Ethereum User Prevents $360 Million Liquidation Crisis

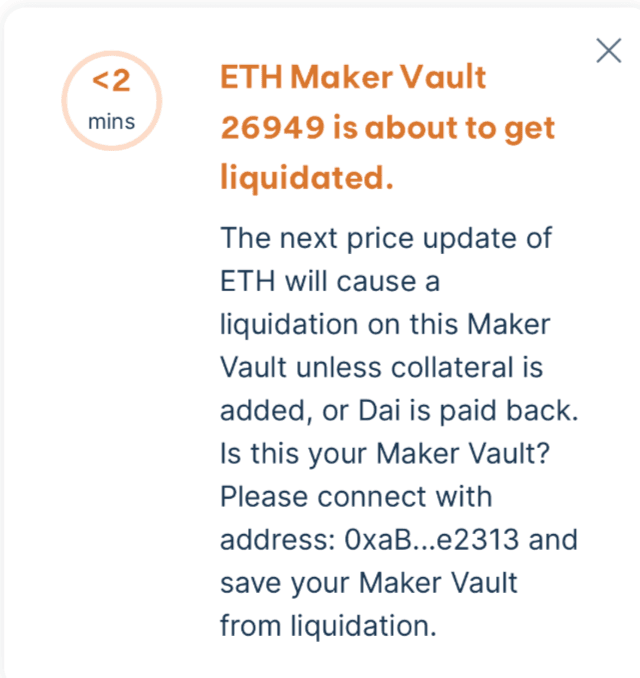

An Ethereum user successfully averted a potential liquidation cascade worth $360 million on Tuesday by adding collateral at the last moment, as the price of ETH experienced a significant downturn. One of the positions held a liquidation price of $1,928, which was nearly triggered during a sharp market plunge that coincided with U.S. trading hours.

Remarkably, the ETH assets were mere minutes away from being liquidated and subsequently sold at a MakerDAO auction. Fortunately, the wallet owner acted quickly, depositing 2,000 ETH from Bitfinex as additional collateral. In addition to this, they repaid $1.5 million worth of the DAI stablecoin to safeguard their position.

This particular wallet had been inactive since November, making the timely intervention all the more surprising. However, it’s important to note that the position is still at risk; it will face liquidation if the price of ETH drops to $1,781 or if the owner does not provide further collateral. At the time of writing, Ether is trading at $1,928, having bounced back from a low of $1,788 recorded on Monday.

In a related development, another wallet, believed by some to be associated with the Ethereum Foundation according to the X account Lookonchain, deposited 30,098 ETH (approximately $56.08 million) to lower the liquidation price of its position to $1,127.

While substantial liquidations worth hundreds of millions of dollars are relatively common in derivatives markets, decentralized finance (DeFi) protocols like MakerDAO operate strictly with spot assets. This distinction means that during a liquidation event, DeFi liquidity struggles to accommodate the skew created by spot asset supply. In contrast, derivative exchanges typically maintain higher volumes and liquidity driven by leverage.

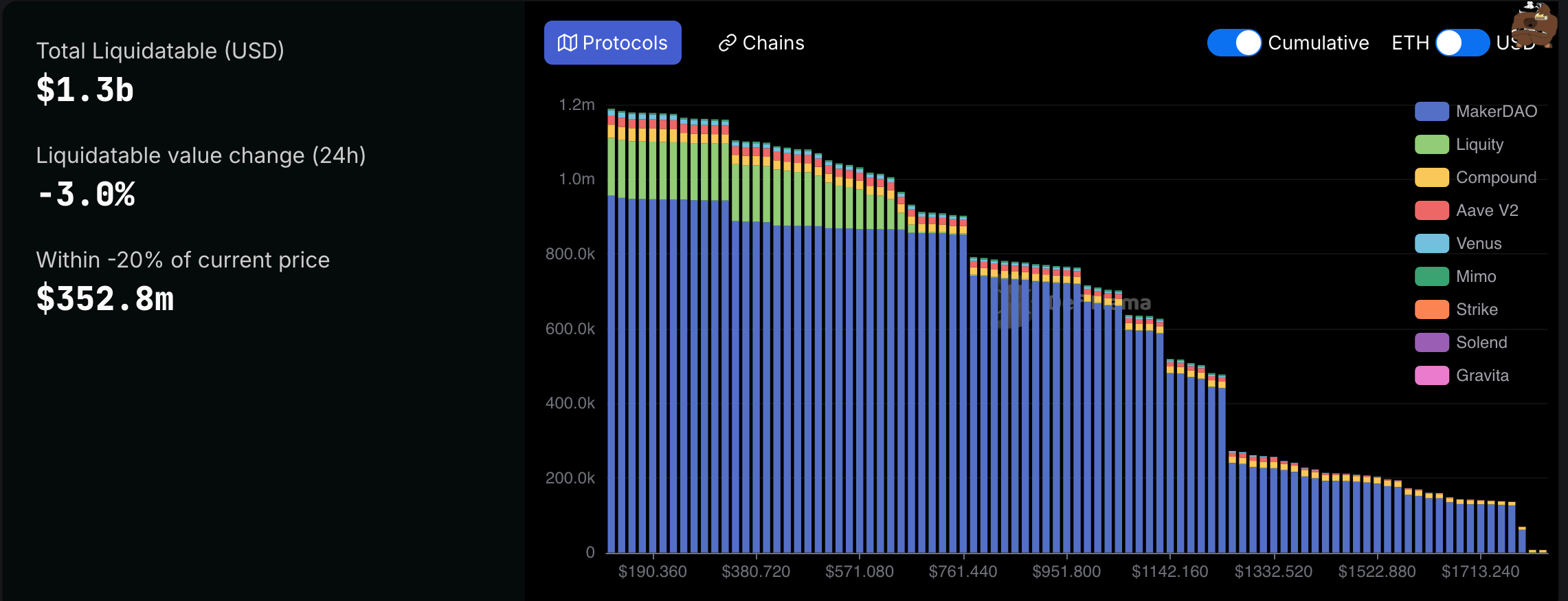

In this scenario, a single nine-figure liquidation on MakerDAO could potentially trigger a sharp decline in the price of ETH, leading to the liquidation of other vulnerable positions in the process. According to DefiLlama, there is currently $1.3 billion in liquidatable assets on the Ethereum network, with $352 million of that amount positioned within 20% of the current market price.