The gold market is attracting safe-haven flows amid growing contagion fears from the collapse of Silicon Valley Bank (SVB) and in a chaotic market environment. Markets are also reassessing interest rate hike expectations ahead of the Federal Reserve meeting on March 22.

“This is useful for gold!”

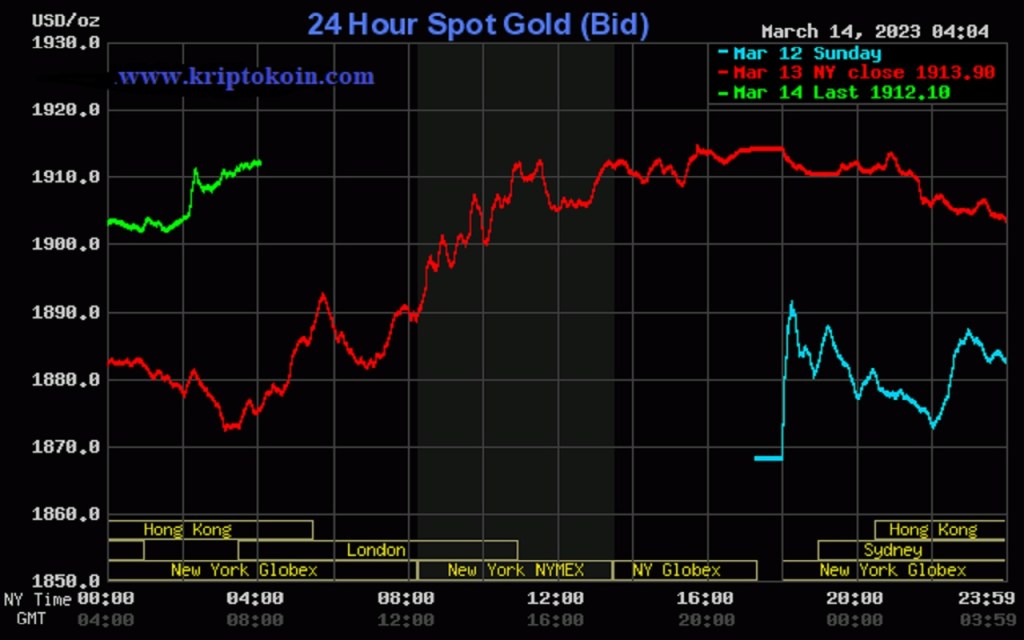

Forex.com senior technical strategist Michael Boutros says there are two main factors pushing the gold industry up. “There is a risk of contagion and the question of whether the Fed can continue to tighten as aggressively as it had anticipated,” Boutros said on Monday. This is beneficial for gold,” he comments. cryptocoin.comAs you can follow, gold prices rose to five-week highs after the SVB and Signature Bank shock and traded comfortably above the $1,900 level.

“We are coming to the next critical level for gold”

According to analysts, there are much more positive aspects to the trade for gold, but certain technical levels need to be reached first. Boutros draws attention to the following levels:

We come to the next critical level and it is $1,912-1,918. This six-dollar range is critical because it is this year’s high day close and 2021 high day close. This is a very important region.

According to Boutros, if gold fails to break above this range, it will be a sign that it is overbought. Meanwhile, he adds that if gold closes above this level on a weekly basis, it will signal the resumption of a broader uptrend. “Right now, coming to this level, I would start to be a little more defensive. This is the first major hurdle test for the gold rally,” he says.

“Flight to safety and interest rate hike still in the driver’s seat”

Phillip Streible, chief market strategist at Blue Line Futures, says safety flight and expectations for rate hikes will remain in the driver’s seat in the short term. The strategist notes that the market is pricing in a pause in the rate hike, but no rate cut is in sight this year. In this context, Streible makes the following statement:

The Fed raised rates so fast we knew things were starting to deteriorate. Now, the central bank needs to rethink its stance. Only nine days left until that meeting.

“There is a very high chance that the gold price will rise to $2,000”

According to Sean Lusk, co-director of Walsh Trading, while the banking industry is in financial trouble, there is a concern that banks may start selling their gold holdings to raise capital, and that will be a short-term negative. Lusk is watching a close below $1,880 as a negative sign. In this direction, it points to the following levels:

What I’m looking for here is a close below $1,880. This could open the door to $1,840 and then we would have a double bottom at $1,812. These are the technical levels I follow. However, this rally has more upside potential if the gold market can close above its daily high of $1,913. There is a very good chance that gold will go up to $2,000.

I can’t forget Tuesday’s CPI report

Tuesday’s CPI statement will be very important for gold. “Tuesday is a ‘be or die’ day for gold,” Boutros says. Market consensus forecasts are for US inflation to slow to 6% in February. “Market turmoil is definitely something that influences the Fed’s decisions, but at the end of the day, if inflation is rising, that should be what it’s aiming for,” Boutros comments.

The market is currently in a heated debate over whether the Fed will choose to raise another 25 basis points on March 22 or stop the tightening cycle. Boutros adds that the Fed’s decision will largely be determined by the CPI report. He clarifies his views on this subject as follows:

The market basically resets the interest rate policy expectation. We were entering the month with 80-50 basis points. But today, at some point, it has swung towards 60% for nothing. Therefore, these radical fluctuations will continue to increase volatility.

Lessons learned from 2008: Risk of a ‘barren’ purification!

While expectations around the Fed are driving the market, the upside potential of gold is clear. But if the narrative changes, Boutros points out, a sale could be ‘bad’. “People just want to readjust their Fed expectations. “The big question is not velocity, but the final rate, where the Fed will level up,” he says.

During the 2008 financial crisis, gold rallied towards the middle of the year, after which the market was shaken by a massive correction. After the Fed cut interest rates, the gold market entered another bull run and reached record highs in 2009. From this point of view, Boutros makes the following assessment:

The story can suddenly reverse for yellow metal. But purification can be sterile. It can really go up and then suddenly interest rate expectations can change. At the end of the day, the techniques were very clear. We made a big uptrend support defense. For me the line in the sand is still $1,807.

Is the US response to the banking route inflationary?

Lusk also voices the notion that the banking fallout is bullish for gold in the short-term, but could be a negative driver in the long-term. Continuing from here, Lusk makes the following statement:

All that money printed to help makes the dollar less valuable. That’s why the dollar is selling today. This only strengthens gold as a safe haven. However, once we get past this new story, will this cause more inflation? Answer Yes. The Fed will have to keep raising interest rates. So how does this affect gold? Probably negative.

It will also depend on how great the risk of contamination is, which is still a big unknown, according to Lusk. Lusk adds that it is unclear how long this crisis will last. “We don’t know who has tentacles to this bank or its subsidiaries and what the real consequences are,” he says.