Ethereum (ETH) is trying to overcome critical resistance points by targeting $ 3,000. While the rise tendency is strengthening, investor interest is increasing. Increased demand and decreasing stock market supply can move the value of Ethereum even further.

Large fund introduction to Ethereum ETFs!

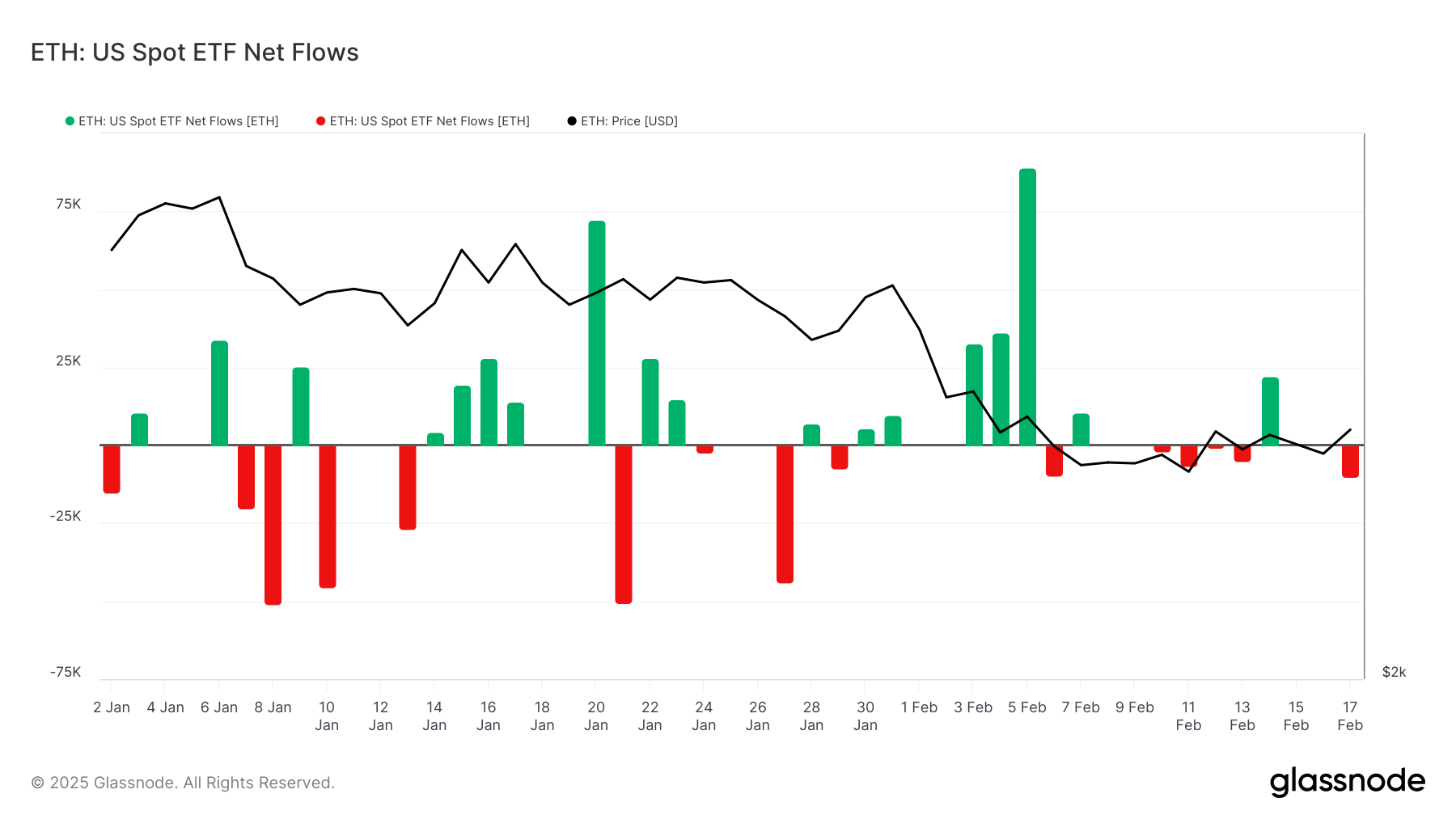

The interest in Ethereum has risen rapidly in recent weeks. Only 145,000 ETH entrance to Ethereum Spot ETFs this month. The total value of these inputs exceeded $ 387 million and reached seven times the numbers in January. This movement reveals the confidence of both corporate and individual investors in ETH.

The rise of ETH price can be strengthened by ETF inputs. As the investor interest continues, Ethereum becomes more likely to break critical resistance levels. Increased fund flow supports optimism throughout the market and can carry the price to higher levels.

The decreasing supply and increasing investor support Ethereum

Ethereum’s supply in the stock markets declined at a record level. Currently, only 6.38 %of the total supply are on stock exchanges. This has been recorded as the lowest stock market supply since the release of Ethereum. While more investors continue to hold ETH, this is upward on the price.

In addition, Ethereum’s visibility on social media platforms rose to 9.2 %. This proves that awareness within the community has increased and investors show more interest to Ethereum. The increase in the interest of investors and the decrease in the stock market supply paves a strong ground for the rise of the price of Ethereum in the long term.

Can Ethereum exceed $ 3,000?

Ethereum is currently trading at $ 2,670 and is trying to maintain a $ 2,654 support point. If the $ 2,793 resistance is exceeded, a strong rise is expected to begin to the $ 3,028 level. Breaking this level can accelerate the long -term rise of Ethereum. If Ethereum can support $ 2,793, investor confidence will increase and the price may rise further. In such a scenario, the next resistance point can be determined as $ 3.303. However, if Ethereum does not exceed this critical threshold, the price may enter the consolidation process and may decline to $ 2,546. This can temporarily weaken the expectations of rise.

Ethereum price movements will continue to be shaped depending on the risk appetite of investors and the general course of the market. If the positive trend is maintained, the target of $ 3,000 can be realized in the coming days!