Bitcoin price managed to recover somewhat in Q1 of 2023. In this environment, crypto mining firm Bitfarms sold $28.5 million worth of Bitcoin to pay off its debts.

Bitfarms sold a huge chunk of 1,267 BTC

The Bitcoin rally in the first quarter of this year was a relief for Bitcoin mining companies. cryptocoin.com After the collapse of crypto exchange FTX, mining firms struggled for profitability. Some even failed to carry this burden and filed for bankruptcy.

According to an SEC filing, Bitfarms mined 1,297 BTC in the first quarter of 2023. However, the company had to sell a huge chunk of 1,267 BTC to pay off its equipment debts. Also, last year Bitfarms had to sell 3,000 BTC to increase liquidity during the crypto winter.

Crypto miner boosts hashrate

Alongside the BTC sale, Bitfarms added 3,000 new miners to increase the hashrate from 4.5 EH/s to 4.8 EH/s. Accordingly, the mining company announced that it aims to reach the 6.0 EH/s milestone by the end of September 2023. Hash rate refers to the computational power for Bitcoin mining. Geoff Morphy, Chief Executive Officer (CEO), who was appointed in December 2022 following the resignation of founder Emiliano Grodzki, said:

With a focus on maintaining financial and operating discipline, we have built strength and resilience to sustain growth. In this context, we accelerated our 6.0 EH/s target from the end of the 4th quarter of 2023 to the end of the 3rd quarter of 2023.

Finally, Bitfarms reported revenue of $30 million, an increase of approximately 10% over the previous quarter’s revenue. The stock is currently trading at $1.08, 8% higher than Friday’s closing price.

Why are Bitcoin and crypto soaring today?

The rise in Bitcoin today can be attributed, as always, to several causes, all of which are interrelated. But right now, the main focus for Bitcoin and the crypto market is the US Dollar Index (DXY) due to its inverse correlation. DXY is (also) facing a very important decision right now.

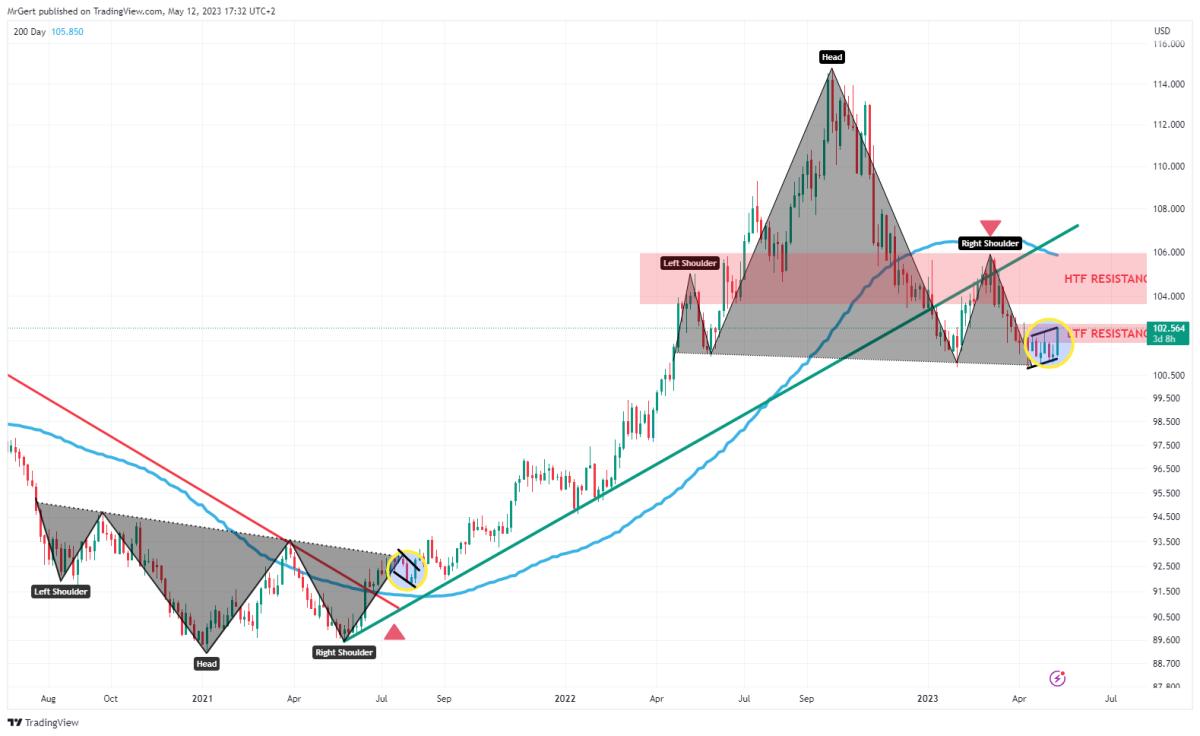

As technical analyst Gert van Lagen explained, DXY may be facing a head and shoulders (H&S) turn similar to what happened in 2020/2021. However, this time it points to a downtrend rather than an uptrend. More than two years ago, DXY showed an H&S bottom under a red downtrend. The right shoulder was above the SMA 200 and a recent pullback marked the start of a rally. Currently, DXY is facing an H&S top above the green uptrend. The right shoulder is located below the SMA 200. Therefore, a final bounce is possible before the current bullish bear phase.

DXY head and shoulders reversed / Source: GertvanLagen / Twitter

DXY head and shoulders reversed / Source: GertvanLagen / TwitterSo why are Bitcoin and crypto rising today? DXY was rejected at 102.8 resistance after rising in the last five days. DXY has seen a slight pullback (for now) to 102.5 at press time. This move is likely to give crypto investors hope for confirmation of a head and shoulders (H&S) turn.

On the other hand, Bitcoin itself has now formed a ‘head and shoulders’ pattern on the 1-day chart. Some analysts are clamoring for Bitcoin to drop to $25,200 or even lower. Other analysts say that BTC is on a very good path for the chart pattern to be invalidated.