Ether’s Price Action: A Potential Bullish Turn Ahead

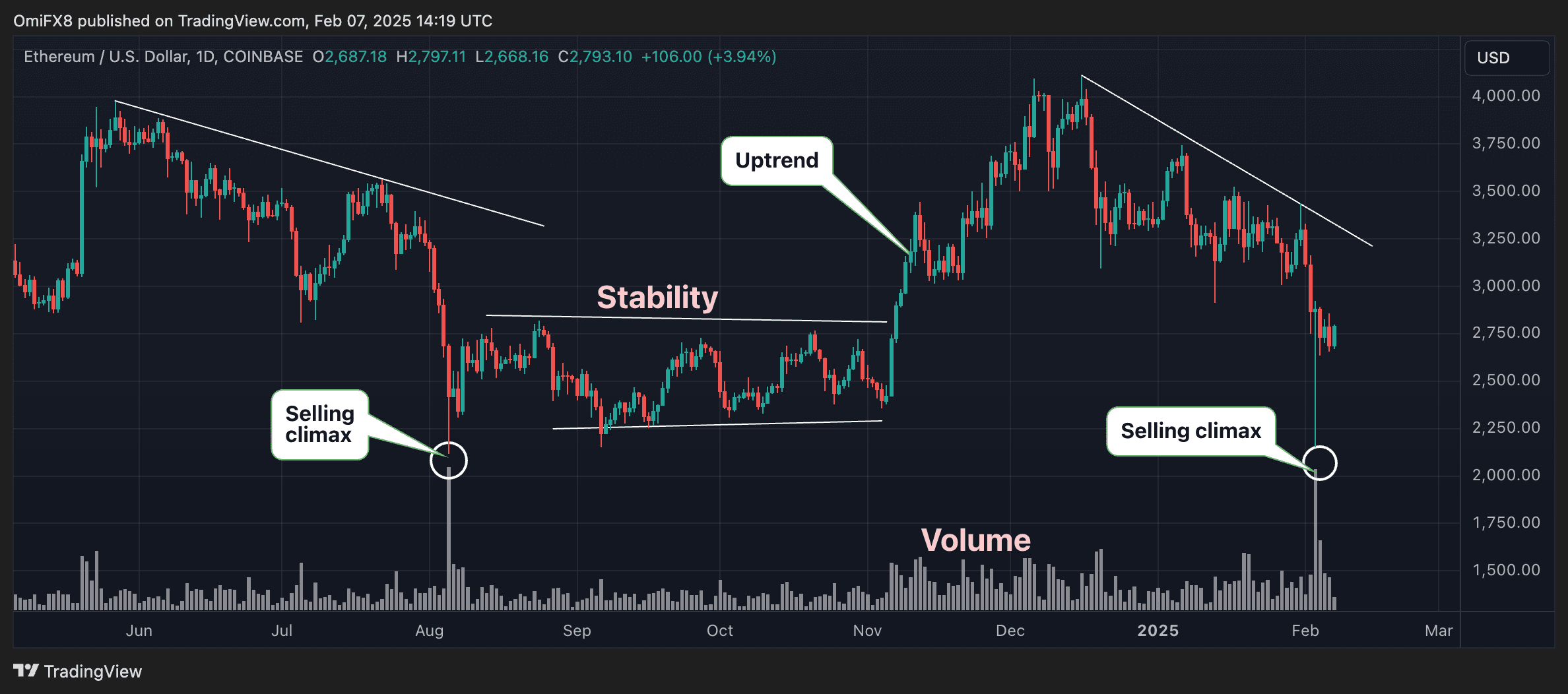

Ether (ETH) is currently exhibiting price behavior reminiscent of the pattern observed during the early August bottom, suggesting that a renewed bull run may be on the horizon.

Since mid-December, Ether has experienced a sharp decline of 32%, falling to around $2,770. This downturn has positioned it significantly behind its larger competitor, Bitcoin (BTC). The recent volatility peaked on Monday when prices plummeted to nearly $2,000 across various exchanges, only to swiftly rebound to $2,700 the same day. This marked the most substantial one-day price swing since September 2021.

The dramatic fluctuations in Ether’s price have led to a notable increase in trading volumes on platforms such as Coinbase and Bitstamp, reaching levels not seen since August. This surge in volume indicates that selling pressure likely peaked at the start of the week, resulting in fewer potential sellers remaining in the market. Such conditions could help stabilize prices and potentially pave the way for a rally.

This scenario mirrors the price action recorded on August 5, when ETH hit a low of approximately $2,100 amid significant volatility and high trading volumes. Following that, the cryptocurrency stabilized within the $2,200-$2,800 range for several weeks before breaking into a new uptrend that ultimately saw prices surge to $4,100. The question now is: will history repeat itself?

As evidenced by Monday’s dip, there appears to be robust demand supporting the bullish outlook. Jake Ostrovskis, an over-the-counter (OTC) trader at the crypto market maker Wintermute, noted, “I am observing strong over-the-counter demand for ETH, which is particularly significant given broker chatter regarding a fund facing difficulties amidst weekend volatility.”

Moreover, U.S.-listed spot Ether ETFs have recorded impressive net inflows of $420 million this week, as reported by Farside Investors. This figure represents nearly 13% of the total $3.18 billion in inflows since the ETFs’ inception.

To further bolster the bullish case, a substantial bull call spread was executed on Deribit this week. This involved positioning a long contract on the $3,500 call option while simultaneously shorting the $5,000 call option, both set to expire on December 26, 2025. This strategy aims to capitalize on a potential rally to $5,000 and beyond by the end of the year.