year. This represents a starting point for this bullish pattern.

Pal says that reaching the 20 level has historically set the stage for Bitcoin to take a big rally in the coming months.

The famous manager explains the details of the model as follows:

After a strong start to the year (up 60% to 100%), crypto markets are completely dead over the summer.

These 20 levels have always produced big moves for the next two to four months…

April 2016: +83% in two months

October 2016: +85% in two months

March 2019: +214% quarterly

July 2020: +102% in four months

January 2023: +85% in three months.

Green signals on technical indicators

Pal also closely monitors Bollinger Bands, a widely used volatility indicator. According to the macro guru, Bitcoin price is hovering near the Bollinger Bands 20 level. This is “currently the tightest band on record”. According to their analysis:

Historically, we were below 25 in April 2016 for only one more month. At that time, Bitcoin increased 44 times to reach 2017 highs…

After looking at Ethereum (ETH), Pal touched on the market-wide correction in the past weeks. The analyst says that despite these sales, ETH continues to be traded in an uptrend.

Additionally, as we highlighted last week, ETH also appears to be forming a large bull flag pattern…

Raoul Pal explains the importance of technology for Bitcoin

Pal, who also attended an AMA event this week, announced his bull expectations with technological development this time. The analyst says that unlike other systems, where most people can only own shares that represent a portion of the network, blockchain gives users and investors a chance to own and operate parts of a network.

In an increasingly digitized world, Pal says that anything that could otherwise theoretically be inflated forever, Blockchain enables scarcity. According to the expert, Bitcoin’s market cycles could be “much bigger” than the tech stocks with which it is often associated.

In the publication, he detailed his analysis with:

In an increasingly digitized world, we need to transfer, save and store value, and value is increasingly digital. And in the digital world we can do anything from infinite abundance and so everything goes to zero in value digitally and blockchain allows you to create scarcity in the digital world…

[Crypto] is a technology that you can directly participate in. Artificial Intelligence (AI), you have to buy Nvidia, that’s the only damn thing you can do, some Microsoft, some other stuff, [but] you’re buying trillion dollar companies. How much money will you earn? 2x, 3x, maybe? Can Tesla go up to 5x, 6x, 8x? Yes of course.

Crypto cycles can be much larger because you actually own the network. If you had a stake in Nvidia, the monetization of all AI networks and the entire ecosystem, that’s why it was so strong [and] tended to outperform other tech stuff.

How about the BTC price?

Recent price movements for Bitcoin have raised comparisons with the volatile period at the start of the COVID-19 outbreak. Considered a store of value, Bitcoin experienced significant price fluctuations between 2019 and 2021. This surge set the stage for the ATH level of $69,000 in 2021. Bitcoin is currently trading down more than 50% from its peak. At the time of writing, it has once again lost the critical $26,000 support. cryptocoin.comAs you follow, the leading crypto has been pricing ETF news in recent weeks.