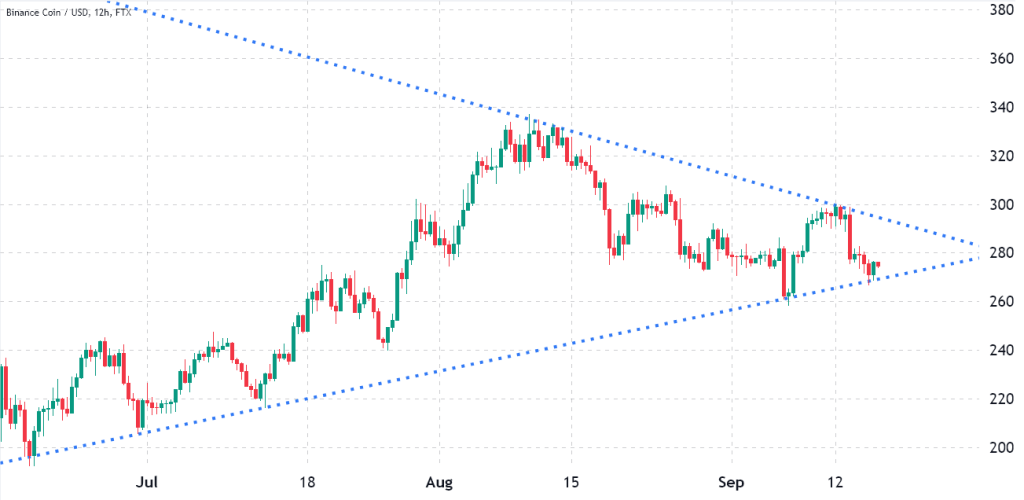

Binance Chain (BNB) is facing an important price test on September 30 as it continues its sideways movement. Its price is moving in a symmetrical triangle formation. Conflicting trends will determine the altcoin’s fate as it battles around $280.

Here’s what will happen on Binance Chain (BNB) on September 30

Binance’s native cryptocurrency BNB entered a symmetrical triangle formation on August 10 when it first encountered the descending trendline at the $335 resistance. The next five weeks have been a struggle around $280, the exact intersection between two conflicting ascending and descending patterns.

It is unclear whether the symmetrical triangle will break up or down until September 30, when the trend lines intersect. BNB Chain token, which currently has a total market cap of $45 billion, has outperformed the broader altcoin market by 15% in the past three months.

BNB Chain’s latest breakthrough in development was announced on September 7 after the project introduced zero-knowledge (ZK) proof-of-scaling privacy technology. Aiming for faster certainty and lower transaction fees, testet is expected to be launched in November. Ethereum mastermind Vitalik Buterin also wants to implement a similar solution for the Ethereum network. Buterin had highlighted the importance of ZK in late 2021.

BNB Chain’s Ethereum compatible network is fully functional. It also hosts DApps, including DEXs, games, collateralized loan services, social networks, yield aggregators, and NFT marketplaces.

A drop in price deposits could be a red flag

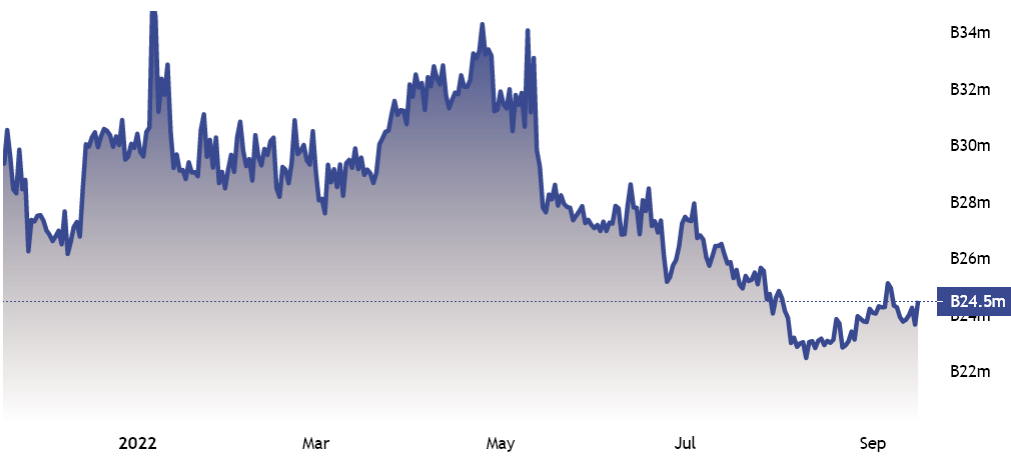

BNB is currently trading 60% below the ATH level. It remains the third largest cryptocurrency by market cap, excluding stablecoins. Also, the network has deposits worth $6.6 billion in TVL terms. Although the price of BNB has increased by 26.5% in the last 3 months, the network’s TVL as measured in BNB tokens has fallen by 12.5% over the same period. Usually, this data is relevant, but it depends on how other competitors are doing.

In fact, lower smart contract deposits have been the norm across the industry. For example, Solana’s TVL decreased 27.5% in 3 months and Avalanche (AVAX) decreased 36%. Even Ethereum saw a 29% cut in ETH deposits, down from 34 million on July 17 to 24.2 million.

In dollar terms, BNB Chain’s current $6.6 billion TVL is up 12% in the three months leading up to September 16. That figure is far superior to Avalanche’s $2.2 billion, according to data from DeFi Llama. BNB also surpasses Solana with its $1.3 billion TVL. We can say that BNB as a whole outperforms its Ethereum competitors.

Gameta-led DApp usage is growing

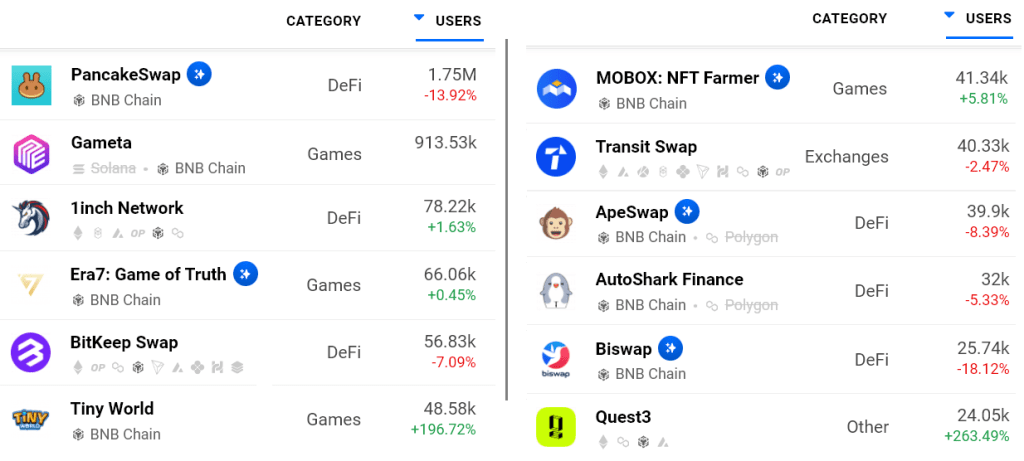

We can tell from the DApp usage metrics whether Binance Chain’s TVL drop is accompanied by a decrease in users. Some DApps, such as games and collectibles, do not require large deposits. Therefore, the TVL metric is irrelevant in these cases.

BNB Chain’s decentralized exchange, PancakeSwap, has 1.75 million active addresses. However, it is the absolute leader in all smart contract networks. Meanwhile, the Ethereum network only has three DApps. These include more than 35,000 active addresses, Uniswap, OpeanSea, and MetaMask Swap. More importantly, three DApps using BNB Chain grew by 190% or more. Gameta was the most promising with over 900,000 active addresses.

Judging by the decline in active addresses in BNB’s TVL and DApp, it can be concluded that it is poised for a fix. However, according to most analysts, making such a prediction would be wrong. However, a more detailed analysis, including a comparison with competitors, shows that the symmetrical triangle formation crossing at $280 on September 30 is the bullish trigger for BNB’s price. cryptocoin.comAs you follow, BNB is currently trading at $277.61.