Hedge funds continue to increase the downward trend ahead of the US Fed’s monetary policy decision last week, according to data from the US Commodity Futures Trading Commission (CFTC). Meanwhile, sentiment is rapidly changing in gold and silver. Here are the details…

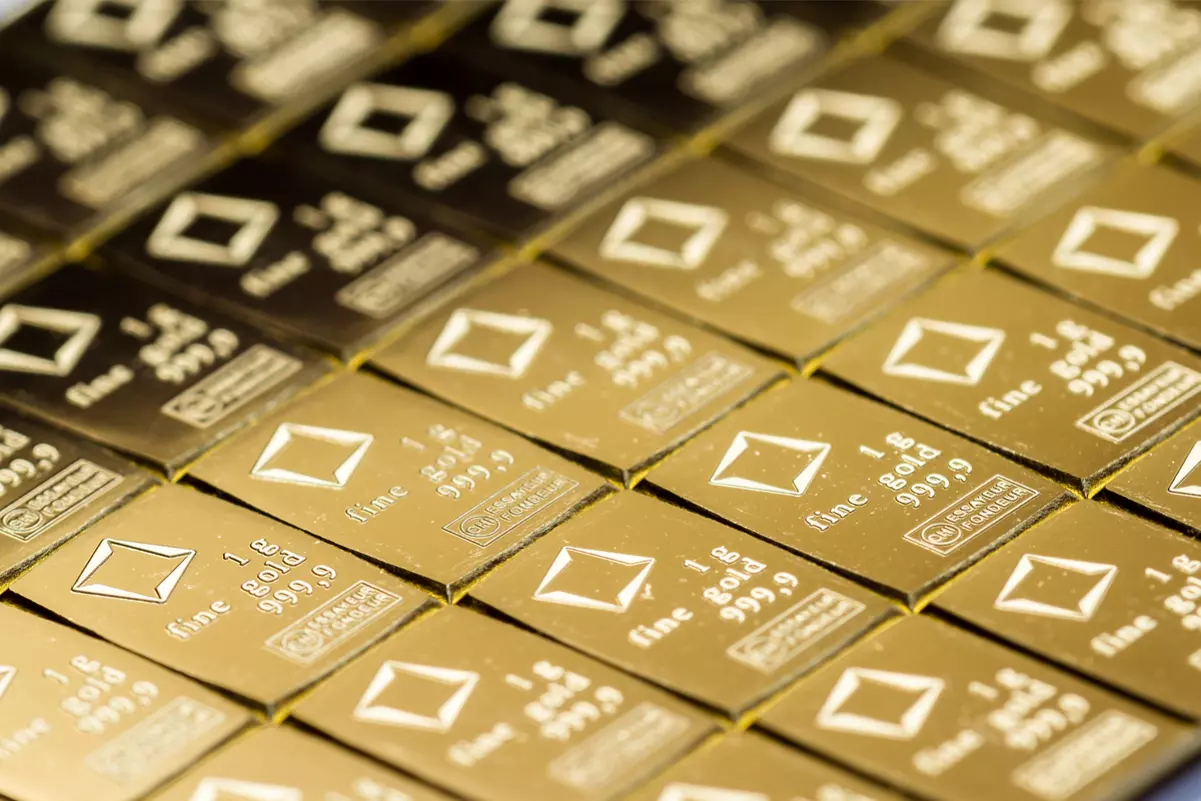

Trader sentiment rises for gold

The latest reports show a slight increase in bearish sentiment in gold and silver. Meanwhile, gold is trading at a three-week high. Analysts state that the data is retrospective as prices recover. Analysts say investors and traders expect the Fed to be much more hawkish over the past week. That’s why they say they’re seeing a relief rally for gold. Analysts said there was a slight change in its stance, although the US FED maintains its aggressive tightening stance.

Fed Chairman Jerome Powell said it would be appropriate for the central bank to slow the pace of rate hikes as the economy begins to react to aggressive monetary policy. TD Securities commodity analysts used the following statements:

After massive liquidations of late and the FED, we saw the market move away from pricing a 100 basis point hike. After that, the long position in the yellow metal quickly bounced back after prices broke past the $1,700 level. He also stated that the Fed may slow the rate of increase in future meetings with 75 basis points of increase and Powell’s speech. Prices have been on the rise due to the resulting disclosures. The golden beetles took more breaths.

Futures and options market also gained momentum

The CFTC’s trader report for the week ended July 19 showed that money managers increased their speculative gross long positions in Comex gold futures by 1,160 contracts. That is, the amount in question rose to 92,216. At the same time, shorts rose more rapidly to 111,309. Net short positioning of gold increased by 19,093 contracts. During the survey period, gold prices briefly dropped below $1,700 to hit a one-year low. The gold market has seen a bearish position increase over the past five weeks. However, analysts noted that gold seems suitable for overbought and short squeeze.

TD Securities said prices have room to rise. However, he stated that they opened a tactical short position in gold as the market appeared overbought after the Fed’s rise. Analysts think that “a repricing in the Fed’s expectations will exacerbate continued outflows in the yellow metal.” Phillip Streible, chief market strategist at Blue Line Futures, said in an interview that he would consider profits as gold prices approach $1,800 an ounce.

Streible added that markets may be a little early to expect a change from the US central bank. He noted that the latest inflation data show consumer prices remain high, which could force the Fed to maintain its aggressive stance longer than expected.

Bearish sentiment for silver

Along with gold, hedge funds continue to decline aggressively on silver. The report showed that money-administered speculative gross long positions in Comex silver futures increased by 310 contracts to 36,721. However, open interest increased by 4,087 contracts to 54,539. Silver position posted a net deficit of 17,818, up 26 percent from the previous week. During the survey period, silver prices were providing support at $18 an ounce.

Similar to gold, silver has seen a solid bounce after last week’s rate hike. The gold/silver ratio remains high, around 87 points, despite falling from its two-year high. Silver prices are currently trading solidly above $20 an ounce. However, some analysts are worried that the rally is not sustainable as the threat of recession increases.