Bitcoin Stock Exchange Investment Funds (ETF) recently recorded a major capital inflow, while Ethereum ETFs gave signals of recovery after a few days of decrease.

Demand for Bitcoin ETFs is increasing rapidly

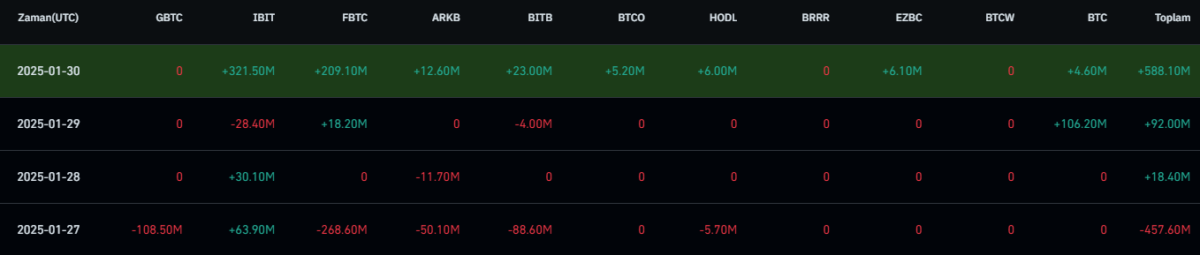

According to Coings data, a total of 588 million dollars of net entries to 12 spot Bitcoin ETF on January 30th. This figure represents an increase of approximately 540 percent compared to the previous day.

The largest entrance was to Blackrock’s IBIT fund with 321.5 million dollars, while Fidelity’s FBTC fund received a $ 209.1 million capital flow. Bitwise’s BITB ETF was $ 23 million and 12.6 million dollars in the ARKB ETF of Ark 21shares was recorded.

One of the remarkable points was that no Bitcoin ETF was out of January 30th. The following funds also contributed to the positive atmosphere of Bitcoin ETFs:

- Franklin Templeton’s Ezbc Fund: 6.1 million dollars

- Vaneck’s HODL Fund: 6 million dollars

- Invesco Galaxy’s BTCO Fund: 5.2 million dollars

- Grayscale’s Mini Bitcoin Trust Fund: 4.6 million dollars

The total transaction volume of these investment instruments reached 2.94 billion dollars. In addition, the total net entries of Bitcoin ETFs have broken a record for the first time since the launch, exceeding $ 40 billion. Currently, the total asset value of Bitcoin ETFs is $ 123.43 billion, which corresponds to 5.94 percent of the total circulating BTC supply.

Ethereum ETFs recovered after a three -day decline

Ethereum ETFs, who have experienced investor outputs for the last three days, re -entry as of January 30 and gave signals of recovery. In this process, a total of 67.8 million dollars of net entrance was recorded and investors’ interest in Ethereum continued.

Blackrock’s ETHA Fund showed the largest recovery from investors with an entry of 79.9 million dollars. Fidelity’s Feth ETF has invested $ 15.4 million, while Grayscale’s Mini Ethereum Trust fund contributed to the recovery with an entrance of $ 12.8 million.

However, Ethe, the main Ethereum fund of Grayscale, experienced $ 40,29 million output. Although this has reduced the general entrances of EThereum ETFs, it is seen that the demand for other funds remains strong.

ETF effect continues in the crypto market

The total net asset of Bitcoin ETFs reached $ 123.43 billion, while the total net inputs exceeded $ 40 billion for the first time. This reveals that corporate investors’ confidence in Bitcoin has increased and is a positive indicator for the market.

The recovery in Ethereum ETFs shows that investors have started to look more positively at the market conditions. In the coming period, it will be one of the most important factors that determine the direction of the crypto market whether the interest in Bitcoin and Ethereum ETFs will continue.