Following the above-expected US NFP data, US CPI data was also above expectations. This strengthened the forecasts for the Federal Reserve to continue aggressive rate hikes. With the winds blowing from the opposite direction, the yellow metal turned south again. Thus, gold prices fell and the precious metal gave back last week’s gains.

“Gold prices may slide below $1,620 support”

cryptocoin.com As you can follow, US CPI data came in above expectations. This was an important indicator that the Fed will continue to move forward on the path of high rate hikes. Gold prices returned to a bearish trajectory as the dollar strengthened and US Treasury yields soared. At the time of writing, gold prices were trading at $1,655, down 0.66%. U.S. gold futures fell 0.86% to $1,662.

According to the report of ANZ Bank economists covering the latest developments in the market, the downward momentum continues. Economists expect gold prices to fall to their previous low of $1,620. In this context, economists make the following assessment:

Strong US jobs reports and higher inflation have kept gold on its downtrend. It is likely that gold prices will fall below $ 1,600. Near support stands at $1,620, the previous low. If this support is broken, it is possible for prices to touch the lower border of the downside channel below $1,600. Near resistance is at $1,715. If this level is broken to the upside, the next resistance will be at $1,800. This will signal a downtrend reversal.

“There is room for further decline below”

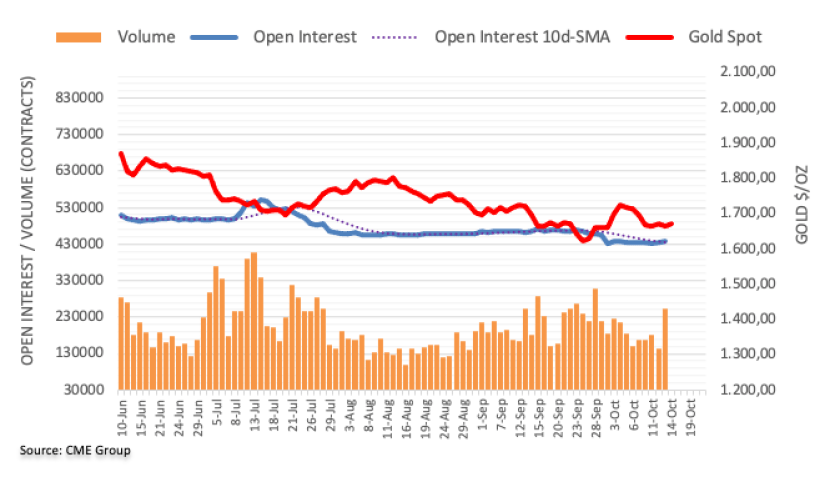

CME Group’s latest data for gold futures markets shows open interest rose by just 856 contracts on Thursday. Thus, open interest recorded its second consecutive daily increase. Volume followed suit. It has now risen markedly to around 109k contracts.

It resulted in modest losses under Thursday’s choppy price action. Meanwhile, the daily drop was amid rising open interest and volume, according to market analyst Pablo Piovano. This hinted at the possibility of extra drops in the cards in the very near term. However, he notes that the next support emerged near the October low of $1,640 (October 13).