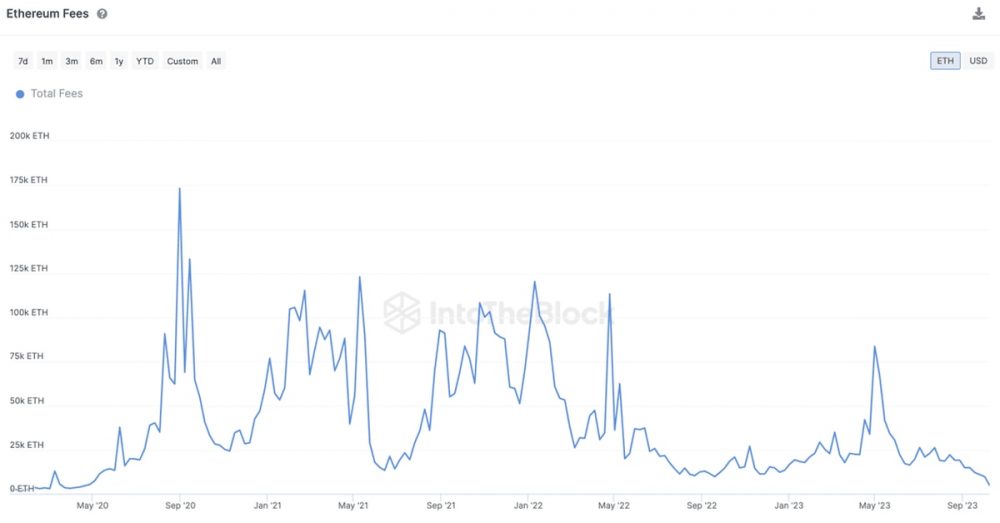

Ethereum is likely entering a new regime dominated by low network revenue generated from fees, testing its native token ether’s (ETH) deflationary supply narrative, crypto data analytics firm IntoTheBlock said in a report.

The Ethereum blockchain’s income from network fees dropped to its lowest level since April 2020 and is down 90% from its high this May, according to IntoTheBlock data.

Ethereum users over the past years’ bull market complained about high transaction costs – also known as gas fees – while the network was prone to clogging due to increased activity from non-fungible token (NFT) trading and decentralized finance (DeFi) yield farming. Those days are gone as prices for cryptocurrencies cratered, demand for NFTs collapsed, and DeFi activity plummeted.

The proliferation of layer 2s, which have been developed to help Ethereum scale and increase its capacity, has also contributed to bringing down fees, the report noted. While the development is positive for Ethereum users who can execute transactions cheaper than before, it impacts ETH’s supply by keeping it inflationary by burning fewer tokens than new issuance.

“The decrease in fees is putting ETH’s ‘ultra sound money’ thesis to a test,” said Lucas Outumuro, IntoTheBlock’s head of research.

Over the past 30 days, ETH token supply has grown by 33,500 ETH – worth some $52 million – driven by the low activity on the blockchain, data shows.

Outumuro said that network fee revenue will likely stay low as speculative activity dries up and users continue migrating to layer 2s. For example, NFT trading was responsible for the bulk of tokens burned in 2021 and early 2022, but last week, it only represented 8%, he said in the report.

“The low fee regime represents a major transition for Ethereum, trading off high revenues and deflationary supply for the promise to be able to attract mainstream users through layer 2s,” he added.