Ether (ETH) continued its recent strength Thursday afternoon, climbing above $2,000 a day after Ethereum successfully completed the long-anticipated Shapella upgrade.

The second-largest cryptocurrency by market value was recently trading at $2,015, up more than 5% over the past 24 hours.

Shapella, also called the Ethereum Shanghai hard fork, continued the transformation of the Ethereum network from a proof-of-work (PoW) to a more energy-efficient proof-of-stake (PoS) consensus started in last September’s Merge.

In the weeks leading to Shapella, market observers had diverged over ETH’s price reaction with some predicting that selling pressure would send the price down, but others seeing little impact or even an increase.

Diogo Mónica, president and co-founder of institutional crypto platform Anchorage Digital, told CoinDesk in an interview post-upgrade that investors would be more comfortable locking in ETH, leading to decreased supply. Monica noted that “there’s liquidity on the chain directly.”

“Plus, demand is increasing with every successful upgrade that we have on the Ethereum network, which are two main reasons why the price is not going to drop massively,” he said.

Monica added that validators looking to exit the chain would have to join an exit queue, and that as a result, institutional investors would “stay on the sidelines” from staking – at least for the moment.

“How the exit queue behaves” in the next few weeks and whether “we get to a pattern of liquidity such that we can start being comfortable staking for the people that aren’t staking” are questions that institutional investors currently have in mind, along with the next potential next move of EIP-4844, or proto-danksharding, he added.

ETH’s performance around the Shanghai Fork will depend less on “technicals” and more on “what risk actually does at that time,” according to a report from Coinbase Research prior to the upgrade.

“If the trading environment sees risk assets selling off, people may decide to un-stake and sell ETH just to de-risk, while institutions may not step in as aggressively on the buy side,” analysts David Duong and Brian Cubellis wrote.

Elsewhere in markets

Bitcoin (BTC) rose 1.8% for the day to change hands at around $30,375 Thursday afternoon. Among institutional investors, for years the key question has been whether BTC is an uncorrelated asset, according to Mike Belshe, CEO of custody provider BitGo, in an emailed comment.

“We’re now witnessing the proof that indeed, when the Federal Reserve stops manipulating markets with infinite money supply, Bitcoin stands alone – uncorrelated,” Belshe wrote, adding that institutional adoption is “about to kick into high gear,” despite regulatory headwinds.

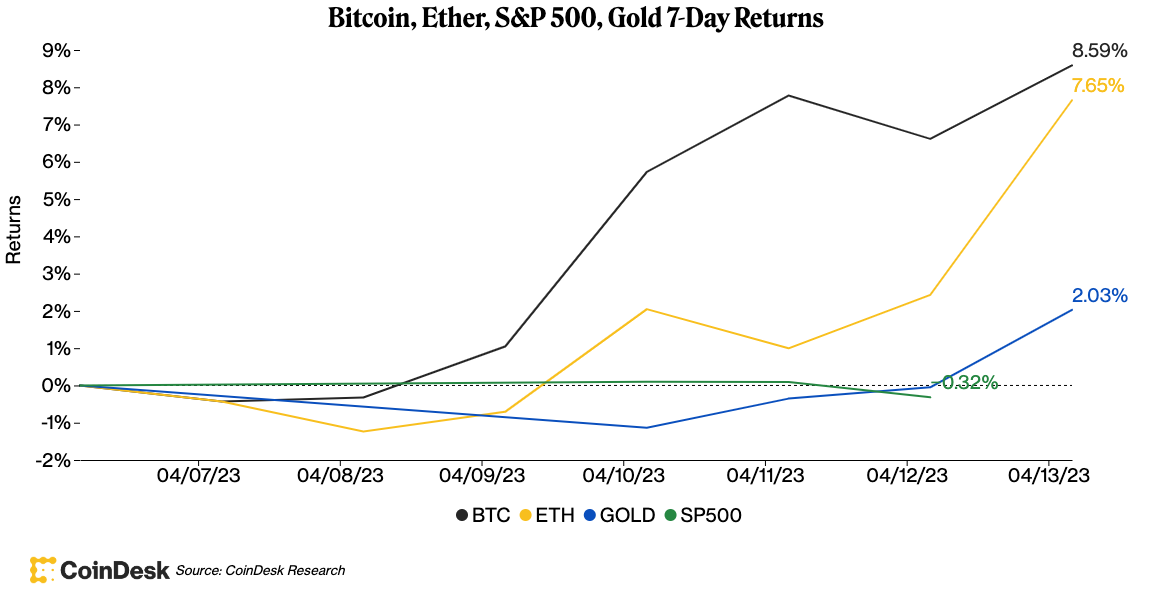

Bitcoin, Ether, S&P 500, Gold 7-Day Returns (CoinDesk Research)

Liquid staking derivatives’ token prices rose on Thursday. Lido DAO’s LDO recently spiked by over 7% in the past 24 hours to around $2.43. Rocket Pool’s RPL was up over 9% to trade at around $46.19, while Stader’s SD was up over 4% to roughly $1.33, according to CoinGecko’s data.

Arbitrum, the popular Ethereum scaling solution’s ARB token, has also been rallying. ARB is trading up 15% over the last 24 hours at around $1.37 – making it one of the day’s top-performing digital assets. Earlier Thursday, Uniswap announced that it had unveiled a mobile wallet app that includes support for Arbitrum. The CoinDesk Market Index, which measures overall crypto market performance, was up 3% for the day.

Equities edged up Thursday afternoon, a day after mildly promising inflation data. The S&P 500 and the tech-heavy Nasdaq recently rose by 1.2% and 1.9%, respectively. The Dow Jones Industrial Average (DJIA) was recently trading up 1%. The 2-year Treasury yield was flat to sit at around 3.97%. Gold rose above $2,050, inching toward its record high, as investors continued their recent penchant for assets that hold value.

Recommended for you:

- Martin Shkreli Is Back. He Loves Crypto

- ‘The Revolutionaries Will Be Televised’: PleasrDAO Launching Live Auctions With Snowden, Ellsberg NFT

- Don’t Let the Neckwear Fool You

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28

The CME FedWatch tool showed that currently 66% of traders see the U.S. central bank raising interest rates 25-basis points at the next Federal Open Market Committee (FOMC) next meeting on May 3.

Lyllah Ledesma contributed to this report.