Ethereum’s once-crowded queue for new validators on the blockchain has almost completely cleared out.

It would be the first time that has happened since Ethereum’s major “Shapella” upgrade in April, which marked the completion of the blockchain’s transition to a fully-functioning proof-of-stake network.

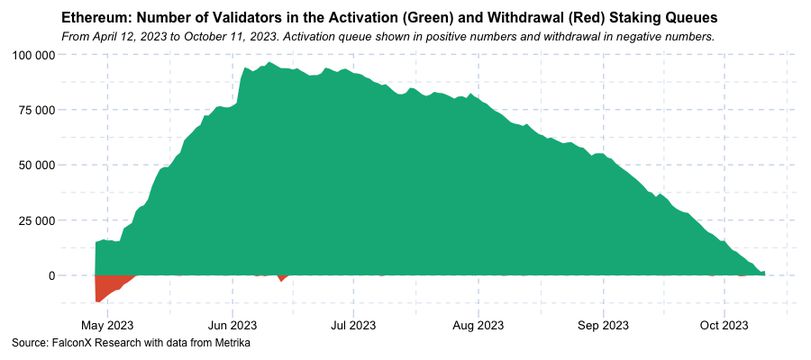

Blockchain data shows that there are now just 598 validators waiting to go onto the network, down from a peak of over 96,000 in early June.

The shrinking queue means that the expected waiting time to add a new validator to the network shrunk to less than five hours as of Thursday. This is a remarkable decrease from when new validators were looking at a 45-day wait due to massive pent-up demand to stake ether (ETH), the network’s native token.

Ethereum’s rules limit how many new validators can come on every blockchain “epoch,” or roughly 12 seconds.

Validators participate in maintaining Ethereum’s proof-of-stake blockchain and verifying transactions by locking up (staking) ETH. In exchange for their efforts, they receive staking rewards.

Ethereum’s Shapella upgrade allowed withdrawal of staked ETH for the first time, eliminating a significant source of risk for investors – that they might not be able to get their funds back out.

The upgrade unleashed a wave of inflows into the blockchain’s staking mechanism.

ETH staking growth was “exceptionally strong” since the Merge – when Ethereum transitioned to proof-of-stake in September 2022 – and Shapella upgrades, but the initial fervor has started to cool, David Lawant, head of research at institutional crypto exchange FalconX, noted in a market report.

“An empty activation queue implies a slowdown in the growth of staked ETH,” Lawant said.

Number of Ethereum validators waiting for activation over time (FalconX)

Staking rewards have dropped significantly to near 3.5% from 5%-6% earlier this year, according to CoinDesk’s Composite Ether Staking Rate (CESR), due to tepid network activity to generate revenue from fees and the increasing number of stakers. Meanwhile, short-term U.S. Treasury yields have surpassed 5% as the Federal Reserve jacked up interest rates to combat inflation.

Ethereum’s staking ratio – the share of tokens staked in the network versus total supply – has grown over 22% from 15% in this April and 6.5% last September, but still lags behind other popular proof-of-stake networks. The same ratio for Solana (SOL) is 69%, while it’s 63% for Cardano (ADA) and 53% for Avalanche (AVAX).

This is largely due to ETH being used as a “network resource,” and because Ethereum possesses “a more distributed shareholder base,” Lawant said.