A very challenging year for the cryptocurrency market is about to end. This year, leading crypto Bitcoin and altcoin projects have moved away from the peaks they saw in 2021. However, there are 28 more days until the end of the year and it is impossible to know what time will bring. In this environment, we have compiled for our readers what the communities predict and what the metrics show for Dogecoin, Cardano, and Ripple.

Dogecoin (DOGE) price prediction for Christmas day 2022

Dogecoin received support from adoption developments in 2022, although its price performance was overshadowed by its 2021 peaks. Indeed, with widespread market volatility, DOGE lost nearly 35% in 2022 alone. According to historical data, over the past three Christmases, Dogecoin has managed to record steady year-over-year (YoY) growth. It is a matter of curiosity whether DOGE will repeat the gains in 2022.

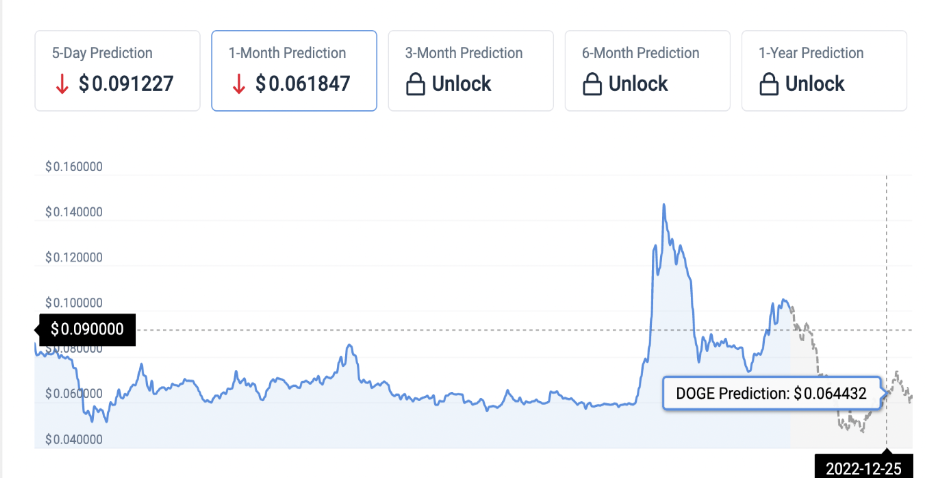

DOGE’s forecast for Christmas 2022 is bearish, according to the CoinCodex forecast, which takes into account several technical analysis indicators. Also, the asset is expected to trade at $0.065 on December 25. At press time, Dogecoin was changing hands at $0.10, down about 2% in the last 24 hours.

Dogecoin price prediction / Source: CoinCodex

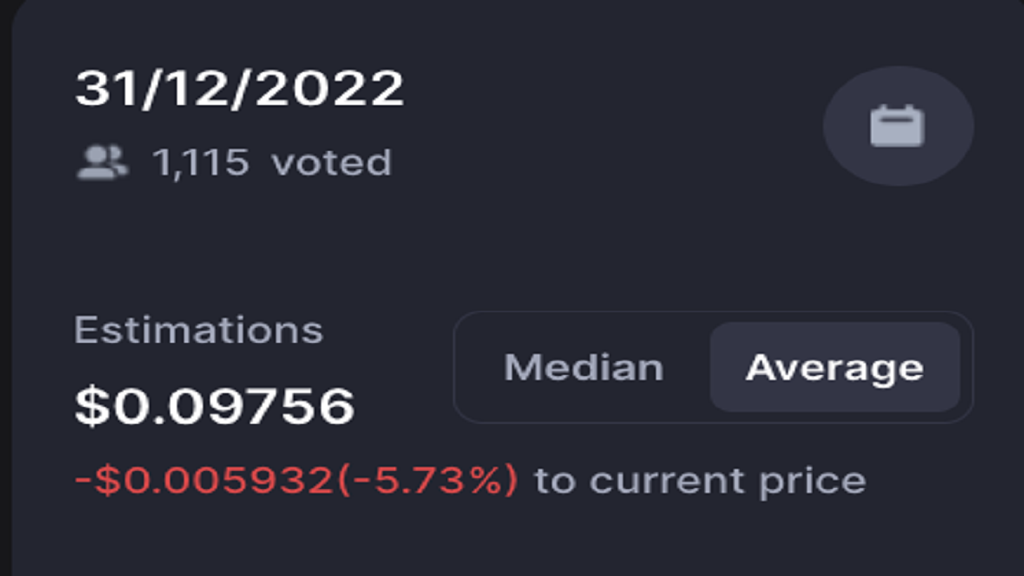

Dogecoin price prediction / Source: CoinCodexAlso, the Dogecoin community on CoinMarketCap remains bearish on DOGE’s prospects towards the end of 2022. The community predicts that Dogecoin will trade at an average price of $0.0975 on December 31, 2022. This means that DOGE’s current price will drop by about 5%.

DOGE social community price forecast / Source: CoinMarketCap

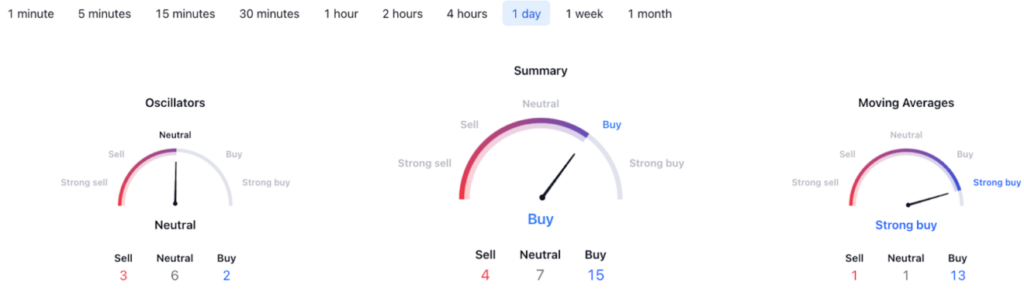

DOGE social community price forecast / Source: CoinMarketCapTechnical analysis, on the other hand, points to a bullish outlook for Dogecoin. A summary of the daily indicators on TradingView are aligned with ‘buy’ at 15, while the moving averages are leaning towards a ‘strong buy’ at 13. For oscillators, analysis is ‘neutral’ at six.

Dogecoin technical analysis / Source: TradingView

Dogecoin technical analysis / Source: TradingViewYear-end Cardano (ADA) price forecast

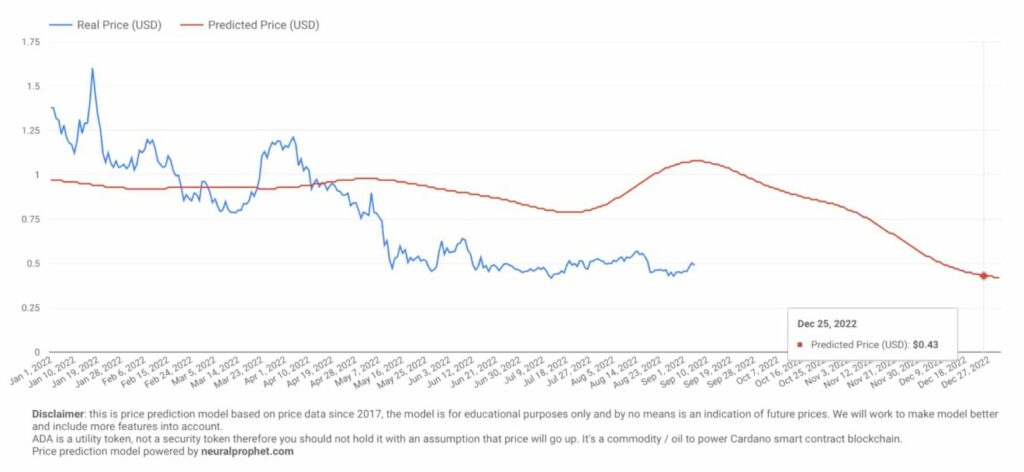

Cardano (ADA) was similarly affected by the rest of the market following the FTX crash. Despite this, it still ranks among the top ten cryptocurrencies by market cap. Currently, NeuralProphet’s PyTorch-based price prediction algorithm using an open source machine learning framework shows that the value of ADA will increase by over 30% by the end of the month. The algorithm predicts that ADA will trade at $0.42 by December 31, 2022. This means an increase of 32% compared to its current price.

ADA price prediction / Source: Cardano Blockchain Insights

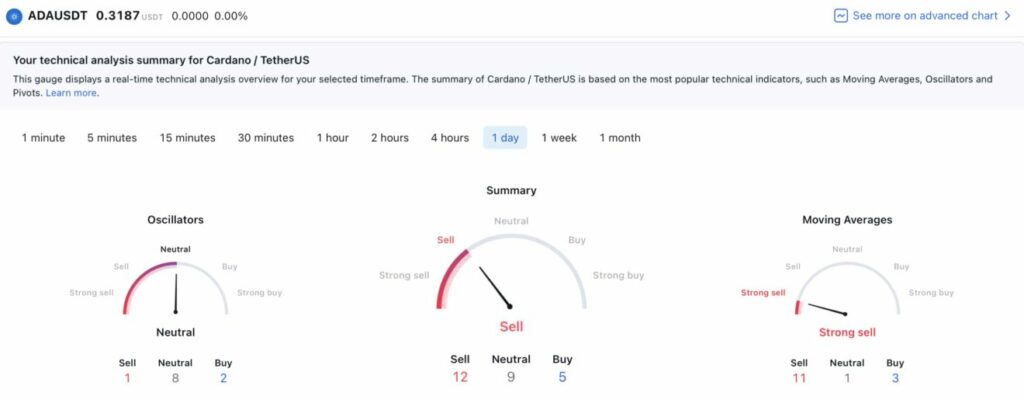

ADA price prediction / Source: Cardano Blockchain InsightsCardano’s technical analysis (TA) indicators on 1-day indicators are in a ‘sell’ position at 12 in their summaries. Also 5 points to ‘al’ and 9 to ‘neutral’. Therefore, the indicators remain relatively bearish. This summary is taken from moving averages (MA), which is again at ‘strong sell’ at 11, while they suggest ‘buy’ at 3 and ‘neutral’ at 11, respectively. On the other hand, the oscillators are slightly more optimistic as they stop at the ‘buy’ zone at 2 as opposed to 8 in the ‘neutral’ and ‘sell’ state.

ADA 1-day sentiment indicators / Source: TradingView

ADA 1-day sentiment indicators / Source: TradingViewXRP price prediction for Christmas day 2022

cryptocoin.com As you follow, Coinbase announced that it will end its wallet support services for XRP on November 29. Despite this, the XRP price has remained largely unchanged. According to historical data, over the past two Christmases, XRP has recorded steady year-over-year (YoY) growth. According to the CoinCodex forecast, XRP’s 2022 Christmas forecast shows a bearish trend. Also, the asset is expected to trade at $0.308 on December 25. Currently, XRP is trading at $0.391. Therefore, this indicates a 21% decrease.

XRP price prediction / Source: CoinCodex

XRP price prediction / Source: CoinCodexContrary to this prediction, the XRP community at CoinMarketCap remains bullish on asset prospects until the end of 2022. The community expects XRP to trade at an average of $0.4287 by December 31, 2022.

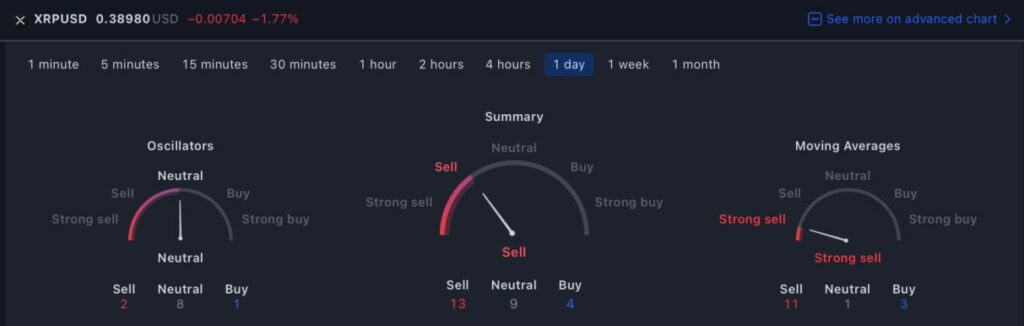

Looking at the XRP technical analysis (TA), the summary on the 1-week indicator suggests ‘sell’ at 13, only 4 for ‘buy’ and 9 for ‘neutral’. So it becomes clear that the summary oscillates towards the ‘sell’ side.

XRP technical analysis chart / Source: TradingView

XRP technical analysis chart / Source: TradingView