2022 was an unforgettable year for crypto investors. Terra (LUNA) and Solana (SOL), which were once among the top 10, have completely lost their former positions in this period. So, do these altcoin projects, which Turks show great interest in, have a chance to return?

Is Solana dead?

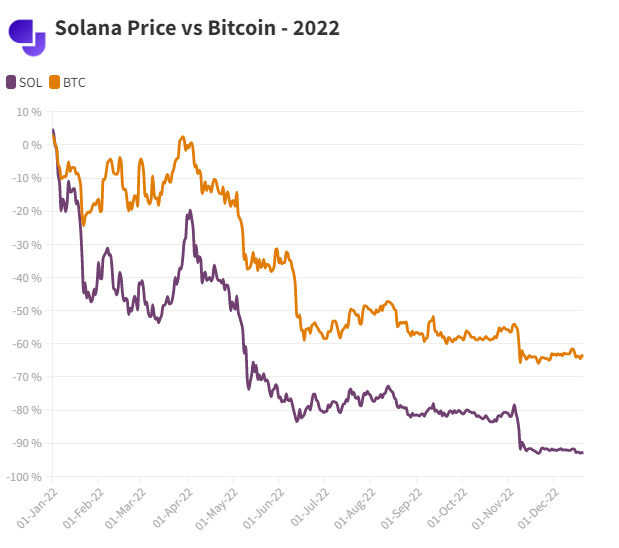

Solana fell from $54.5 billion to $4.4 billion, losing 95% of its value. This free fall took place in just one week of the FTX bankruptcy in November. After the scandalous event of 2022, Solana (SOL) moved away from the top 15 by market capitalization. Next to other cryptocurrencies, it was the most damaged altcoin compared to its competitors.

Issues surrounding the altcoin project

The first problem is the constant outages that occur in the Solana network. Throughout 2022, some experienced outages that exceeded hours. Prior to that, Solana has for some time positioned itself as an “ETH killer” when it comes to TPS and cheap gas fees. The result was a flood of interest and huge profits during the pandemic. However, as the cuts continued at a relentless pace, Solana had and still has serious problems.

On the other hand, increasingly prominent Tier 2 projects attack the core use case, threatening Solana’s core features as well. Different Tier 2s are evolving, which means Solana is lost among her rivals.

Sam Bankman-Fried

cryptocoin.com November 11 was the date when FTX officially declared bankruptcy and SBF announced its resignation. This, too, had dire consequences for Solana. The disgraced founder of FTX was a staunch early supporter of Solana, and SOL even appeared on FTX’s much-publicized balance sheet as it desperately sought investors at the last minute. In fact, Bankman-Fried was Solana’s biggest champion.

I'll buy as much SOL has you have, right now, at $3.

Sell me all you want.

Then go fuck off.

— SBF (@SBF_FTX) January 9, 2021

Critics now argue that SOL’s vertical rise during the epidemic was partly due to Bankman-Fried’s interventions. The SOL distribution is also notorious for being VC-heavy, which means it can affect the price of whale wallets significantly more than other cryptocurrencies.

In the nearly two months since FTX crashed, Solana has struggled significantly more than any other cryptocurrency. Investors fear that some of Bankman-Fried’s support for SOL is due to fraudulent activities, given the revelations about what happened behind closed doors at FTX. Caroline Ellison, Alameda CEO and close confidant of Bankman-Fried, told the SEC that Bankman-Fired deliberately manipulated the FTT token. In all this, it was enough to undermine Solana’s future.

Projects and capital leave Solana

The total value (TVL) locked on Solana, which we looked at DeFi, is currently $217 million, compared to over $10 billion in late 2021. Perhaps even more worrying is the migration of projects from Solana to competing networks. Well-known NFT collections DeGods and y00ts announced last week that they’re moving to Ethereum and Polygon respectively, it was a hammer blow for Solana.

Solana’s collapse was so stark that even his supposed biggest rival, Ethereum founder Vitalik Buterin, stepped in to say kind words. It says a lot about SOL’s decline, since it’s hard to even call it a competitor to Ethereum anymore, given that it’s no longer even in the top 10 of blockchains for TVL.

Some smart people tell me there is an earnest smart developer community in Solana, and now that the awful opportunistic money people have been washed out, the chain has a bright future.

Hard for me to tell from outside, but I hope the community gets its fair chance to thrive🦾🦾

— vitalik.eth (@VitalikButerin) December 29, 2022

Can collapsing altcoin projects return?

Now the question is how all these problems can be forgotten and projects can return. The problem here is twofold. As Vitalik puts it, “the dreadful opportunistic mercenaries have been weeded out”. While this does significantly damage SOL as previously discussed, it points to a short-term problem.

On the other hand, there are numerous problems that preceded the Bankman-Fried saga and still remain. Solana’s market-leading TPS and cheap fees are great, but they come with a tradeoff for security and stability. Therefore, analysts think that high network features will remain in the shadows for a while. Also, the entire altcoin market is already experiencing a harsh winter. With inflation still high, a weak geopolitical climate, and many more downside variables and uncertainties, the macro climate isn’t going to change anytime soon.