Cryptocurrency market traded in the red zone today, especially the leading crypto Bitcoin. An algorithm has gained a reputation for outperforming crypto markets. Here is this robot announcing the latest altcoin allocations in an environment where most cryptos have given up on their recent gains.

Traders’ risk appetite is aggressive, according to Real Vision

cryptocoin.com As readers, you may have heard of Real Vision Bot (Bot). This algorithm polls each week to generate portfolio reviews that reveal a ‘hive mind’ consensus. Real Vision founder and macroeconomics expert Raoul Pal describes Bot’s historic performance as “amazing.” It claims to outperform the top 20 cryptoassets in the market combined, by 20%.

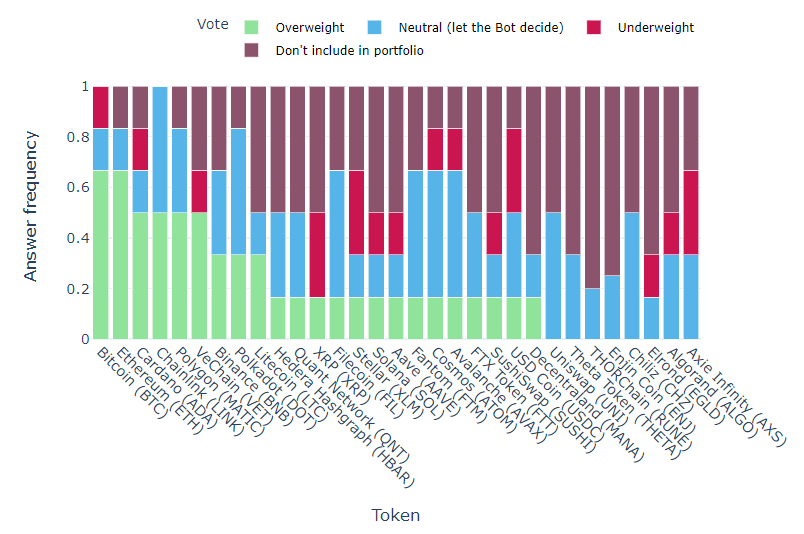

Despite the market downturn, Bot’s latest data shows that traders’ risk appetite remains aggressive. Most market participants weighted 67% in their portfolios for both leading crypto Bitcoin (BTC) and leading altcoin Ethereum (ETH). They also voted to take an extreme position with 21 altcoins in addition to them.

ADA, LINK and MATIC stand out in the extreme position

Ethereum rival Cardano (ADA) and decentralized oracle network Chainlink (LINK) took third place with 50% votes for excessive position allocation. In addition, the layer-2 scaling solution Polygon (MATIC) is also at this level. “The latest results of the RealVision Exchange crypto survey. Cardano, Chainlink and Polygon surprised with equal percentage of votes. The top five in the ranking are as follows: Bitcoin 67%, Ethereum 67%, Cardano 50%, Chainlink 50%, Polygon 50%.

Source: Real Vision Bot

Source: Real Vision BotSupply chain management blockchain VeChain (VET) has received less than 50%. BNB, the native token of popular cryptocurrency exchange Binance, took the seventh place with a 30% weighted allocation. The cross-chain interoperability protocol Polkadot (DOT) and the decentralized peer-to-peer cryptocurrency Litecoin (LTC) follow in their wake.

Participants also have Hedera Hashgraph (HBAR), Quant Network (QNT), Ripple (XRP), Filecoin (FIL), Stellar (XLM), Solana (SOL), Aave (AAVE), Phantom (FTM), Cosmos (ATOM), It prefers to include altcoin projects such as Avalanche (AVAX), FTX Token (FTT), SushiSwap (SUSHI), US Dollar Coin (USDC) and Decentraland (MANA) in its portfolios.

Real Vision focused on these altcoin projects in the portfolio

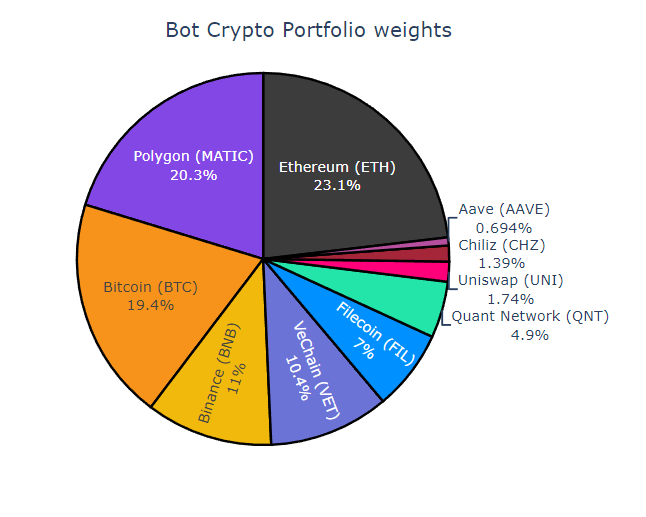

Decentralized oracle network Chainlink leads the latest survey-based exchange portfolio breakdown with 17.1%. It is followed by Ethereum with 14.3%, Polygon with 12.2%, Bitcoin with 11.9% and Polkadot with 8.57%. The other eight altcoin projects receive an allocation of between 2% and 7%. Meanwhile, Bot himself is building a portfolio. Real Vision identifies cryptocurrencies, which make up about 75% of its weekly assets, as follows. The bot team makes the following statement in this context:

Here are the latest weights of the RealVision Exchange crypto portfolio. It was rebalanced on Saturday. Chainlink weight in the exchange portfolio was staggering. The bot sticks to Ethereum, Polygon, Bitcoin and Binance.

Source: Real Vision Bot

Source: Real Vision Bot