The gold price lost its upward momentum last week as the US dollar appreciated. The stronger-than-expected US nonfarm payrolls report underscored the Fed’s economic confidence. Market expert Daniel Dubrovsky states that crude oil prices and the US CPI report for May may keep gold prices under pressure. We have prepared the market analysis of the expert with his own narration for our readers.

“Hard times are coming for the price of gold”

As you can follow from cryptokoin.com news, the gold price has been more bullish last week. Couldn’t find acceleration. In fact, the precious metal has mostly changed very little. Generally speaking, gold has seen its downtrend since the mid-March pause in mid-May and climbed as high as 3.11% before cutting gains. Is the yellow metal losing its uphill battle and poised to resume its broader downtrend?

The road ahead remains challenging for gold, as markets don’t usually move in a straight line, with a downtrend pause possibly signaling profit taking or consolidation. In May, traders turned from inflationary woes to recessionary woes. This resulted in markets significantly lowering their expectations for a 2023 Federal Reserve rate hike.

This means that the probability of a 50 basis point hike in September decreases. As a result, Treasury rates and the US dollar weakened. When these assets move in the same direction, in this case downwards, this bodes well for gold and vice versa. But last week, we saw the Fed feel confident about the economic outlook, undermining expectations for a pause in September.

As a result, bond yields are on the rise again and the US Dollar may rise again. Last Friday, another robust nonfarm payroll report broke the wires and highlighted the central bank’s confidence. Not surprisingly, the price of gold fell as the US dollar rose and Treasury yields rose. Therefore, more difficult times await the yellow metal.

“Rising dollar and bond yields reduce the appeal of gold”

All eyes will be on the May US CPI report next week. Headline inflation is still expected to remain at 8.3% year-on-year, the same as in April. The core indicator, which excludes volatile food and energy prices, is forecast to slow to 5.9% annually compared to the previous 6.2%.

With crude oil prices at their highest level since the beginning of March, it seems unlikely that inflation will disappear for now. Therefore, a strong dollar and higher bond yields could continue to work together to reduce gold’s appeal.

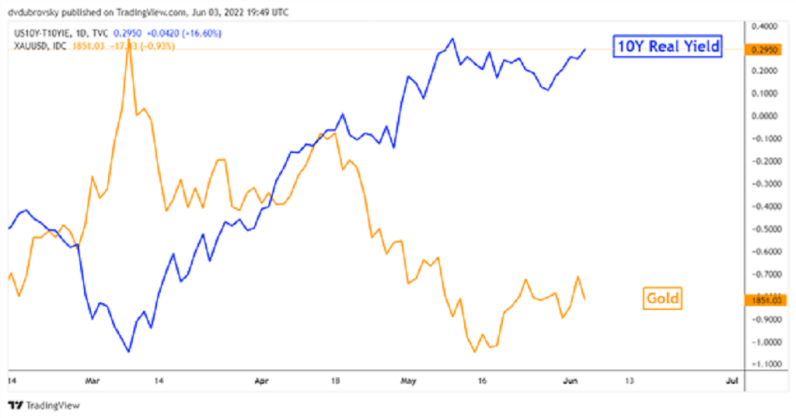

US 10-year real interest rate chart with gold price

US 10-year real interest rate chart with gold price