Canadian mining firm Hut 8 and Singaporean crypto firm Matrixport are keeping their Bitcoin price predictions high despite the recent correction. Pointing to 2024, company representatives expect the leading crypto to trade in 6-digit numbers.

Canadian mining company Hut 8 sets date for $100,000

In a new YouTube interview, Hut 8 vice president Sue Ennis mapped the Bitcoin price’s $100,000 journey. The senior executive expects a new bull market in 2024, when the next halving cycle will take place. In part of the interview, Ennis conveyed his price estimates as follows:

In the next cycle, I believe Bitcoin could rise to $100,000 levels. This is based on Bitcoin capturing even just 2% to 5% of the $13 trillion gold market in institutional portfolios. If Bitcoin was able to capture even just 2% to 3% of the market cap of gold, it could have had a huge impact on the price, pushing it above $100,000.

Currently, Canadian mining company Hut 8 Hut 8 has 9,152 BTC in reserve. He holds 8,305 of them unencumbered. Meanwhile, the company’s ASIC hash rate capacity is 2.6 exahash per second. Hut 8 mined a total of 44.6 BTC in July.

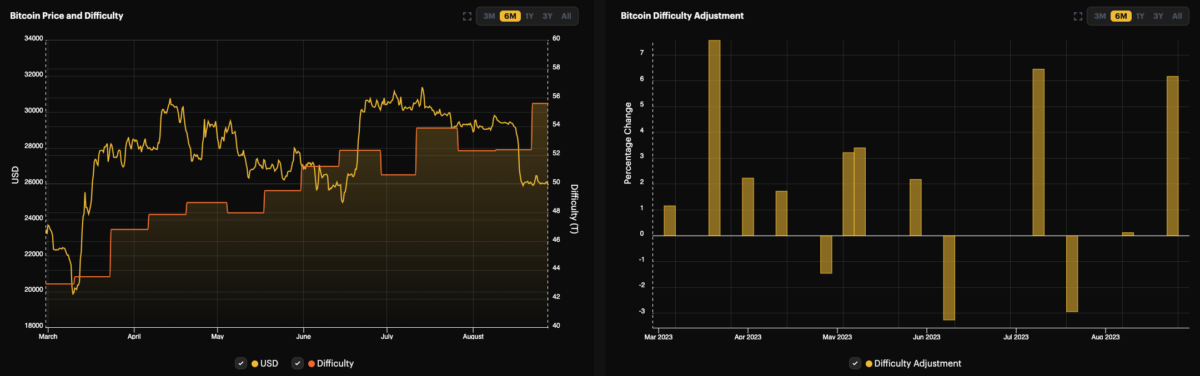

Could Bitcoin difficulty bring new selling pressure for BTC?

According to data from the Hashrate Index, spikes in Bitcoin difficulty trigger decreases in BTC price. After increasing difficulty recently, miners are now preparing for the April 2024 halving cycle. Miners may prefer to thaw their Bitcoin reserves a bit to switch to more efficient ASICs before the halving. This brings to mind whether BTC will rise as much as investors expect before and after the halving. Ennis answers this question as follows:

There are many unprecedented dynamics going on in the mining industry right now…. The interesting thing is that the hash rate continues to be online despite the Bitcoin price trading in a certain band… We are still seeing an increase in the hash rate.

What has changed right now is that we are seeing the Bitcoin price drop a bit but the hash rate continues to increase… I think what is really exciting and different is that we are making a tremendous amount of new entrants into the global Bitcoin network.

Matrixport analysts are more cautious: drop is still possible for Bitcoin

Analysts at Singaporean crypto firm Matrixport have addressed short-term Bitcoin opportunities in a new report. Analysts state that the current levels are suitable for a long Bitcoin position with a stop. However, analysts still do not rule out bearish risks.

At this point, Matrixport Research Head Markus Thielen reported that they are currently looking for a loaded long Bitcoin position. Thielen sets the stop loss for the long position at $25,800. This is pretty close to the price of Bitcoin, which was trading at $26,000 at the time of writing.

Thielen later stated that risk markets, especially cryptocurrencies, will rise inversely as yields on U.S. Treasury bonds fall. He also pointed out that market makers can accelerate price increases by buying when the Bitcoin rally begins. The Matrixport executive emphasizes that returns may weaken further as the US inflation rate falls. However, he predicts that US stock markets could rise to ATH levels:

The US macro backdrop continues to be quite favorable for risky assets. Given that inflation will continue to fall and the Fed is on hold for the time being, we expect US stock markets to reach historic highs in December 2022. The Fed’s rapid rate hikes may also have a deflationary effect, but this could lead to a prolonged boom.