Bitcoin (BTC) saw its rise above $20,000 on October 4, after a long time. Accordingly, the recent BTC price peak is rising with equities against the falling US dollar. So, which price levels should upstream investors pay attention to? Analysts warned of some selling zones.

“These levels are selling territory in Bitcoin rally”

Data from TradingView showed the price of Bitcoin gained over 5% prior to the Wall Street opening. Macroeconomic concerns don’t seem to be having a big impact on the cryptocurrency market this week. Now short-term price analysis suggests a potential bull run to $21,000, as late last month. But over $21,000 is a bit of a challenge. Because there is an important sales area in this region. Crypto analyst Capo said:

“20500-21000 is a sales territory. If the BTC price gets there, the sales will start. In any case, it doesn’t look like there will be a huge rise.”

“The rise occurred due to the weakening of the dollar”

Razzoorn, an analyst at international trade group The Birb Nest, also spoke about BTC. Razzoorn noted that the current move marks Bitcoin’s fifth attempt to escape a massive liquidity cloud in a few weeks. There is potentially limited upward movement. Accordingly, Bitcoin is gaining in value as US stocks rose markedly the day before. Meanwhile, the US dollar was also damaged. The US dollar index (DXY) suffered losses and fell to 111 points.

“BTC is heading towards these levels”

Meanwhile, famous crypto analyst Michael van de Poppe also took to Twitter. “The market is rising,” Poppe said. The analyst, who is the CEO and founder of the Eight trading platform, was more optimistic than the others. Poppe said:

“We are turning $19,500 into support. Now, BTC is struggling to hold the $19,600 high. If that happens, I assume we will continue towards $22,400.”

Bitcoin hashrate approaching all-time high

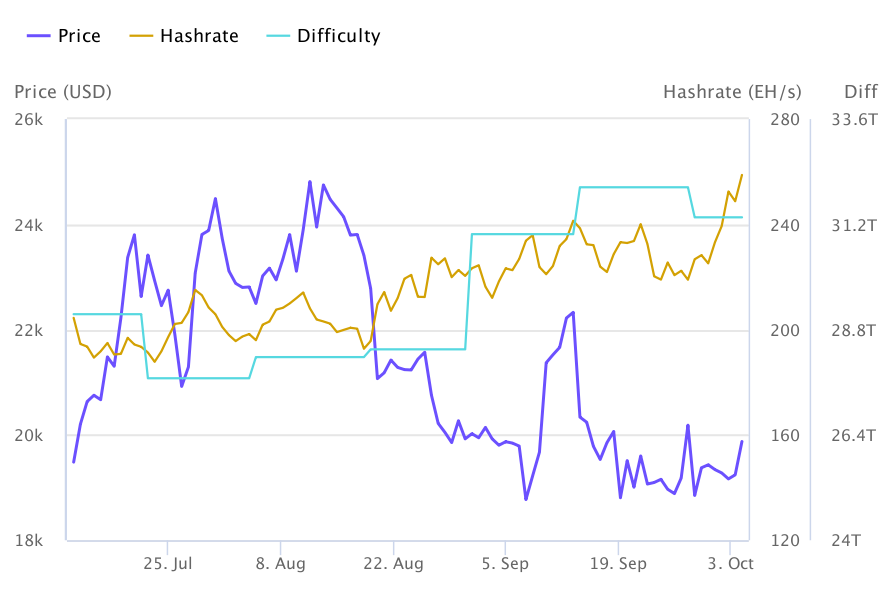

Bitcoin (BTC) hash rate continues to rise to all-time highs despite the long-term price drop. According to Braiins Insights, the mining hash rate peaked on October 4 at 258 exahash per second (EH/s). While the price of the coin has fallen by 58% against the US dollar to date, the mining hash rate has increased by 43%.

Bitcoin Gandalf from Braiins marketing team made some statements on the subject. “The all-time high hashrate indicates that miners are on the rise for BTC,” Gandalf said. However, he adds that the current macroeconomic environment is “not so rosy now.” According to him, this may pose a problem for miners in the future.