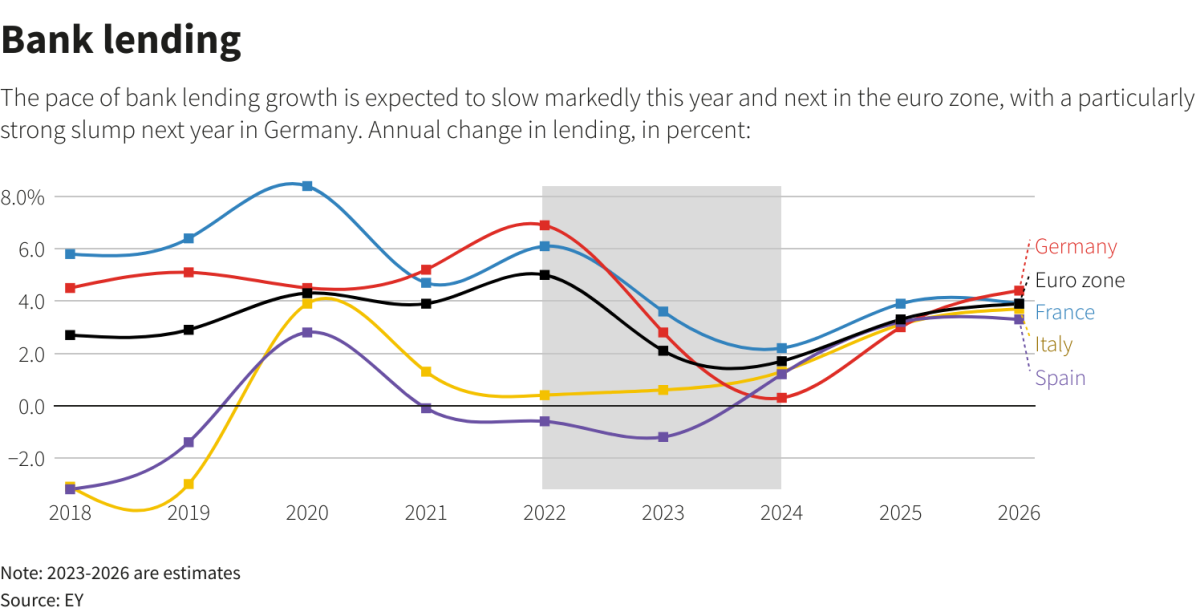

Global auditing and consulting firm EY has released a new report on the course of loans in the European region after the central bank meeting. According to the research conducted by experts, credit growth in the region will remain calm for a while due to the high interest rate policy.

EY shared its Eurozone credit growth forecasts in its research report released this morning. The consultancy company determined that loans to businesses and individuals operating in the region will increase by 2.1% this year. Loan growth, which was recorded as 5% in 2022, will reach the lowest level of the last period with 1.7% in 2024.

Attention to Housing Market!

Experts emphasized the decrease in mortgage loans from 4.9% growth rate in 2022 to 1.4% today. The slowdown in mortgage loans, which individuals generally take to buy housing, may be a preliminary signal of a possible recession in the sector.

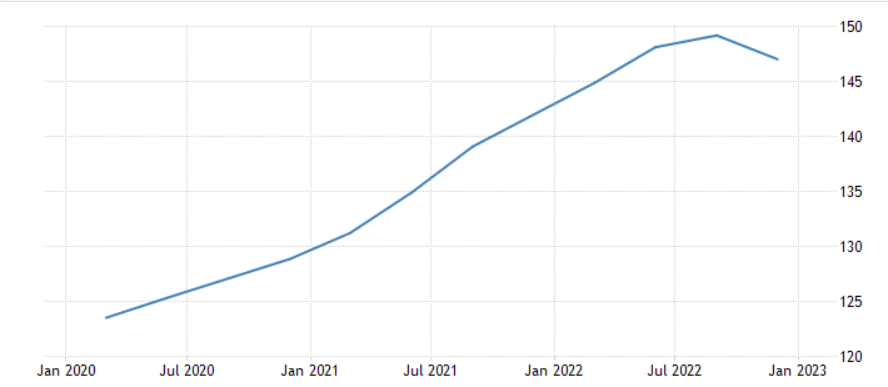

According to Eurostat data, the housing index, which was 123 in the first days of the pandemic, rose to 150. Average housing prices, which peaked in the summer of 2022, are showing a downward trend today.

Germany Is Falling From The Top To The Bottom!

In the credit growth report shared by EY, the forecasts for Germany, the largest economy in the region, drew attention.

According to EY’s report, Germany, which is the region with the highest loan growth rate in the region with 6.9% in 2022, will lag behind almost all of Europe with a rate close to 0 in 2024. Experts commented that the decrease in loan demand will have a negative impact on the country’s annual growth.