The co-founder and CEO of BitMEX exchange predicts that Bitcoin (BTC) and Ethereum (ETH) prices will continue to decline following this week’s Terra (LUNA) crash. In his regular weekly analysis, he predicts a dramatic collapse this week. Let’s keep in mind that the estimates are not precise.

Famous CEO revealed a dramatic Bitcoin and ETH scenario

In a new blog post, Arthur Hayes says that he is preparing to accumulate the crypto giant as he predicts a drop to previous lows. According to Hayes, investors will have another opportunity to buy BTC at $20,000 and ETH at $1,300. In part of the article, he says:

These levels roughly correspond to the ATH levels of the 2017/18 bull market.

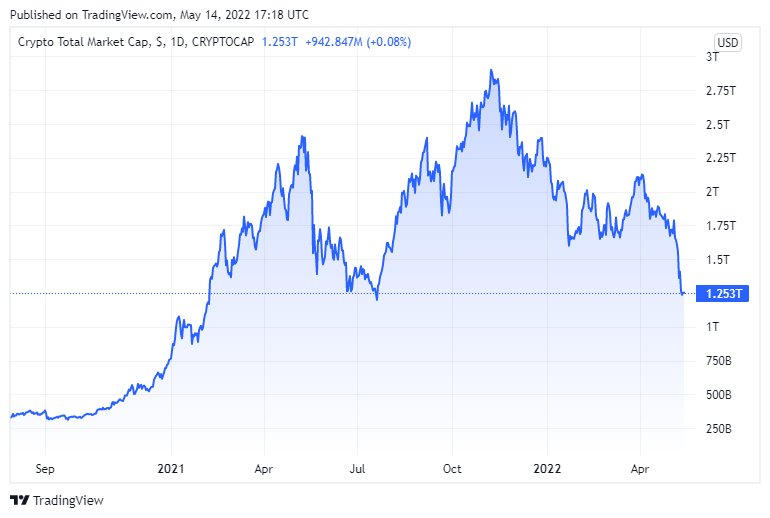

At the time of writing, Bitcoin and Ethereum are trading in the critical $30 and $2,000 zones. Meanwhile, the total market capitalization fell back to $1 trillion. That means more than half of the money at the November peak has left.

Arthur Hayes interprets the effects of the LUNA collapse

Stating that the continuation of his statements, the UST and LUNA collapse made investments more uneasy, Hayes said that the recovery after the decline says it may take some more time:

This will continue to weigh on all cryptocurrencies as all investors lose confidence and prefer to suck their thumbs, grab the safety blanket and hold onto fiat cash. Once the bloodshed is over, the crypto equity markets should be given time to recover. As

Kriptokoin.com , the decentralized finance payments ecosystem Terra crashed earlier this week and lost all of its value.

However, Hayes says that despite their depreciation, there has been no structural change in long crypto positions:

If anything, I’m evaluating the various altcoins I own and I increase exposure.

In March, Hayes and BitMEX co-founders Benjamin Delo and Samuel Reed were found guilty of breaking a law that required financial institutions to help the government detect and counter money laundering schemes. The US Department of Justice (DOJ) claimed that the trio deliberately failed to maintain anti-money laundering protocols and profited from the transactions of US-based clients while operating outside the country.