The US inflation data released yesterday showed that price increases started to decline after an 11-month hiatus. Market players are waiting for the FED’s interest rate decision on June 14, after inflation that came in below expectations. The Federal Open Market Committee (FOMC) will update the interest rate tonight at 9 PM. Prior to that, the options market and on-chain analysis say the following for Bitcoin price…

Bitcoin price drops before Fed rate decision

The Federal Open Market Committee (FOMC) will announce its interest rate decision at 21:00 tonight. In half an hour, President Jerome Powell will be speaking at a press conference. Bitcoin traders take a defensive position before the Fed rate decision. Currently, expectations are that the US will keep interest rates constant. Still, some observers are keeping the door open for future increases in a move they describe as a “hawkish pause.”

Bitcoin-linked sells or bearish bets are more expensive than bullish positions leading up to the Fed meeting, according to options data tracked by QCP Capital. This trend indicates a tense mood in the market. Market analysts at QCP Capital said on Tuesday that “the risk-reward balance this week is in favor of long BTC and ETH sales.” Falling inflation is creating space for the Fed to hold interest rates steady today, according to the QCP. Bitcoin price expects below $26,000, down 0.75% intraday ahead of meeting time.

Also, positive inflation-adjusted interest rates, also known as real rates, often put pressure on zero-yielding assets like gold and Bitcoin. “Positive real rates are often bad for zero-yielding assets,” QCP analysts said. Overall, BTC is negatively correlated with real returns,” he says.

What’s next for bitcoin price?

Historically, investors have tended to look to post-Fed movements in US stock markets to decide their strategies. This strategy may not work this time, given the recent weakening of the correlation between Bitcoin and the S&P 500 and Nasdaq stock indices.

“The skipping of the Fed rate hike will likely be celebrated by stock bulls who helped push the S&P 500 to new year highs,” Joshua Olszewicz, head of research at Valkyrie Investment, said in a weekly market review.

“Regulatory actions point to unrest”

In terms of crypto, Olszewicz said, “Bitcoin and Ethereum have not benefited from the stock risk environment over the past few weeks. This points to unease about potentially pending regulatory action,” he added. cryptocoin.com As we reported, Binance is accused of selling Bitcoin to stop the massive exits it faced following the SEC lawsuit. A drop in BNB price below $220 will lead to a serious liquidation.

4. Binance have not sold BTC or BNB. We even still have a bag of FTT.

It is amazing they can know exactly who sold based on just a price chart involving millions of traders. FUD. 🤷♂️ pic.twitter.com/M3MUH2bFRE

— CZ 🔶 Binance (@cz_binance) June 13, 2023

A look at on-chain metrics before the Fed rate decision

On-chain analytics firm Glassnode reports that Bitcoin miners are sending massive amounts of BTC to exchanges amid ongoing sales. Bitcoin flow from miners to exchanges reached $70.8 million last week, the largest inflow, according to the firm.

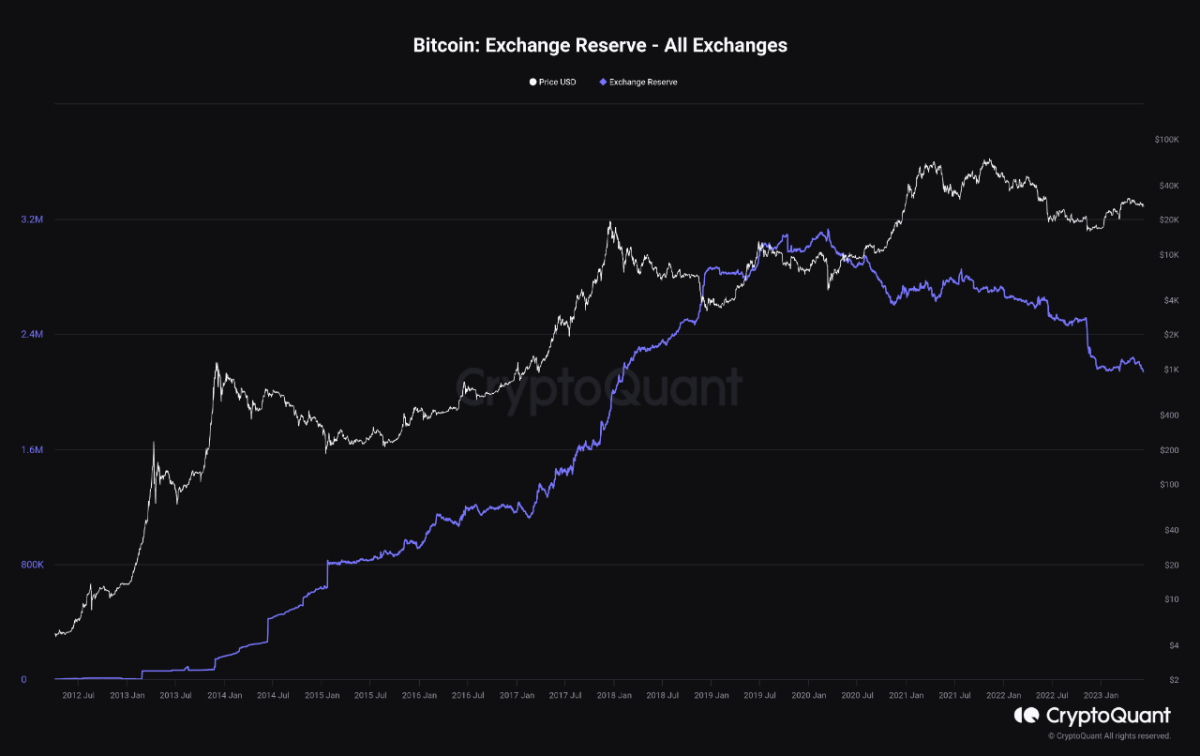

But despite these downsides, other on-chain metrics offer a more optimistic outlook for Bitcoin. Underlining the continued decline in foreign exchange reserves, analyst JA Marrtuum of Cryptoquant says that the available supply of Bitcoin for trading is dwindling. In particular, this trend adds to the narrative of increasing scarcity, which has historically been a catalyst for price appreciation.

Also, the percentage of Bitcoin held by long-term investors has remained flat compared to previous cycles. Analyst Marrtuum reports that this shows that despite the short-term volatility, a significant portion of Bitcoin investors are sticking to long-term expectations.

Technical analysts point out the importance of $25,400

Crypto analyst Cryptocator noted that the channel resistance of $27,200 and support at $25,400 are crucial. A break of this support could lead to a drop to $24,800 or $24,700. 26.300 acts as resistance for the bulls to take the stage.

Another technical analyst, Captain Faibrik, pointed out the wedge formation on the BTC chart. Accordingly, BTC bulls need to retake the $27,000 resistance zone for bullish momentum. If BTC price fails to hold the support line of the wedge formation, a 15% drop could be at the door.

$BTC So far, So Good..!!

Bulls are Defending the Major Trendline..

Expecting Wedge Upside Breakout Soon..📈#Crypto #Bitcoin #BTC pic.twitter.com/Aa67KLlNlj

— Captain Faibik (@CryptoFaibik) June 13, 2023

The latest situation in the crypto money market before the Fed rate decision

Bitcoin price remains below $26,000, down 0.75% on the day before the Fed rate decision. Here are the intraday movements of the biggest altcoins with XRP’s notable 8% depreciation:

- Ethereum (ETH): -0.3%

- Binance Coin (BNB): 4.8%

- XRP (XRP): -8.3%

- Dogecoin (DOGE): -0.0%

- TRON (TRX): 0.8%

- Solana (LEFT): -2.6%

- Polkadot (DOT): 0.0%

- Litecoin (LTC): -1.0%

- Cardano (ADA): -2.9%

- Polygon (MATIC): 0.2%

- Avalanche (AVAX): 0.6%

- Shiba Inu (SHIB): 0.7%