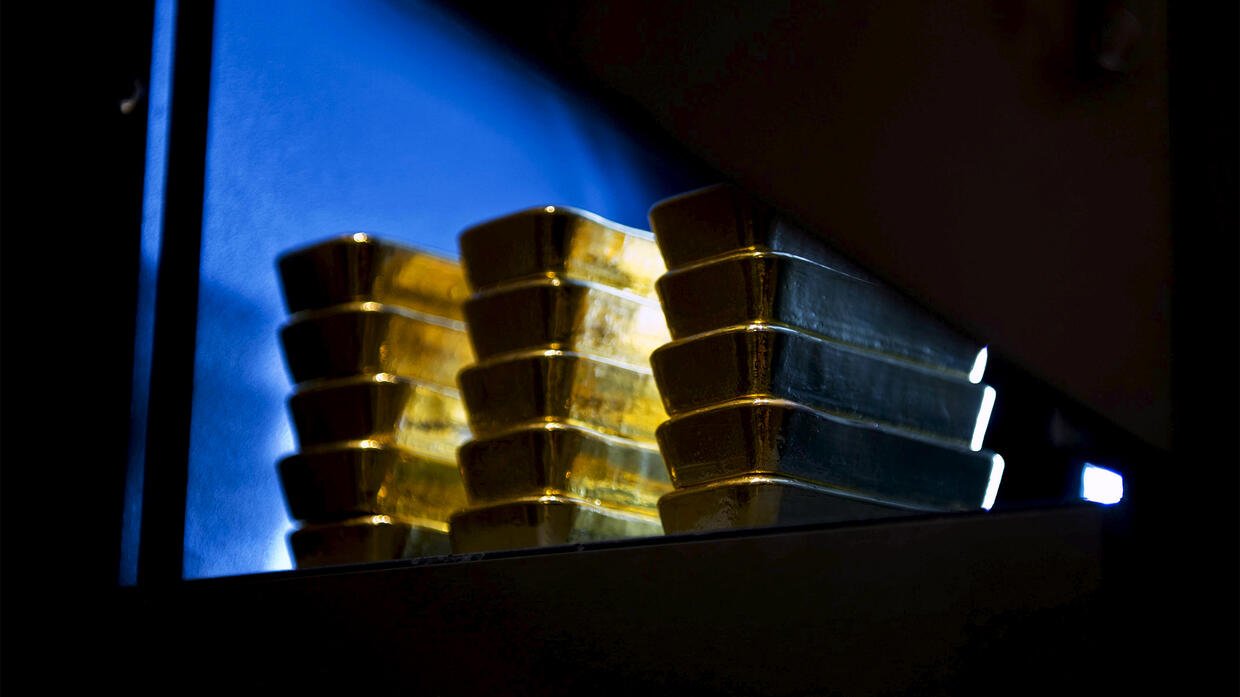

With markets in the third week of 2023, gold has already increased by 4.5 %and traded above critical $ 1,900. However, according to Australia and New Zealand Banking Group (Anz), precious metal must continue to settle on this psychological level for the continuation of the rally. Bank of America (Bofa) says that gold will take an important place in portfolios in the next three years.

Gold made with a good move, but…

After last year’s decline, the gold finally made his move. In fact, many analysts are looking for new record levels this year with the cooling of inflation and the expectations of the Fed Pivot. Anz reported that gold is a precaution against the slowdown in 2023 in his report on Monday. Anz We expect gold to remain in favor of gold when inflation is withdrawn and interest rates are approaching the summit. In the midst of the Fed’s most aggressive monetary tightening since 1980, prices were strongly recovered after last year’s correction. ”

The Bank says that in 2023, the Fed’s interest rate cycle is a pause, stagnation risks, a weak US dollar, high geopolitical risks, and strong physical demand in the Fed’s interest rate cycle. However, Daniel Hynes and Soni Kumari, the strategists of the bank, noted that in the short term, gold is at risk of correction due to technical installation. Analysts make the following assessment:

The last rally seems to be vulnerable to price correction, as the Fed is largely caused by the expectations of pigeoning. Any disappointment on the monetary policy front may cause prices to improve in the short term. We keep our 12 -month price target at $ 1,900.

This level is critical for the continuation of acceleration

After the gold rises over $ 1,900, it rises to $ 1,918, while the yellow metal is traded well above the 200 -day moving average. Analysts draw attention to the following levels:

In order to maintain this momentum, prices need to continue to settle over $ 1,900. We believe that the macro environment is not supporting enough to maintain the current price level. We noticed that there is a rising wedge formation in the daily technical table. If prices fall from the current levels to $ 1,870-1,900, we expect the trend to reversing. It confirms the fall of $ 1,800 and the price to $ 1,730.

Investment and physical demand will support the price of gold

All eyes will be the result of the Federal Reserve Monetary Policy meeting on February 1st. According to CME Fedwatch Tool, markets are currently 93.2 %chance to an increase of 25 BPS. Kriptokoin.comAs you have followed from the Fed, the December meeting increased the target policy interest by 50 BPS to 4.5 %. This was a modest increase after a 75 BPS increase four times.

Anz The FED will probably fight to return inflation to a 2 %target range. It should keep the interest rate constant by 2024 to 5 %. This leaves the interest rate for the market in the late 2023 and the price reduction of the market. Anz is constructive about gold in the longer term. In the report,

Investment and physical demand for 2023 supportive. The reopening of China paves the way for durability in the intake of physical gold. With the fall of global economic growth to 2.4 %in 2023, there is a consensus that a stagnation is coming. This will be the lowest level of the last forty years, except for the first year of the GFC and Covid-19.

Gold performs better in such periods

There is also a risk of stagflation and there will be a more strategic positioning in this scenario. “Gold performs better than stocks before and during a crisis,” the report says. The weakening of the US dollar is something that should be followed closely in 2023. “After the low level of low in the middle of 2021, the analysts have increased by 29 %, and that the dollar has made close to 114 peaks in the 4th quarter of 2022 and has recently fell below the 200 -day moving average. Gold tends to provide an average of 18 %of 18 months after the dollar summits.

On the geopolitical front, the ongoing war in Ukraine, the increasing tension between the US and China on Taiwan, Iran’s nuclear program and North Korea’s unprecedented level of missile test will continue. Anz makes the following assessment:

These upcoming geopolitical turmoil is potentially important economic and financial risk sources. Such a ground supports safe asset investment. Even central banks continue to increase gold reserves to diversify foreign exchange reserves. A higher geopolitical risk premium keeps gold prices constant.

China’s demand for jewelry will be the main source of increasing growth this year

According to Anz’s appearance, physical demand will also balance the weak corporate demand in 2023. In this context, analysts make the following statement:

Stagflation and geopolitical risks are strong, since individual investments are strong, as they encourage individual investors to purchase. We estimate that this will reach more than 1,200 tons in 2022 to the highest level of years. The extraordinary purchases of the central banks of some developing market economies supported the purchase of physical gold and made a record purchase with 399 tons in the third quarter of 2022. China’s demand for jewelry will be the main source of increasing growth this year.

Yellow metal will be a strong portfolio diversification

Gold investors have been doing too many ‘spirit search’ for the last two and a half years. However, according to Bofa, Gold will be an important place in portfolios in the next three years. Dear metal ended the year straight, and since it hit these new record levels in 2020, it has been largely down and sides. But this is finally changing. Baofa Commodity Strategist Michael Widmer makes the following assessment:

Interest in gold was silenced in the last quarters compared to other classes of assets. Because a stronger dollar did not offer any incentives to increase the investment of yellow metal. These factors, as well as others, have led to some mood among market participants. However, we think it is early to call the death of gold.

Macro view for gold turns into an upward in 2023. Also, this will last until at least 2026. Widmer refers to several drivers, indicating the following:

First, they are increasingly discussing the principle of making real gold miners copper. In addition, data from our colleagues in Özkaynak research confirms that some senior gold miners enter the basic metals. However, a view of income collapse shows that gold will be on the basis until at least 2026. Secondly, the macro ground surrounds the bull gold. Our long -term perspective field analysis confirms that yellow metal can be a powerful portfolio diversification.

Gold and Bitcoin follow many different orbits

Widmer also says that you follow Gold and Bitcoin’s many different orbits. At this point, he points out that he is essentially unrelated. In other words, Bitcoin argues other than previous arguments that investors away from the attention of investors. In this context, Widmer makes the following statement:

Gold and crypto currencies sometimes compete to attract the attention of the investor. Of course, both a crypto and a gold payment tool can be a value store. When the world becomes multiolar, the second point is important for central banks, especially to developing markets. Until this point, in the rise of the war in Ukraine, the Central Bank of Russia lowered dollar assets and at the same time increased the purchase of gold.