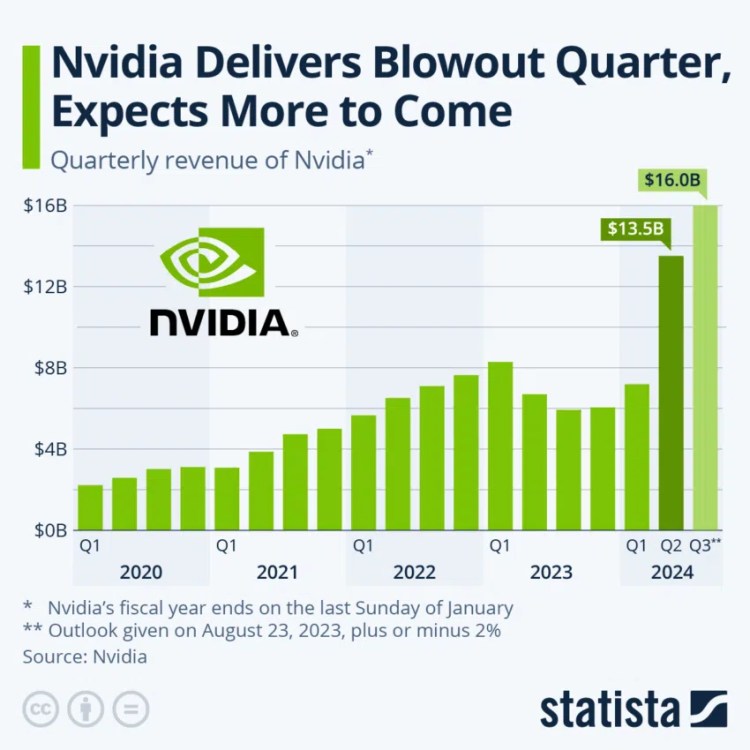

Nvidia’s phenomenal 211% year-over-year growth is giving the tech industry optimism. However, some experts are skeptical of this rapid rise. Rob Arnott, founder of Research Affiliates LLC, offers a similarly bleak perspective on FTX.

Nvidia’s quarterly financials fuel concerns

Nvidia draws attention with the $2.3 billion credit line it gave to expert vloud provider CoreWeave. This loan was made possible with the support of major lenders such as BlackRock. BlackRock, which is also Nvidia’s third largest shareholder, owns more than 115.6 million shares.

CoreWeave CEO Michael Intrator said, “We met with them to determine the coverage and payment plan. “It is important for us to borrow against an asset base to provide a cost-effective way to access debt markets,” he said.

The most notable aspect of this line of credit was that Nvidia aimed to meet the increasing artificial intelligence workload by using graphics processing units (GPUs) as collateral. Also, the $2.3 billion line of credit is on par with Nvidia’s data center revenue in the second quarter. The firm posted record revenue of $10.3 billion, up 141% from the prior quarter and 171% from the same period last year.

While these financial tactics are legal, they certainly cast doubt on Nvidia’s ethical practices.

Risks pointing to FTX fate

Rapid obsolescence of technology devices is one of the main risks with Nvidia’s GPUs. However, it recalls the disastrous financial strategy adopted by crypto exchange FTX.

Sam Bankman-Fried, the former CEO of FTX, reportedly mixed client funds with counterparties and made transactions without direct client approval. More importantly, some of these leveraged transactions used FTT, an exchange-developed cryptocurrency, as collateral.

The effects of Nvidia and CoreWeave’s intertwined financial activities are spreading in the financial market, just as FTX and Alameda Research are doing in the cryptocurrency market.

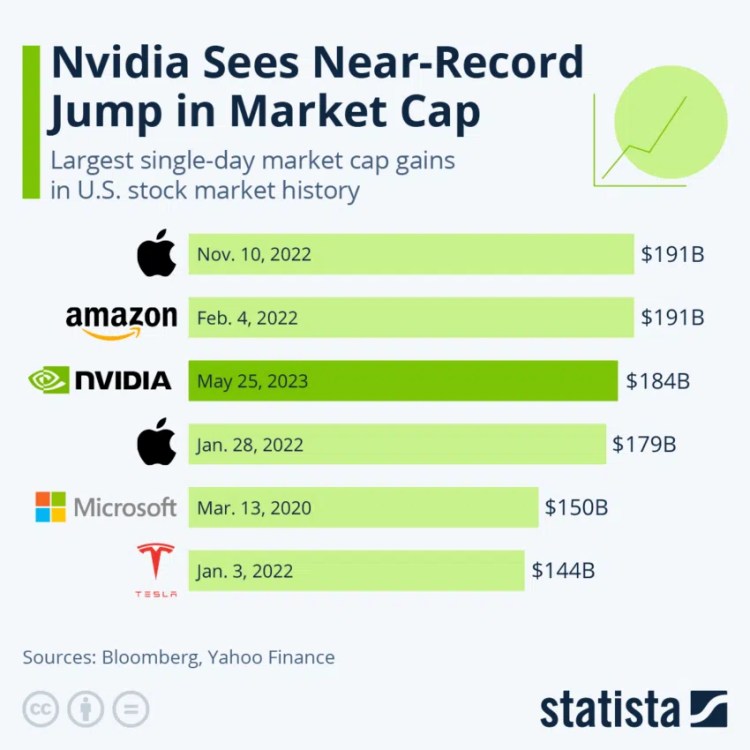

Indeed, Nvidia’s massive growth in 2023, adding $836 billion to its market cap, has impacted stock market sentiment. The perceived dominance in the AI sector has galvanized the entire technology sector. This inflated growth could mask real demand for productive AI and inadvertently create an unstable bubble.

Experts say Nvidia could crash like FTX

Nvidia’s astronomical rise has attracted the attention of both investors and market experts. This bullish enthusiasm is so intense that many seem to have overlooked the dangers of market bubbles. Indeed, as Nvidia’s valuation rises, concerns of a potential market bubble are beginning to take hold.

Rob Arnott, founder of Research Affiliates LLC, offered a bleak outlook. Nvidia, which has increased by 211% since the beginning of the year, may be the pioneer of the computer science revolution. But Arnott described the stock as “the textbook story of the Great Market Mistake.”

Nvidia’s price reflects the certainty that the GPU architecture will continue to dominate, not be replaced by new entrants or internal projects at other AI companies, and current market prospects are not overly optimistic…. Overconfident markets paradoxically turn bright future business prospects into even brighter current stock price levels. Nvidia is the current example of this genre: a great company with prices beyond perfection.

Arnott noted that a drop in Nvidia’s value could precipitate a broader market collapse. Known for his solid views on potential market bubbles, the expert highlighted the risks of overlooking historical patterns. According to Arnott:

Even accurate narratives can take longer to materialize than most investors expect. Investors consider positive uncertainty about future growth to be more likely than negative. As the 2020 dot-com bubble indicated at the time, tech stocks don’t take into account all future growth and beyond.

Recent fillings showing that Nvidia CEO Jensen Huang has sold a significant number of shares also fuel the story. He exercised stock options for two groups of 29,688 shares, valued at $4 each.

Records show that Huang exercised these options on an equivalent amount of common stock from September 1 to September 6, covering three separate transactions.

Following this, Huang sold these purchased shares in three separate lots within the same period. The sales price of these shares fluctuated between $466.13 and $497.17. When the company’s statements were analyzed, it was seen that Huang’s earnings were about 14 million dollars for each of these three parties, and he earned about 42,828,053 dollars.

Investors must exercise caution in light of the complex financial maneuvers surrounding Nvidia. As history has shown, uncontrolled optimism can pave the way for bubbles, and even industry giants are not immune from these backlash.