The euro’s fall toward $1 for the first time in 20 years – approaching so-called parity with the U.S. dollar – is turning some crypto traders’ focus to the exchange rate’s impact on crypto valuations and to stablecoins linked to the European common currency.

Thanks to the emergence in recent years of stablecoins tied to government-issued currencies besides U.S. dollars, the vast realm foreign exchange has been slowly creeping into digital-asset markets.

And some observers say the euro’s latest slide could inject bearish pressures into the bitcoin (BTC) market and influence demand for euro-pegged stablecoins.

“Currency turmoil (such as that currently experienced by the euro and others) usually ends up favoring the U.S. dollar, as forex market participants see it as the ‘least risky’ currency. This is accentuated by the divergent interest rate paths between the U.S. and the EU,” said Noelle Acheson, head of market insights at the crypto trading firm Genesis Global Trading. “This could negatively impact the price of bitcoin in dollar terms, which for the past couple of years has been negatively correlated with the dollar index.” (Genesis is owned by Digital Currency Group, CoinDesk’s parent company.)

The euro has depreciated by 10% against the dollar this year, a significant move for major fiat currency pair. The exchange rate was last seen trading near 1.02, or 200 pips short of the parity level of 1.00.

The decline seems to have stemmed from the European Central Bank (ECB) lagging behind the Federal Reserve (Fed) in tightening monetary policy despite rising inflation and the threat of a full-blown energy crisis in the European Union.

The currency market pundits are convinced that the ECB will continue to lag, allowing EUR/USD to slip well below 1.00. Engineering a lift-off from a record negative interest rate of -0.5% is easier said than done for the ECB as hawkish expectations recently saw Italian bond yields collapse relative to their German counterparts, raising fragmentation risks. Fragmentation essentially means as the central bank raises rates, the impact of the tightening is not felt in the same way across the common currency area.

Financial markets are driven by sentiment, so when a major national currency like the euro is trampled and pushed toward or below critical levels, investors tend to move out of risky assets, fiat currencies and seek refuge in established safe havens like the U.S. dollar and government bonds. Therefore, EUR/USD’s drop to or below 1.00 could spur broad-based demand for the greenback, pushing lower bitcoin and other risky assets.

While bitcoin believers have long hailed the cryptocurrency as a haven asset, historically the digital currency has moved in tandem with technology stocks and in the opposite direction to the dollar index (DXY). For instance, the DXY, which tracks the greenback’s value against major currencies, has rallied nearly 12% this year. Meanwhile, bitcoin and Wall Street’s tech-heavy Nasdaq index have tanked 55% and 27%, respectively.

Not that things couldn’t change. But that’s mostly been the pattern.

Chart showing the EUR/USD exchange rate and comparing bitcoin’s 2022 performance to Nasdaq and the dollar index. (TradingView) (TradingView)

Focus on euro-pegged stablecoins

Euro-pegged stablecoins could lose their shine.

Stablecoins are tokens tracked by a blockchain and intended to consistently match the purchasing power of a fiat currency, like the dollar or the euro. The issuer of the stablecoin promises that users or holders of the stablecoin can redeem the investment anytime at a one-to-one exchange rate.

The structure exposes the user to exchange-rate risk. For instance, assume a trader named Bob purchased one euro-backed tether stablecoin EURT a month ago. Theoretically Bob can redeem EURT for one EUR anytime. However, EUR/USD has declined by 4.2% from 1.065 to 1.02 in four weeks. So, if Bob redeems EURT today, the redemption would yield a loss of 4.2% in dollar terms, assuming he didn’t earn additional yield by lending out the asset on the decentralized lending and borrowing protocols.

Therefore, holders of euro-pegged stablecoins may opt for redemptions, given the bearish outlook for the common currency.

“Overall, 1.0 is an important psychological level,” Dessislava Aubert, senior research analyst at Paris-based Kaiko, told CoinDesk in an email. “If it breaks, it will most likely spur some FX volatility in the short run, spilling into other asset classes, including crypto, and trigger selling of euro-backed assets.”

Laurent Kssis, managing director and head of Europe at crypto exchange-traded fund firm Hashdex, said the euro-pegged stablecoin market may get tested for its robustness and come under pressure.

One question is whether potential redemptions and volatility in the euro-pegged stablecoins would have a Terra-like contagion effect on the broader crypto market. The answer is probably no because the euro-pegged stablecoin market is quite small.

The euro-pegged stablecoin market was worth $440 million at press time. That’s just 0.29% of the dollar-pegged stablecoin market value of $151 billion, according to data tracked by CoinGecko. Cryptocurrencies more broadly have a market capitalization of $950 billion.

The biggest euro-pegged stablecoin at press time was the euro-backed tether, or EURT, with a market value of $210 million. Euro stasis, or EURS, the second-largest euro stablecoin, had a market cap of $126 million. Terra’s algorithmic stablecoin UST had a market cap of $18 billion before it collapsed in mid-May, dragging the crypto market lower and leading to volatility in the broader stablecoin market.

“Euro-backed stablecoins are still such a small portion of the overall market that any redemptions the current euro weakness might trigger would not materially impact the overall market cap,” Acheson said.

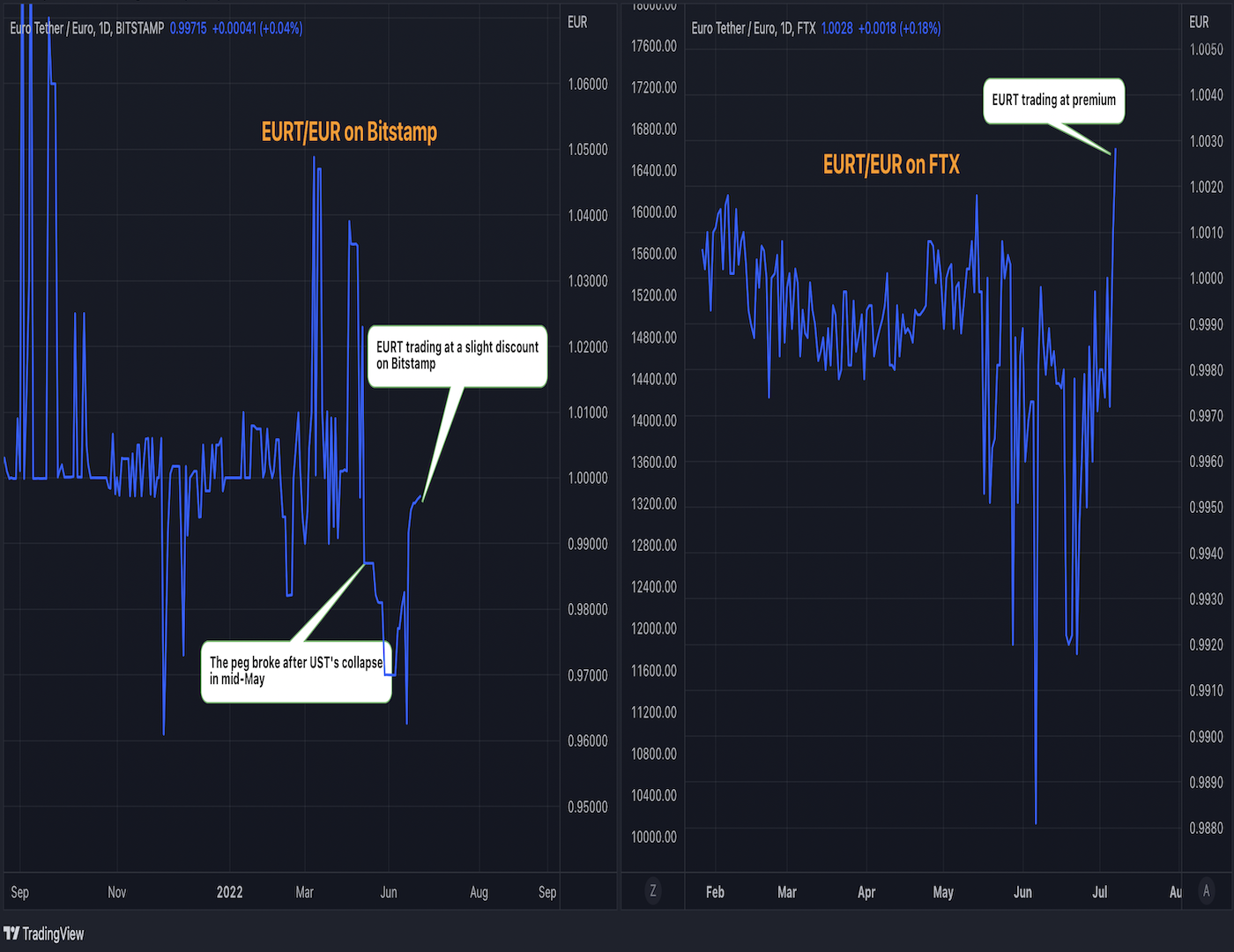

As of writing, EURT traded at a slight discount, just below the 1 euro peg on Bitstamp, having dropped to 0.96 euro on June 20. The peg broke after UST’s collapse in mid-May. Meanwhile, the euro tether traded at a slight premium on crypto exchange FTX.

Charts showing EURT/EUR exchange rates on Bitstamp and FTX (TradingView)

Zero-sum game and ECB rate hikes

The currency market is a zero-sum game. When we say the euro is likely to lose ground against the dollar, it also means the dollar is expected to rise and there is incentive to hold the greenback-pegged assets.

So while the EUR/USD slide may dent the appeal of the EUR-pegged stablecoins, it could spur demand for the dollar-pegged stablecoins. With the Fed raising rates aggressively to tamp inflation, traders already have a solid reason to hold the dollar-pegged stablecoins.

Besides, the ECB is widely expected to exit the negative interest rate policy this year, which may eventually bode well for the euro and assets backed by the common currency. Circle, the issuer of the second-largest dollar-pegged stablecoins USDC, recently launched a new euro-backed stablecoin called EUROC, perhaps in hopes that ECB’s rate hikes would translate into demand for euro-backed assets.

Interest-rate traders expect the ECB to raise the benchmark borrowing costs by 140 basis points (1.4 percentage point) by the end of the year. The central bank’s benchmark interest rate currently stands at -0.5%.

“Rising interest rates will benefit yield products, like stablecoins,” Bill Cannon, head of exchange-traded product portfolio management at Valkyrie, said. “Similar to traditional foreign-exchange strategy, utility depends on the use of the product, and it is our understanding that opportunities are limited in the euro-denominated stablecoin products at this time. But just like everything else crypto, that could change quickly.”