The cryptocurrency market is now largely under the control of bots. Many traders use trading software to manipulate the market and manipulate prices to their advantage. The impact this had on the Ethereum (ETH) network pushed gas fees to a one-year high.

Controlled by Ethereum (ETH) network trading bots

The latest news on the matter is the emergence of the Jared bot, which has been identified as a significant contributor to Ethereum’s rising transaction fees. The Jared bot is associated with the Ethereum Name Service domain “jaredfromsubway.eth”. The bot focuses on Pepe Coin (PEPE), which continues to rally in double digits lately.

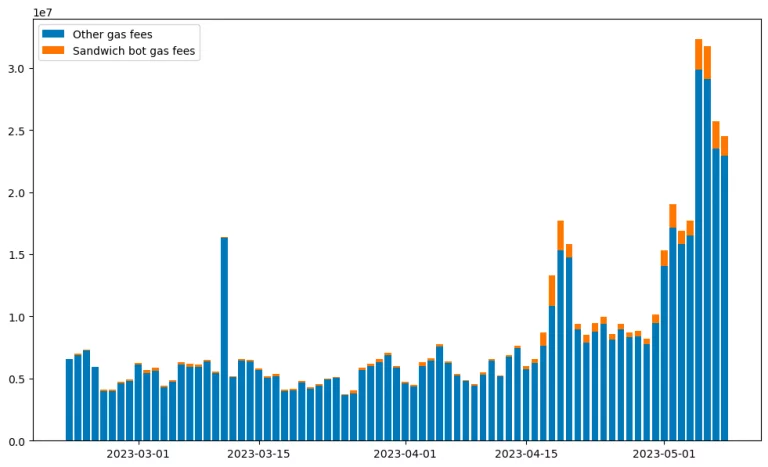

According to data from EigenPhi, the bot made a profit of $2.7 million in a week from April 17. In the same period, more than 60% of Ethereum blocks consisted of bot-sourced transactions.

How did it make a profit of $2.7 million in one week?

The bot uses a technique called a “sandwich attack” to make a profit. In this method, trading bots take advantage of the waiting state in the mempool. For example, while waiting in line for an ETH transaction, the bot makes its own deal with high gas prices beforehand. In this way, he buys coins at a lower price. He then makes a profit by selling them at a higher price.

As a result of such activity, Ethereum gas prices soared to their highest level since May 2022.

Biggest culprit for rising Ethereum gas fees

The Jared bot is the major contributor to the rising gas fees of the Ethereum network. Between its launch on February 27, 2023, and May 8, the bot spent $34.35 million instead of paying a $40.65 million gas bill. Thus, it earned a net profit of $6.3 million. During that time, the bot processed 254,000 transactions, of which 98.31% were identified as sandwich attacks.

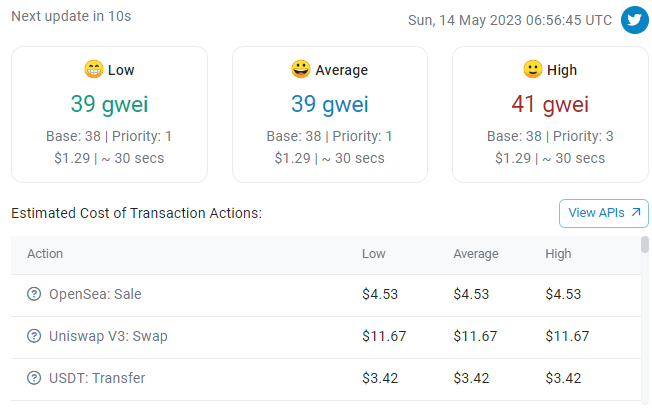

In early May 2023, Ethereum’s gas prices soared to the highest level seen since May 2022. Average transaction costs increased from 9.07 gwei in October to 155.8 gwei on 5 May. It currently averages 39 gwei. Specifically, this bot’s gas consumption accounts for a significant portion of Ethereum’s overall gas consumption.

Can MEV bots be blocked?

In response to the increasing number of bots engaged in this type of activity, CoW Swap has developed a product called MEV Blocker in collaboration with Agnostic Relayer. This product is designed to protect users from sandwich attacks and other MEV related bots. It processes transactions through a network of users looking for MEV opportunities called seekers.

CoW Swap, in collaboration with @beaverbuild and Agnostic Relayer, is proud to announce MEV Blocker. https://t.co/WIhaaGtP0e ⛱️

MEV Blocker is a free RPC endpoint that *pays users* to protect themselves from MEV across a wide variety of use cases in DeFi, NFTs, and dApps. pic.twitter.com/Fa6cRNjrxf

— CoW Swap | Better than the best prices (@CoWSwap) April 5, 2023

The rise of the Jared bot and other MEV-related bots has forced developers to take action against such activities. While the use of bots for trading purposes is legal, their activities harm other market participants. On the other hand, the Ethereum network experienced long outages of up to 25 minutes on May 11 and 12. cryptocoin.comWe have included the details in this article.