The US Federal Reserve and the European Central Bank are focused on price stability promises. Therefore, they doubled down on their calls to continue raising rates. However, the inflation problem still does not go away. Undoubtedly, the gold market does not respond well to this situation. Therefore, gold prices risk falling below $1,900 in the short term.

Conditions are negative for central banks to take a step back!

The latest macro data from the US supports the Fed’s further tightening. The Conference Board’s consumer confidence report rose to 109.7 in June. Thus, it reached its best level since January 2022. This has pushed recession calls further away. It also supported the Fed’s further 25 basis points increase. Among other data, US durable goods increased more than expected. New home sales rose in May.

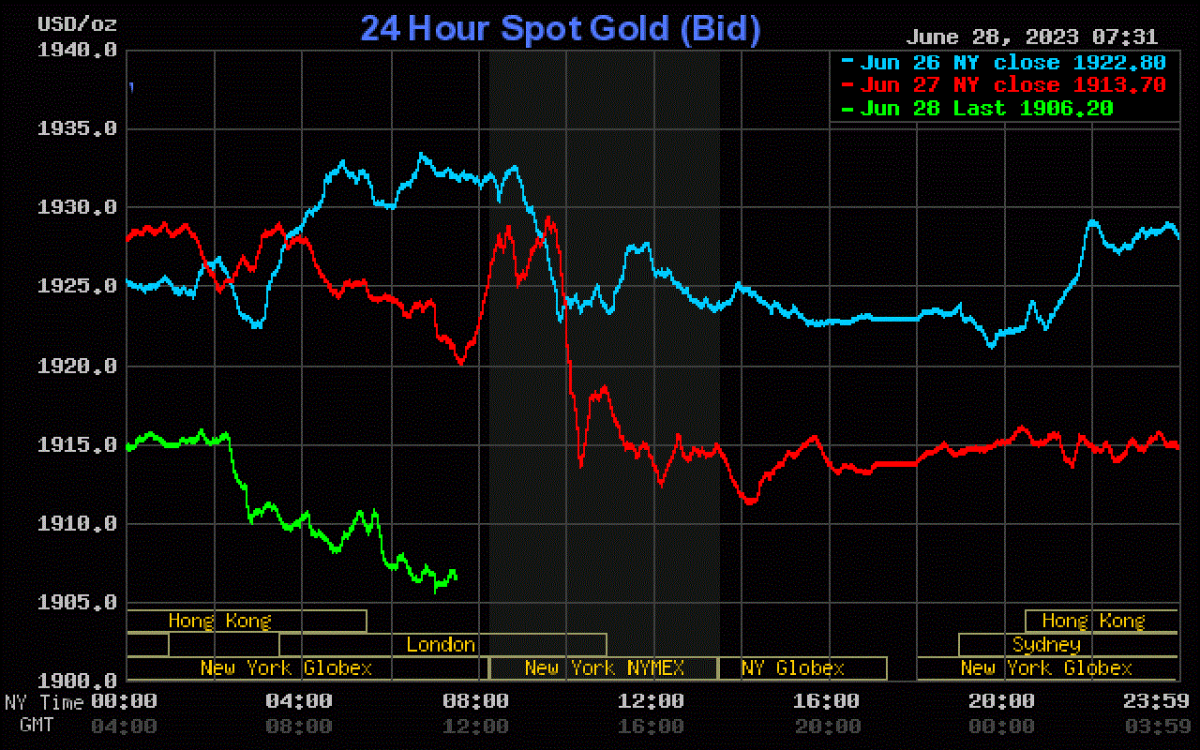

CME FedWatch Tool sees the probability of a 25bps rate hike in July as 77%. Morgan Stanley also jumped on the July rate hike train, updating its forecasts on Tuesday. “We now conclude that the bar for rate hikes in July is significantly lower than we initially expected,” the economists said in a note. By contrast, gold prices approached their lowest levels since March on Tuesday.

On the other side, cryptocoin.com As you follow, ECB President Christine Lagarde in Europe gave the signal that more interest rate hikes are coming, warning that inflation has entered a new phase and may continue for a while. Speaking at the ECB’s annual monetary policy meeting in Sintra, Portugal on Tuesday, Lagarde said: “It is unlikely that the central bank will say with full confidence that peak rates have been reached in the near future. “Unless there is a significant change in outlook, we will continue to raise interest rates in July,” he said. Market expectations predict that the ECB’s interest rate will reach 4%. This means that a rate hike is likely in the summer and fall.

It will take a long time for inflation to return to target.

Despite more than a year of the most aggressive monetary tightening in decades, inflation remains a global problem. Rising prices are one of the top three near-term economic concerns for 85% of central banks this year, according to the closely watched OMFIF Global Public Investor 2023 survey released Tuesday. None of the respondents expects inflation in major economies to fall to the targeted level in the next 12-24 months.

The International Monetary Fund (IMF) also warned this week that markets are underpricing the effort by central banks to contain inflation. Gita Gopinath, Deputy Director General of the IMF, underlined the following points in her statement:

Inflation takes too long to return to target. Headline inflation decreased significantly, while services inflation remained high. Therefore, the expected date for inflation to return to the target may shift further.

All eyes will be on Powell for gold prices

The gold market is now gearing up for Fed Chairman Jerome Powell’s statements in Sintra on Wednesday. Commerzbank analyst Thu Lan Nguyen comments:

The expectation of more interest rate hikes, especially in the USA, will continue to reduce the sensitivity in the gold market. At the central bank conference in Sintra, Portugal this week, central bank governors will likely continue to adopt a more hawkish tone. Therefore, this situation is unlikely to improve for now.

Gold prices at risk of slipping below $1,900

OANDA senior market analyst Edward Moya says gold prices risk falling below $1,900 in this environment. According to Moya, the situation for gold prices has been quite bad since the beginning of May. That’s why Moya comments:

If expectations for further tightening from the Fed rise, this could send gold temporarily below the $1,900 level.

Gold needs to break these levels to drop hard

From a technical perspective, gold’s close support level is $1,917, says Dragostin Kozhuharov, chief analyst at CompareBroker. From this point of view, Kozhuharov draws attention to the following levels:

For a more significant decline, a strong move below these two price levels must occur first. Next comes the $1,900 level. The next support below this would be $1,877 and the 200-day moving average.