Thursday’s crypto exploit related to decentralized finance (DeFi) giants Yearn and Aave came with an unusual twist: Some users actually made money instead of losing it.

The reason, Aave integrations lead Marc Zeller says, is because the exploiter paid back Aave users’ USDT debts as part of the flash loan heist. CoinDesk estimates they recouped over $350,000 whereas the exploiter – who repaid every USDT position on Aave version (v)1 in a flash loan – cashed out millions of dollars in stablecoins before converting to ether (ETH) and transferring funds to mixer Tornado Cash.

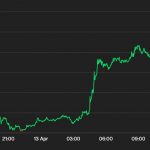

On April 12, the day before the exploit, 27% of the total USDT pool was loaned out, but at press time the amount of USDT borrowed on Aave’s v1 protocol now stands at $0.00. Roughly $1.31 million USDT is available for liquidity, according to the website for Aave’s v1 USDT market.

Recommended for you:

- How Regenerative Finance Is Bringing Sustainability to Crypto

- ‘The Revolutionaries Will Be Televised’: PleasrDAO Launching Live Auctions With Snowden, Ellsberg NFT

- Crypto Think Tank Coin Center Sues US Treasury Over Tornado Cash Sanctions

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28

Thursday’s hack is the second time an exploit involved a positive aspect. Euler Finance, which originally suffered a $200 million hack, not only recovered the majority of the funds but opened up redemptions to let users withdraw their money.