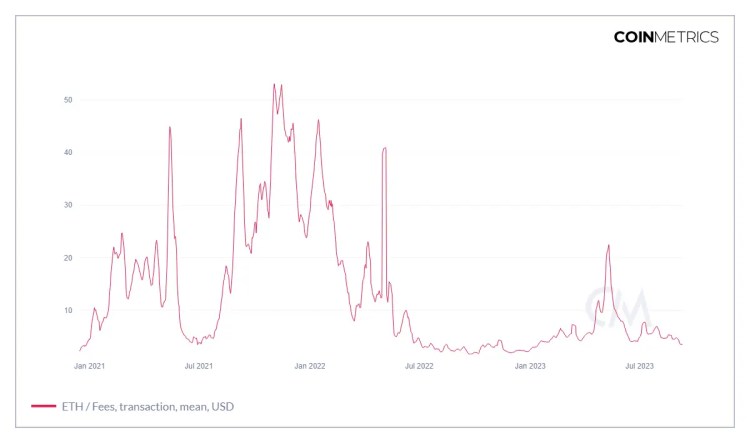

The lackluster course in the Bitcoin and altcoin markets is also reflected in the activities on blockchain networks. The Ethereum network, which investors once complained about due to astronomical transaction fees, is now quite cheap.

Blockchain tracking platform Coin Metrics revealed that transaction fees on the ETH network showed a downward trend during the summer months. The average of gas fees determined within the framework of demand and supply for the last 7 days was 3.51 dollars. Average ETH fees exceeded $21 in May.

The decrease in transfer fees in the Ethereum network also pleases investors using decentralized exchanges (DEX). Transaction fees on popular exchanges such as Uniswap dropped to around $4.

How Are Low Fees Affecting the Ethereum Network?

Network fees remaining low as a result of the inactive market are putting inflationary pressure on Ethereum. According to data from Ethereum supply tracker Ultrasound.money, ETH supply increased slightly last week. This situation did not significantly affect the deflation process that has continued since the Merge update.

According to the website, as the first year of the Merge update ended, 983 thousand ETH were burned in the market. This amount represents 0.25% of the total supply.