The price of gold began last week under a moderate drop pressure. However, he managed to regain his traction before making a downward correction towards the weekend. Thus, gold closed the week with little changes above $ 1,750. Market analyst Eren Şengezer says Fed’s minutes of October Policy Meeting and next week’s PMI surveys may affect the US dollar and thus the movement of gold.

US dollar recovered again

At the weekend, Federal Reserve President Christopher Waller said that the markets are ‘very ahead’ and that inflation has fallen ‘open, strong’ evidence will not fall, he said. Kriptokoin.comAs you have followed, San Francisco Fed President Mary Daly also recommended that the markets should stop thinking about the speed of interest rate hikes and start thinking about the level. These comments caused the risk rally to lose speed. Thus, he helped the dollar to remain resistant to its rivals. This limited the rise of gold on Monday.

Data from China on Tuesday showed that industrial production is 5.0 %. Growth was below 5.2 %expectation of the market. In addition, retail sales shrinked by 0.5 %in the same period after a growth of 2.5 %in September. Investors applauded China’s decision to relax the restrictions on the coronavirus, while this data could not change the mood of the market. Global stock indices made strong gains while registering a golden peak.

The US has declined, gold rises above $ 1,780

In the meantime, the US Office of Statistics revealed that the Producer Price Index (PPI) decreased from 8.4 %in September to 8 %in October. This data came below the market expectation of 8.3 %. Therefore, he put pressure on the dollar and increased his gold over $ 1,780 for the first time since August. At the end of the American session, increasing geopolitical tensions forced investors to take a cautious stance. Therefore, the US dollar began to strengthen as a safe port.

The dance of gold and dollar continues

On Wednesday, two Russian -made missiles that hit Poland triggered a flight to the safe harbor. So, the price of gold began to fall. Later reports, tensions began to decrease. This allowed gold to find support while struggling to protect the dollar power.

On Thursday, the US Census Office reported that housing beginnings and construction permits decreased by 4.2 %and 2.4 %, respectively, respectively. These figures reminded the negative impact of increasing interest rates on the housing market. These data made it difficult to recover the dollar. However, the price of gold closed the day in the negative region with the pressure of the 2 %increase in the 10 -year treasury bond return. In the absence of high -effective macroeconomic data description, markets remained relatively calm on the last trading day of the week. Yellow metal fluctuated around $ 1,760 in a narrow channel.

The first important data will be the US Services PMI

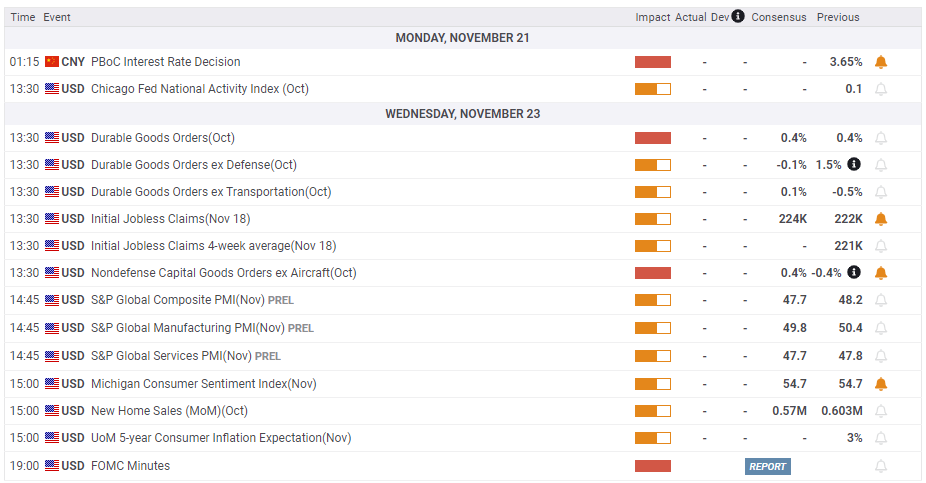

In the US, stocks and bond markets will be closed on Thursday, November 24th. It will also close early on Friday on the occasion of gratitude. All important US data will be announced on Wednesday next week. Therefore, investors will not be easy to walk around them. S&P Global will publish the pre -production and service PMI surveys of November. Services in September, 49.3, fell to 47.8 in October. Thus, he showed that the commercial activity in the service sector continued to shrink through accelerating. Analyst makes the following assessment for the effect of the data:

If the Services PMI decreases at the beginning of November, the US dollar may have difficulty in finding demand. It is possible for this to allow gold to rise further.

Event of the Week: FOMC minutes

Later on Wednesday, the US Federal Bank (FED) will publish the minutes of the October policy meeting. The FED said in a recent policy statement that they would take into account the “cumulative tightening, policy delays and economic and financial developments” while determining the speed of interest rate hikes of policy makers. This interpretation has created expectations for a less aggressive fed policy tightening. However, FOMC President Jerome Powell said they focused on reaching the final interest rate. He also added that he expects to be higher in the dot graph in December.

However, CPI figures, which were softer than expected for October, triggered a risk rally. CME Group’s Fedwatch Tool shows that the markets have priced a 50 BPS interest rate hike in December 80 %. The market location shows that the dollar can continue to weaken until a 50 BPS increase is fully priced. According to the analyst, the FED’s next week’s statement confirms the intention of policy makers to choose a smaller interest rate hike at the last policy meeting of the year.

Meanwhile, because the country is an important consumer of yellow metal, market participants will closely pay attention to the developments surrounding China’s zero-Covid policy. According to the analyst, if China decides to take strict measures again next week, the gold will probably return south.

GOLD PRICE TECHNICAL Appearance and Gold Estimation Survey

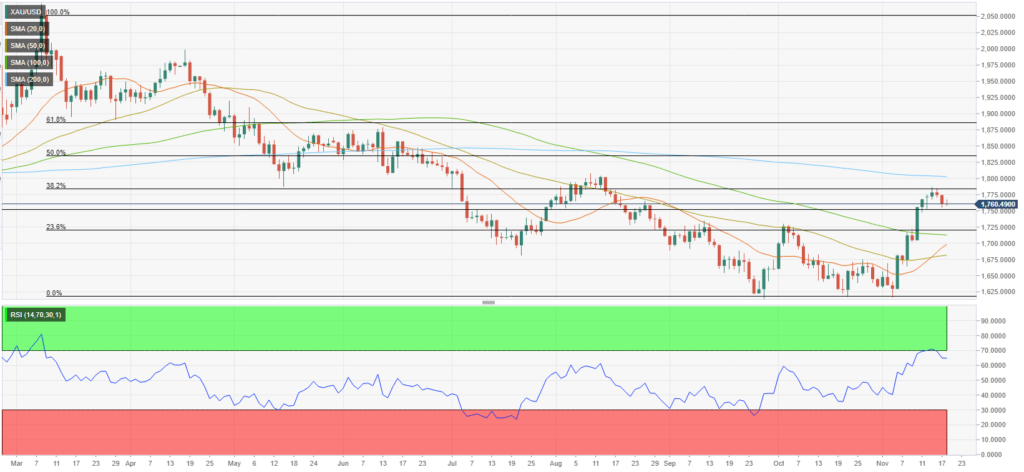

Market analyst Eren Şengezer draws attention to the following levels in the technical appearance of gold. The relative power index (RSI) indicator in the daily graph increased over 70 at the beginning of the week. However, he later retreated moderately. This shows that the last decline is a technical correction rather than the beginning of the month’s trend. In addition, the price of gold is comfortable on the simple 100 -term moving average (SMA).

In the increasing direction, $ 1,780 stands as the first resistance. It is possible for the gold to face a strong resistance at $ 1,800 before targeting $ 1,830 with a one -day closing above this level. Temporary support is formed at $ 1,750. If gold drops below this level and starts to use this level as resistance, it is possible to extend the downward correction to $ 1,720 and $ 1,700.

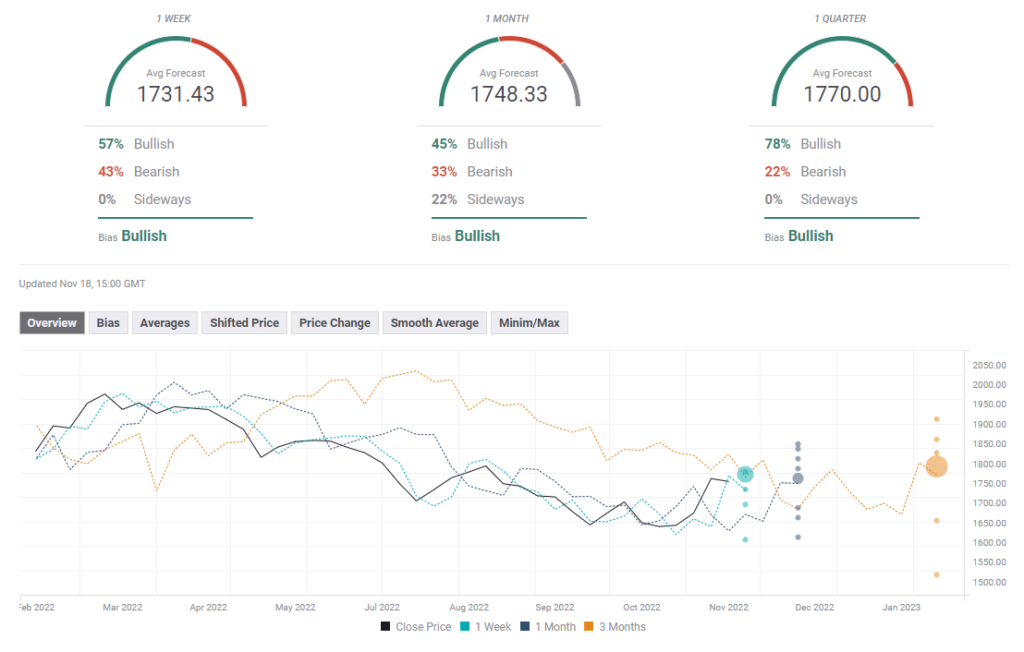

The FXSTREET Forecast Survey draws a mixed table for gold in the short term. The average one -week average target is $ 1,731. The quarter appearance continues to rise overwhelming with an average target of $ 1,770.