Ether’s Recent Slide and Its Implications

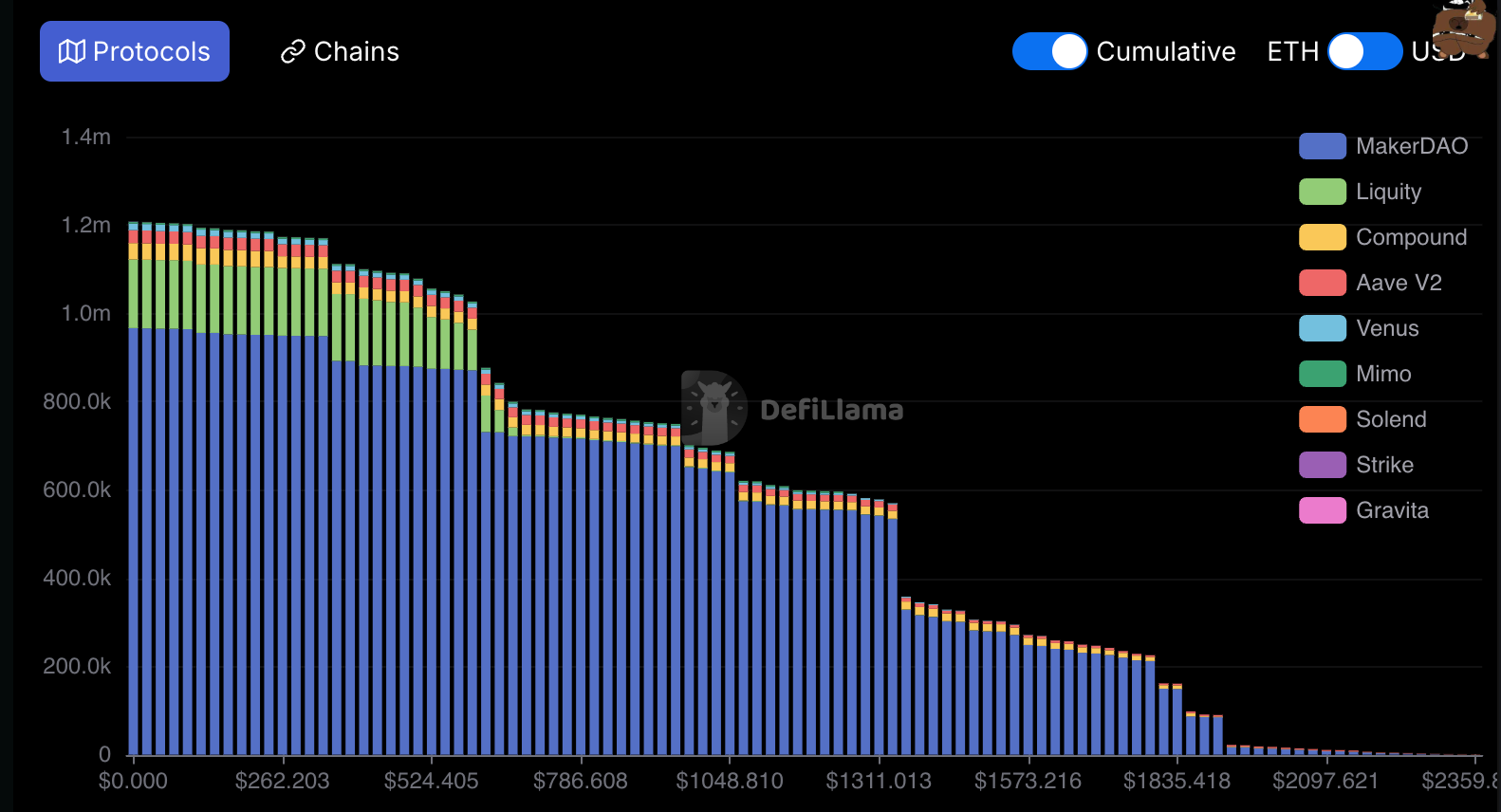

The recent decline of 11.5% in the price of Ether (ETH) over the last 24 hours has brought the second-largest cryptocurrency perilously close to triggering significant liquidations on the MakerDAO platform, which operates on a collateralized debt model. Current on-chain data reveals that three substantial MakerDAO positions are at risk of liquidation if the price of ETH falls to $1,926, $1,842, and $1,793. Each of these positions carries a value ranging from $109 million to $126 million.

At present, Ether is trading around $2,390 following a broader market sell-off, which has been fueled by diminishing investor sentiment and a downturn in global equity markets. The question of whether this price drop signals the onset of a bear market remains open to interpretation. Historically, assets have seen declines of up to 30% during previous bull market cycles. This trend often serves to eliminate excess leverage before a potential rebound occurs. Notably, ETH has already decreased by 42% since reaching its peak on December 16.

To trigger the liquidations on MakerDAO, ETH would need to decline by an additional 19%. Such a decline could potentially initiate a liquidation cascade across various decentralized finance (DeFi) platforms and exchanges. In the last day alone, approximately $296 million in ETH positions have already been liquidated across exchanges, as reported by CoinGlass.

It’s important to note that deleveraging events resulting from sharp sell-offs can create opportunities for astute traders. These traders may find undervalued assets available for purchase, as the current spot price is often influenced by a temporary lack of liquidity rather than reflecting what might be considered the asset’s true intrinsic value.