Jake Claver, Director of the Digital Ascension Group and CEO of Beyond Broke LLC, talked about an altcoin project that institutional investors will flock to.

Beyond Broke CEO says this altcoin will peak in institutional interest

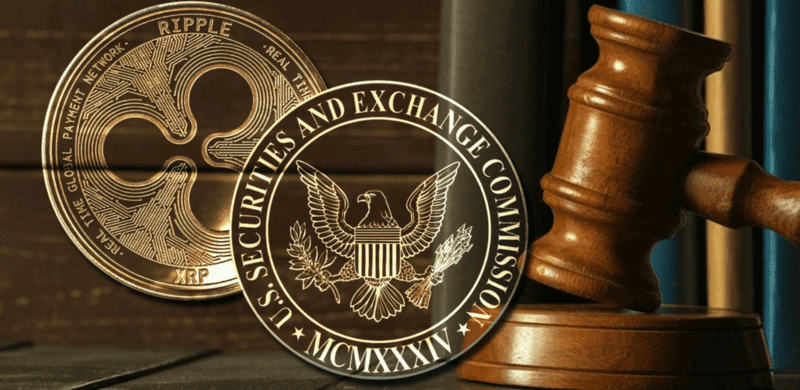

The famous executive says that once the SEC and Ripple lawsuit is over, XRP will stand out as the only regulated cryptocurrency in the US. According to Claver, this will elevate XRP to a unique position. It will also increase institutional adoption and enable it to gain more volume on exchanges.

“I think the case resolves a few different issues,” Claver said on the Black Swan Capitalist YouTube channel. Let’s say Congressional legislation on these assets ends before it comes, the only clear thing will be XRP,” he stressed.

Claver also underlined: “So what are these financial institutions going to do when it’s all in the air? Will they be given an assignment? They will jump out of everything they have and flow (to XRP) into it. So what does the price look like in the secondary market when all this volume is traded?”

Powerful statement by @beyond_broke that resonates well: If the #SEC #Ripple lawsuit concludes, #XRP will stand alone as the ONLY regulated digital asset, triggering a surge in institutional adoption.

To watch the full interview:https://t.co/dMb0553EX7 pic.twitter.com/zXyVD3wl8Q

— Black Swan Capitalist (@VersanAljarrah) May 23, 2023

Potential implications of SEC lawsuit, according to Jake Claver

Claver underlines that, contrary to what many people believe, the SEC litigation may actually benefit XRP. He points out that the community has focused only on the negative effects of litigation, without paying attention to its potential benefits.

Claver’s recent comments reflect his belief that the SEC lawsuit could change the game for XRP. Ben Armstrong, popularly known as BitBoy, had previously said that I was going through the trial phase of XRP. He also mentioned that it will stand out as the only altcoin classified as a non-secure.

What is the one altcoin I can feel confident on heading into the next bull run? It's none other than XRP! ❌ I detail why this is the case, looking into the impending end of the Ripple vs. SEC legal case and what it can mean for the future of the altcoin.https://t.co/OuGl5aOeuK pic.twitter.com/tEOTJTExkt

— Ben Armstrong (@Bitboy_Crypto) April 14, 2023

What happens if XRP is declared as a security?

In such a case, Claver suggested, institutions transmitting transactions in XRP would need to obtain a broker-dealer license to facilitate those transactions. He also noted that one of the important outcomes would be the approach to taxation.

The main reason people don’t currently hold or use it is because they don’t know how to tax it – is it a currency, a commodity, a security?

Claver also stated that classifying XRP as a security would limit the number of exchanges that would trade with it. He emphasized: “If it were regulated as a security, the existence of exchanges would hinder its ability to trade.”

“Ripple can take flight”

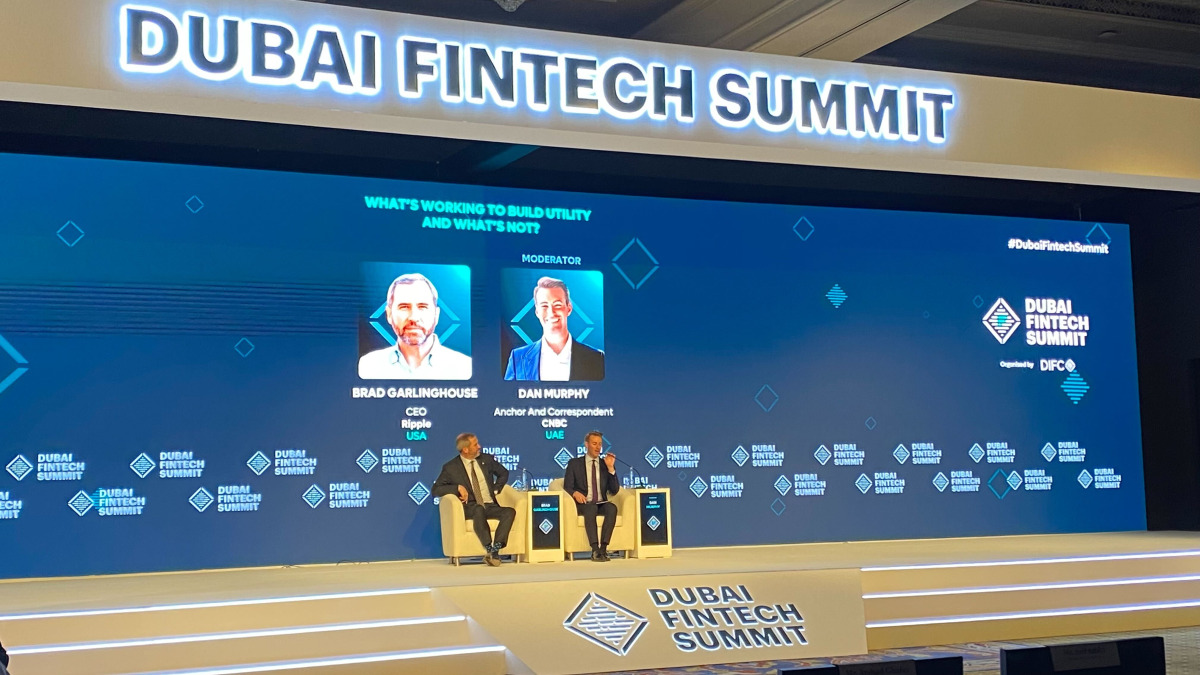

Meanwhile, Ripple CEO Brad Garlinghouse has raised bull flags after his company’s recent supremacy in the SEC lawsuit. The CEO stated that Ripple is ready for growth and will mobilize significant capital to accelerate growth.

In his interview at the Dubai Fintech Summit, Garlinghouse said, “We have more than a billion dollars in cash on our balance sheet. We plan to use this to increase both internal growth and growth for acquisitions.”

He also pointed to Switzerland and the United Arab Emirates (UAE) as attractive locations for companies that Ripple is considering acquiring.

“We plan to make acquisitions in markets that are friendly to these technologies,” Garlinghouse said. There were representatives from the UAE and Switzerland. These countries provide clarity for entrepreneurs to invest. This allows a larger company like Ripple to invest,” he said.

Ripple aspires to be more than just liquidity & payments.

Acquisitions in crypto-friendly markets (like UAE and Switzerland), for expansion. pic.twitter.com/yTRMEasngN

— 🌸Crypto Eri 220k+ Followers (Beware of Imposters) (@sentosumosaba) May 18, 2023

How about the XRP price? Are altcoin bulls still strong?

XRP emerged as one of the top earners last week. cryptocoin.comWe have included the decision from the SEC case that prompted the price in this article.