The rise of the Ethereum price to $ 2,800 triggered the liquidation of short positions, while Bitcoin’s stagnant course increased market volatility.

Bitcoin counts in place as Ethereum rises

The fact that Ethereum reached $ 2,800 aroused great interest in the markets, while many investors had to close their short positions. However, Bitcoin could not catch the same acceleration, and this increased the uncertainty in the market.

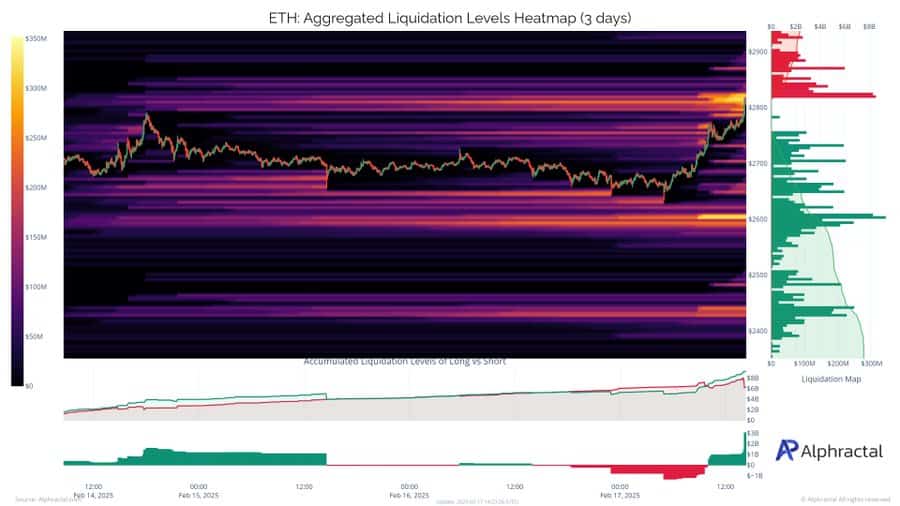

With the latest price movements, a new liquidation pool of $ 2,600 has emerged, which is seen as a critical threshold for ETH’s direction.

When the price of Ethereum reached $ 2,800, a large liquidation took place in short positions. The interest in short positions has increased more than 40 %in the last week and over 500 %since November 2024. This shows that there is a strong decline in the markets.

If Ethereum cannot maintain its rise, the $ 2,600 level will stand out as a critical support point. Liquidations that will take place at this level can determine the direction of the price movement. High short position accumulation can increase sales pressure if the price returns here.

Discrimination between Ethereum and Bitcoin

As Ethereum rises, the price of Bitcoin remained constant, revealed the separation between the two cryptos. One of the main reasons for this separation is geopolitical developments. The economic policies of Trump administration, such as customs tariffs, highlight Bitcoin as a safe port, while Ethereum is more sensitive to regulation pressure due to wider usage area.

In addition, more than 40 billion dollars of corporate investment in Bitcoin ETFs increased Bitcoin’s market dominance and caused Ethereum’s market share to shrink.

Liquidation map and technical indicators

Ethereum’s liquidation map shows that an important cluster of $ 2,800 has occurred. As it rose to this level, short positions were rapidly liquid. However, in downward movements, $ 2,600 liquidation pool stands out as a critical support.

Technical indicators say that care should be taken. ETH was traded at $ 2,670, while a decrease of 2.73 %on a daily basis. Although the RSI indicator is at the level of 39.71 and indicates a possible recruitment interest, the fact that the OBV (ten-lanish volume) is at 25.81 million shows that the purchase momentum is limited.

The fact that Ethereum is around $ 2,670 shows that uncertainty continues in the market. If this support level is broken, the ETH price can be retracted to the $ 2,600 liquidation pool. However, for an upward movement, the price needs to exceed $ 2,800 with a strong volume.

To be aware of last -minute developments Twitter ‘ in, Facebookin And Instagram follow and follow Telegram And Youtube Join our channel!