Decentralized lending platform Euler Finance opened up redemptions for recovered funds to its users Wednesday at 2:00 UTC, allowing users to claim the capital they have in the protocol almost a month after the protocol suffered a flash loan exploit.

Recommended for you:

- No Let-Up in Demand for Bitcoin, Ether Puts After Dovish Fed Minutes

- Crypto Derivative Volumes Saw Speedy Growth as Prices Rose in January

- Australian Regulator Tells Banks to Report Exposure to Startups and Crypto-Related Business: Report

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28

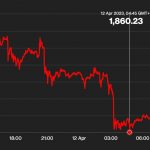

Users are able to redeem their share of recovered funds, which stand at 95,556 ether (ETH) and $43 million of the DAI stablecoin, collectively worth about $223 million based on current prices. The price of EUL, the native governance token of the Euler Protocol, has increased 2.5% in the past 24 hours, but has slid 9.4% in the past week, per CoinGecko

Euler Finance suffered a $200 million exploit in March, and by April, the protocol had successfully recovered most of the capital it lost. Reopening redemptions represents a positive ending for the saga, a fairly rare occurrence when protocols get exploited; for instance, the $625 million taken from Axie Infinity’s Ronin network, orchestrated by North Korea’s Lazarus Group, has not been returned, though Sky Mavis, the firm developing Axie, raised $150 million to reimburse users.

Several users in Euler’s Discord have expressed gratitude and disbelief that they were able to retrieve their funds. A community member who goes by Fredda said, “I cannot believe I actually got my money back.” Another user called Holden wrote, “Thanks for getting this done so quickly and professionally. I didn’t imagine a month ago I’d be seeing a return of my funds.”