A crypto analyst known for his accurate predictions has predicted 2 altcoins that could surpass Bitcoin (BTC) in terms of performance.

Analyst, who knows about crypto crashes, shared altcoins that he expects to rally

Saying that Bitcoin may suddenly rise in November, DonAlt updates his view of the market. Analyst’s accurate predictions cryptocoin.com You can take a look at this article. In a recent Youtube video, DonAlt said that Solana looks strong and may be accelerating to surpass BTC:

Solana’s case against Bitcoin is successful. I think it has a chance to perform better. The USD pair pulled back a bit, but not that strong.

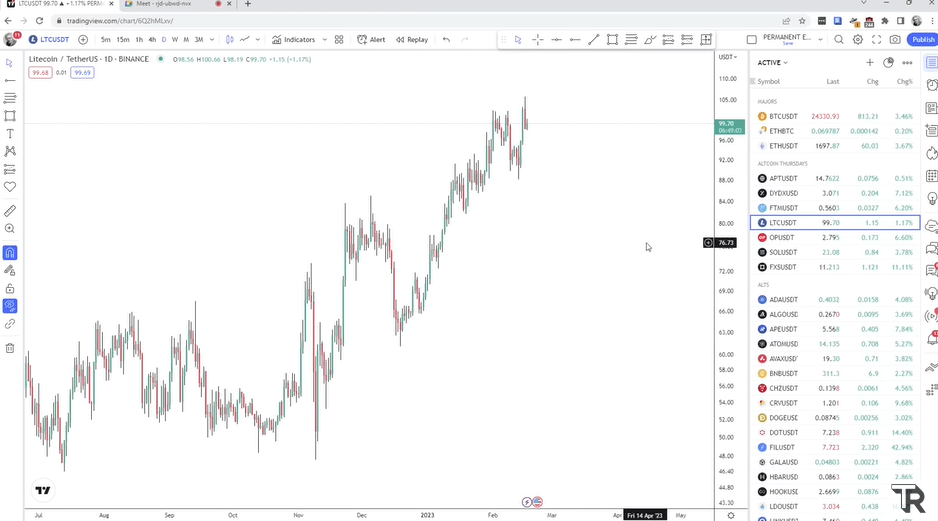

“Litecoin (LTC) can do 2x if it can break this level”

The crypto analyst remains bullish when it comes to the rest of the altcoin market, especially Litecoin (LTC). DonAlt bought LTC near the November low of $60 and says it could rally further if it can break $100:

If it struggles with $100 for a while and clings to this resistance, I think it will be much better. That’s why I won’t give up soon…

We’ve seen this before. Litecoin has offered exciting positions like twice before. He’s struggling with $100, but I think more will follow. If that happens, I think it could easily double up. So going from $100 to $200 seems unlikely.

Leading crypto may lag behind in terms of performance

As for the trajectory of Bitcoin, the crypto analyst thinks that the leading crypto is probably on its way to reach at least $32,000. At this point, it may need to be reassessed. According to DonAlt’s analysis:

About $32,000 is good enough for me. At that point I would probably sell or at least start making some profits. To be honest, I could see it getting higher.

When I wrote ‘maybe we’ll go back to $60,000’ when the market was at $16,000, I got a lot of criticism. If we go to $30,000, you’ll see a lot of people immediately say ‘$60,000’. You can always go 5x, 10x in crypto, but you can always go down to 95%.

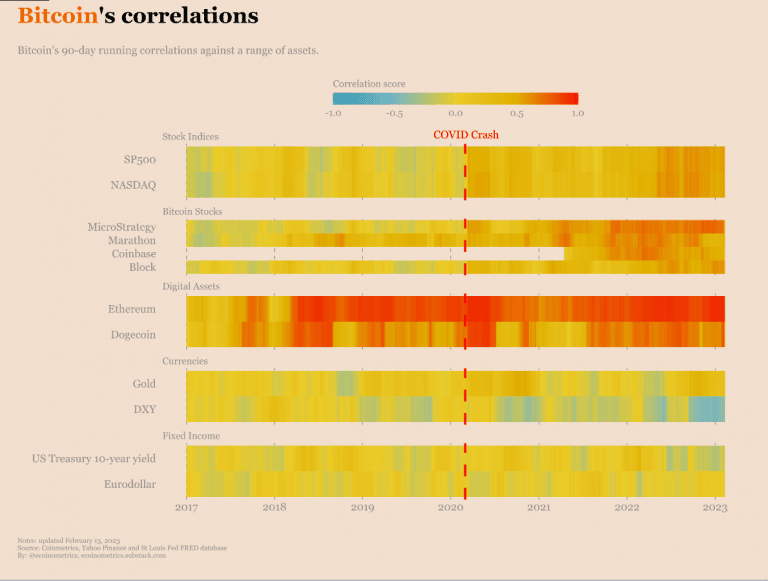

There is a growing convergence between Bitcoin and traditional stocks

In terms of BTC, recent price movements were independent of traditional markets and markedly distorted the correlation between cryptocurrencies and stocks. Predictably, Bitcoin has a strong relationship with other cryptocurrencies. The price of Bitcoin and gold have been highly correlated lately, although they have been in and out of correlation zones in the past.

Despite this, there was zero correlation between DXY and Euro futures before or after the outbreak. High correlation is shown in dark red, high anti-correlation is indicated in dark blue, and no correlation is shown in yellow.

As a result, their data revealed that as of this writing, the SP500, Nasdaq and Bitcoin Index are all moving in opposite directions. BTC is currently consolidating to provide permanence to the $25,000 region.